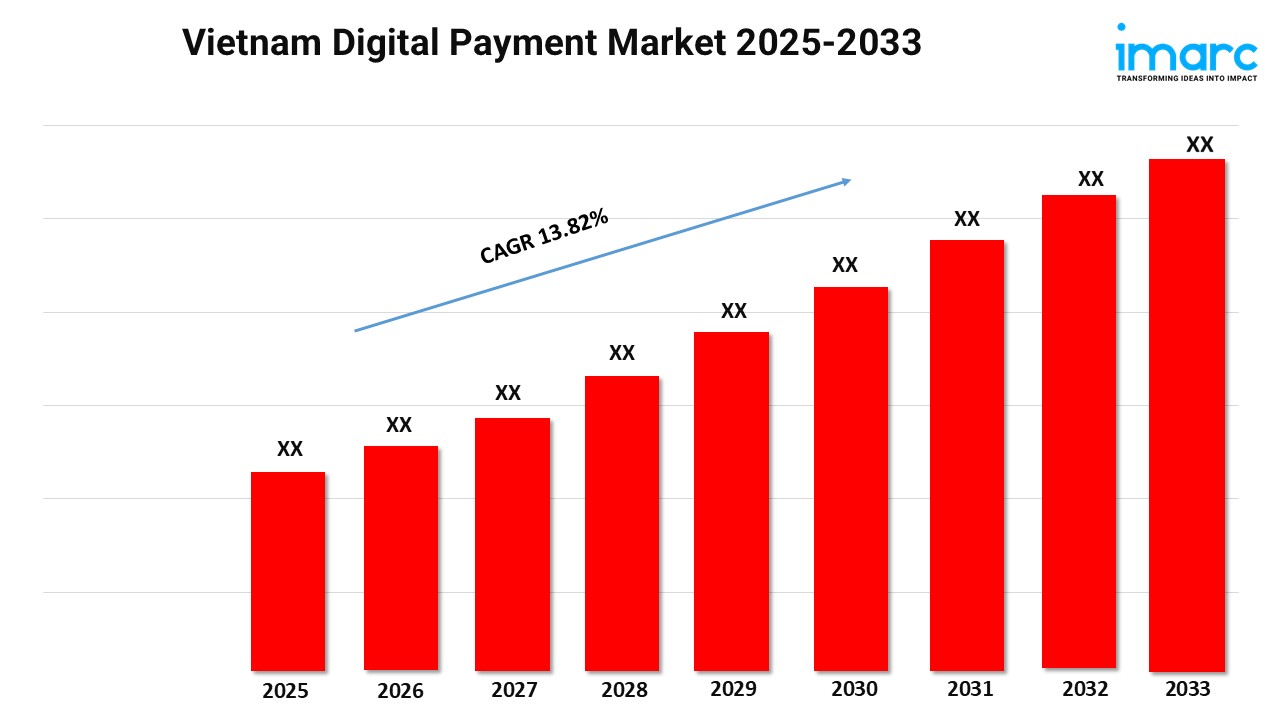

Vietnam Digital Payment Market Overview

Base Year: 2024

Historical Years: 2019–2024

Forecast Years: 2025–2033

Market Growth Rate: 13.82% (2025–2033)

The Vietnam digital payment market is experiencing rapid growth fueled by fintech innovation, smartphone penetration, and government support for a cashless economy. Vietnam digital payment market size reached USD 498.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,597.1 Million by 2033, exhibiting a growth rate (CAGR) of 13.82% during 2025-2033.

Grab a sample PDF of this report: https://www.imarcgroup.com/vietnam-digital-payment-market/requestsample

Vietnam Digital Payment Market Trends and Drive:

Growth in the Vietnam digital payment market due to the increase in the use of smartphone’s the rapid rate of urbanization particularly among the people in Ho Chi Minh city and Hanoi. Minutes/Mobile payment apps like MoMo are on the top, followed by apps like ZaloPay as consumers favour them over traditional modes of payment for easy, instant cashless transactions especially in shelf markets, online shopping etc. Mobile payment systems such as QR code payments become popular as they improve affordability among small business people and hustle from the streets. Government related programs for finanacial inclusion help increase use of digital products, payments through contactless cards and transferring funds online especially in rural areas. Concerns regarding cyber threats grow, and providers need to start using biometric authentication and fraud detection solutions. People are still using cash as a major form of payment but younger people are more inclined to use their smartphone to pay via digital wallet. Proposed changes in the regulatory framework bring less stringency in the licensing of fintech companies, which in turn are likely to encourage more innovation of P2P lending and remittance services.

Vietnam’s digital payment market is evolving with growth in e-commerce and more people joining the workforce leading to high transaction volume in terms of online shopping and bill payments. Some of the platforms, for instance Shopee and Lazada, have conveniently included payment systems in their systems making it convenient for the customers hence increasing usage. Consumers are engaged in spending cash for video games, premium streaming, and subscriptions, with millennials and Gen Z leading the way through traditonal prepaid wallet services. There are often changing regulations, aimed at making data protection more stringent, which create difficulties for smaller vendors but provide opportunities for large and well-prepared firms. New technologies are adopted, providing efficient, secure and dependable international payments especially for remittances. Banks joined forces with fintech are increasing, contributing to building the digital payments network especially in unbanked areas. Consumers wanting quick and inexpensive solutions to their transactions increase pressure on the solution to be processed quickly and cheaper. This keeps on pushing the providers of loyalty programs to pass more incentives back to the consumers through rebates and lower prices.

We explore the factors propelling the Vietnam digital payment market growth, including technological advancements, consumer behaviors, and regulatory changes.

Vietnam Digital Payment Market Report Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

Payment Mode Insights:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

Deployment Type Insights:

- Cloud-based

- On-premises

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=20405&flag=F

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145