“Executive Summary:

The global Sales Tax Software market size was valued at USD 10.38 billion in 2024 and is expected to reach USD 20.53 billion by 2032, at a CAGR of 8.9% during the forecast period

The global Sales Tax Software Market is entering a new phase of expansion driven by technological innovation, changing consumer behavior, and a growing emphasis on sustainability. As industries worldwide adopt smarter, more efficient systems, the demand for solutions within the Sales Tax Software Market continues to accelerate. This growth is being fueled by advancements in automation, data analytics, and digital transformation, which are helping businesses enhance productivity, reduce costs, and meet evolving regulatory and environmental standards.

Our latest market research report provides a comprehensive overview of the Sales Tax Software Market, featuring detailed insights into regional trends, competitive dynamics, and key growth drivers. The report also includes segment-wise analysis, forecasts, and strategic recommendations to help stakeholders make informed decisions in a rapidly shifting environment. With in-depth coverage and actionable intelligence, this report serves as a vital resource for investors, decision-makers, and industry professionals looking to capitalize on emerging opportunities in the global Sales Tax Software Market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Sales Tax Software Market report.

Download Full Report: https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market

Sales Tax Software Market Overview

**Segments**

– By Component

– By Deployment Model

– By Organization Size

– By Industry Vertical

The global sales tax software market is segmented by component into software and services. Based on the deployment model, the market is divided into cloud-based and on-premises. In terms of organization size, the market caters to small and medium-sized enterprises (SMEs) and large enterprises. Furthermore, the industry vertical segmentation includes retail and e-commerce, BFSI, IT and telecom, manufacturing, healthcare, and others.

The software component segment of the market is expected to witness significant growth due to the increasing demand for automation in tax compliance processes. Cloud-based deployment models are gaining traction among businesses looking for cost-effective solutions with easy accessibility. SMEs are increasingly adopting sales tax software to ensure compliance with changing tax regulations. The retail and e-commerce sector is anticipated to be a major contributor to market growth as online sales continue to surge.

**Market Players**

– Avalara, Inc.

– Vertex, Inc.

– Sovos Compliance, LLC

– Ryan, LLC

– TaxJar

– CCH Incorporated

– Wolters Kluwer

– Thomson Reuters

– Intuit Inc.

– Xero Limited

– EXL

– TaxSlayer LLC

– TaxCloud

– Nexus

– Sales Tax DataLINK

Avalara, Inc. and Vertex, Inc. are among the key players in the global sales tax software market, offering a wide range of solutions to streamline tax compliance processes for businesses of all sizes. Sovos Compliance, LLC and Ryan, LLC are also prominent players known for their comprehensive tax management software. TaxJar and CCH Incorporated cater to specific industry verticals, providing tailored solutions for retail, e-commerce, and financial services sectors. Wolters Kluwer and Thomson Reuters are renowned for their expertise in tax research and compliance tools. Intuit Inc. and Xero Limited focus on providing user-friendly accounting software integrated with sales tax features. EXL and TaxSlayer LLC offer innovative tax solutions for both individuals and enterprises. TaxCloud, Nexus, and Sales Tax DataLINK are emerging players in the market, contributing to the competitive landscape with their advanced tax automation technologies.

https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market The global sales tax software market is experiencing significant growth driven by factors such as the increasing complexity of tax regulations, the need for efficient tax compliance processes, and the rising adoption of digital platforms for business operations. One noteworthy trend in the market is the shift towards cloud-based deployment models, which offer scalability, flexibility, and cost-effectiveness to businesses of all sizes. Cloud-based solutions provide seamless access to real-time tax data and updates, giving organizations the agility to adapt to changing tax scenarios quickly.

Moreover, the demand for sales tax software is particularly high among SMEs, as they look to navigate the intricate landscape of tax compliance without the resources of larger enterprises. These smaller businesses are increasingly turning to technology solutions to automate tax calculations, filings, and reporting, thereby reducing the risk of errors and penalties associated with non-compliance. The retail and e-commerce sector, in particular, stands out as a key driver of market growth, as the rapid expansion of online sales channels necessitates efficient tax management solutions to ensure adherence to diverse tax laws across regions.

Key market players such as Avalara, Inc. and Vertex, Inc. dominate the sales tax software landscape with their robust offerings tailored to meet the evolving needs of businesses. These industry leaders focus on innovation, integration, and user-friendly interfaces to enhance the tax compliance experience for their customers. Additionally, emerging players like TaxCloud, Nexus, and Sales Tax DataLINK are making significant strides in the market by introducing advanced automation technologies that streamline tax processes and enhance operational efficiency for businesses across sectors.

As the global sales tax software market continues to evolve, businesses are poised to benefit from a plethora of solutions designed to simplify and optimize tax compliance workflows. The convergence of technological advancements, regulatory changes, and industry best practices will drive further innovation in the market, enabling organizations to stay ahead of the curve in a rapidly changing tax landscape. In this dynamic ecosystem, market players need to focus on differentiation, customer-centric solutions, and strategic partnerships to maintain a competitive edge and capture new growth opportunities in the evolving sales tax software market.Sales tax software market is highly competitive with a diverse range of players catering to different segments and industries. As businesses increasingly prioritize automation and digital transformation, the demand for sales tax software is expected to continue to grow rapidly across various sectors. One of the key trends shaping the market is the rising adoption of cloud-based deployment models, which offer scalability, cost-effectiveness, and real-time access to tax data. This shift towards cloud solutions is driven by the need for flexibility and agility in managing complex tax compliance processes.

Moreover, the emphasis on compliance efficiency, especially among SMEs, is propelling the demand for sales tax software as businesses seek to streamline tax calculations, filings, and reporting to avoid penalties and errors. The retail and e-commerce sector, in particular, is driving significant market growth as online sales channels expand globally, necessitating robust tax management solutions to navigate diverse tax regulations across regions effectively.

Key market players such as Avalara, Inc. and Vertex, Inc. dominate the landscape by offering innovative and tailored solutions to meet the evolving needs of businesses. These industry leaders focus on enhancing user experience, integration capabilities, and continuous innovation to stay ahead in the competitive market. Additionally, emerging players like TaxCloud, Nexus, and Sales Tax DataLINK are disrupting the market with advanced automation technologies that optimize tax processes and improve operational efficiencies for businesses in various industries.

Looking ahead, the sales tax software market is poised for continued evolution as technological advancements, regulatory changes, and shifting consumer behaviors drive the need for more sophisticated tax compliance solutions. Businesses will benefit from a growing array of tools designed to simplify tax workflows and adapt to changing tax landscapes. Market players will need to differentiate themselves through customer-centric strategies, ongoing innovation, and strategic partnerships to capitalize on the expanding opportunities in the dynamic sales tax software market. The evolving market dynamics will create a competitive environment where only the most agile and customer-focused players will thrive in meeting the diverse needs of businesses worldwide.

The Sales Tax Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market/companies

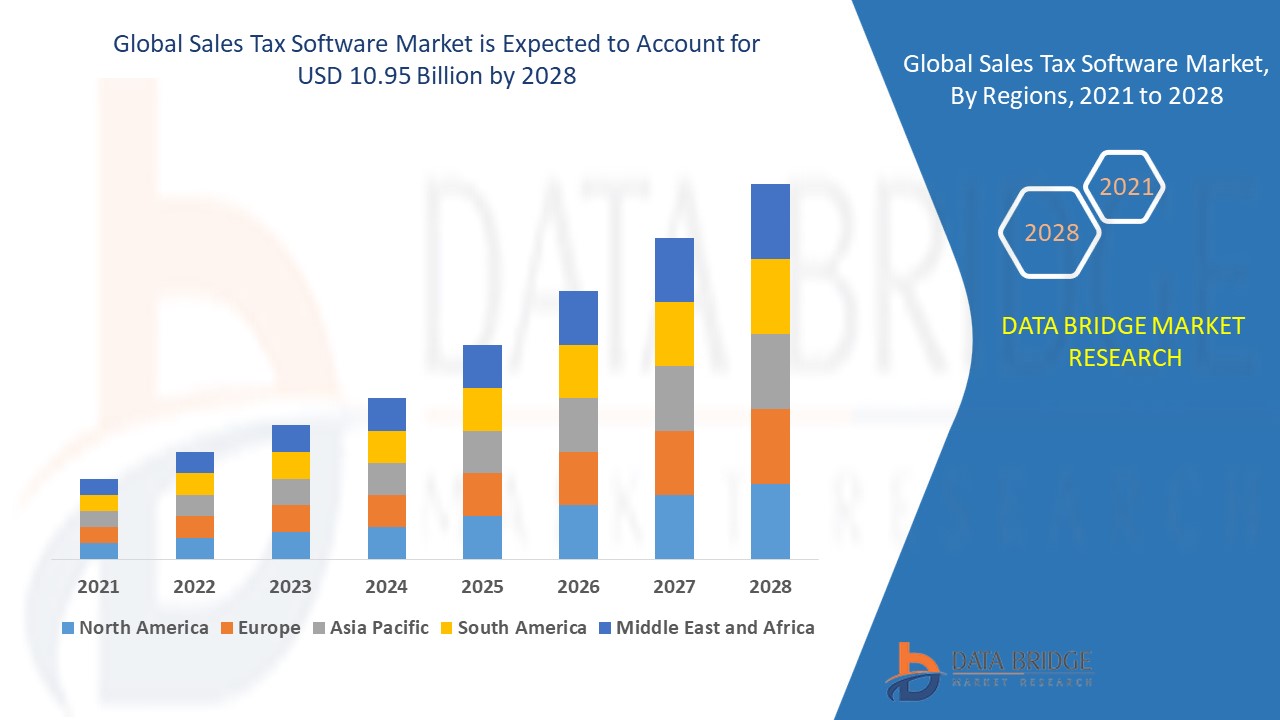

Regional Outlook

North America:

The Sales Tax Software Market in North America is driven by advanced technological infrastructure, strong consumer demand, and supportive government policies. The United States holds the largest share due to early adoption and robust investment.

Europe:

Europe showcases steady growth in the Sales Tax Software Market, supported by strict regulatory frameworks, sustainability initiatives, and innovation-led economies. Key contributors include Germany, the U.K., and France.

Asia-Pacific:

Asia-Pacific is the fastest-growing region for the Sales Tax Software Market, fueled by population growth, urbanization, and industrial expansion. China, India, and Japan are major markets with high potential.

Latin America:

Growth in Latin America is moderate but rising, driven by expanding middle-class populations and increasing awareness of Sales Tax Software Market applications. Brazil and Mexico are the leading countries.

Middle East & Africa:

The Sales Tax Software Market in this region is gaining momentum due to infrastructural developments, diversification efforts, and rising investments. The UAE, Saudi Arabia, and South Africa are key players.

Competitive Landscape

Future Trends— Global Sales Tax Software Market

Upcoming Technologies:

The Sales Tax Software Market will witness rapid adoption of cutting-edge technologies such as artificial intelligence, machine learning, the Internet of Things (IoT), blockchain, and automation. These technologies are expected to enhance operational efficiency, enable real-time data-driven decisions, and introduce innovative products and services.

Consumer Behavior Changes:

The Sales Tax Software Market will be shaped by changes in consumer preferences toward offerings that are experience-driven, convenient, and personalized. Increasing demand for transparency, digital engagement, and value-driven purchases will push companies to innovate their marketing and product strategies.

Sustainability Trends:

Sustainability will be a critical focus, with consumers and regulators alike driving demand for eco-friendly materials, energy-efficient processes, and circular economy initiatives. Businesses are anticipated to prioritize green innovations to reduce carbon footprints and meet stricter environmental regulations.

Expected Innovations:

The market is expected to see significant innovations, including smart products, integration of advanced analytics for predictive insights, and development of new materials or solutions tailored to emerging needs. Collaboration between technology firms and industry leaders will accelerate these innovations.

Why This Report is Valuable

This report provides in-depth industry insights that help stakeholders understand the current market landscape, key drivers, challenges, and growth opportunities within the Sales Tax Software Market. It offers regional and segment-wise forecasts that enable precise market planning and targeted investment strategies tailored to specific geographic areas and product/service segments.

The report includes comprehensive competitor benchmarking, allowing businesses to evaluate their position relative to key players, understand competitive strategies, and identify gaps or opportunities for differentiation. Additionally, it delivers actionable strategic recommendations based on market trends and data analysis to support informed decision-making, optimize business growth, and enhance market presence.

Top 15 FAQs About the Global Sales Tax Software Market Research Report

- What key segments are analyzed in the Sales Tax Software Market report?

- Which regions show the highest growth potential in the Sales Tax Software Market ?

- What time frame does the Sales Tax Software Market report cover for forecasts?

- What are the major drivers influencing the growth of the Sales Tax Software Market?

- Who are the leading competitors in the Sales Tax Software Market?

- How is market size estimated for the Sales Tax Software Market?

- What research methodologies are used to compile the Sales Tax Software Market report?

- Does the report discuss regulatory impacts on the Sales Tax Software Market?

- Are emerging technologies covered in the Sales Tax Software Market analysis?

- How does consumer behavior affect the Sales Tax Software Market trends?

- What sustainability trends are impacting the Sales Tax Software Market?

- Does the report include a SWOT analysis of key players in the Sales Tax Software Market?

- How frequently is the Sales Tax Software Market report updated?

- Can the Sales Tax Software Market report be customized for specific business needs?

- What are the future opportunities and challenges identified in the Sales Tax Software Market?

Browse More Reports:

https://www.databridgemarketresearch.com/es/reports/asia-pacific-cleanroom-technology-market

https://www.databridgemarketresearch.com/de/reports/global-laparoscopic-retrieval-bags-market

https://www.databridgemarketresearch.com/pt/reports/middle-east-submarine-cable-system-market

https://www.databridgemarketresearch.com/es/reports/global-polycrystalline-solar-cell-multi-si-market

https://www.databridgemarketresearch.com/ru/reports/u-s-veterinary-diagnostics-market

https://www.databridgemarketresearch.com/ru/reports/global-check-rails-market

https://www.databridgemarketresearch.com/de/reports/global-canoe-and-kayak-rental-service-market

https://www.databridgemarketresearch.com/es/reports/north-america-at-home-testing-kits-market

https://www.databridgemarketresearch.com/pt/reports/global-aseptic-processing-market

https://www.databridgemarketresearch.com/es/reports/global-specialty-films-polymer-market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set itself forth as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Sales Tax Software Market Size, Sales Tax Software Market Share, Sales Tax Software Market Trend, Sales Tax Software Market Analysis, Sales Tax Software Market Report, Sales Tax Software Market Growth, Latest Developments in Sales Tax Software Market, Sales Tax Software Market Industry Analysis, Sales Tax Software Market Key Player, Sales Tax Software Market Demand Analysis“