U.S. Meat Substitutes Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

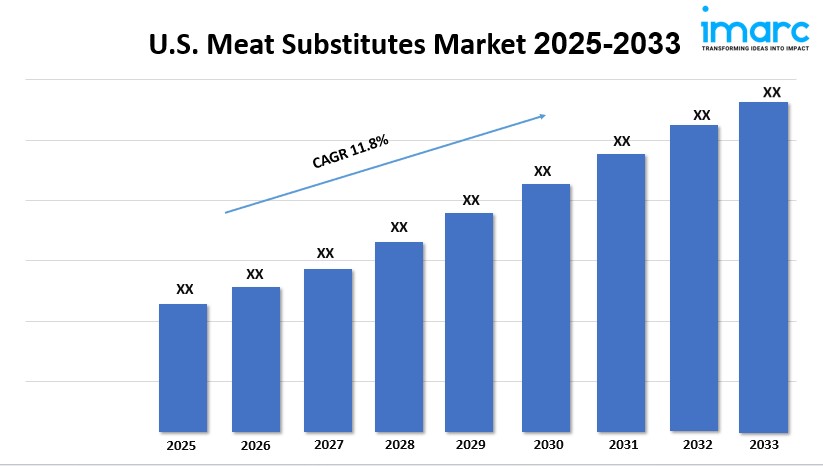

Fueled by increasing consumer focus on health and environmental sustainability, coupled with advancements in product innovation and wider availability, the U.S. meat substitutes market is primarily driven by a significant shift towards plant-based and flexitarian diets. According to the latest report by IMARC Group, The U.S. meat substitutes market size is anticipated to reach USD 1.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.6 Billion by 2033, exhibiting a CAGR of 11.8% from 2025-2033.

Download a sample copy of the Report: https://www.imarcgroup.com/united-states-meat-substitutes-market/requestsample

U.S. Meat Substitutes Industry Trends and Drivers:

The U.S. meat substitutes market is experiencing robust growth, driven by increasing consumer demand for plant-based alternatives due to health, environmental, and ethical concerns. Valued at approximately $2.25 billion in 2023, the market is projected to grow at a CAGR of 15.18% through 2029, reaching $5.25 billion. Companies like Beyond Meat and Impossible Foods are leading the charge, launching innovative products such as Beyond Sun Sausage and fourth-generation Beyond Burger, which focus on improved taste, texture, and nutrition using ingredients like avocado oil and fava beans. These advancements cater to a growing demographic of vegans, vegetarians, and flexitarians—13.46 million and 20.2 million respectively—who seek sustainable and healthier options. Environmental concerns, particularly the high greenhouse gas emissions from livestock farming, further fuel adoption. Retail expansion, with major chains like Whole Foods dedicating more shelf space to plant-based products, enhances accessibility, while fast-food chains like Smashburger introduce plant-based burgers, reflecting a cultural shift toward meat alternatives that align with modern values.

Technological innovation is transforming the U.S. meat substitutes market, with advancements like extrudable fat technology and prolamin technology improving the texture and authenticity of plant-based meats. Textured Vegetable Protein (TVP), holding a 60% market share, remains dominant due to its versatility and cost-effectiveness, particularly in soy- and pea-based products. However, challenges persist, including higher price points compared to traditional meat, which can deter price-sensitive consumers. For instance, pea protein shortages and high production costs contribute to premium pricing, positioning some substitutes as luxury goods. Despite these hurdles, government support and consumer trends toward clean labeling—emphasizing transparent, natural ingredients—are driving growth. The retail sector, accounting for 37.5% of distribution, benefits from omnichannel shopping trends, with 86% of CPG sales from omnichannel shoppers. While the market faces competition from traditional meat preferences, its trajectory remains strong, supported by a young, health-conscious demographic and ongoing investments in sustainable food technologies.

U.S. Meat Substitutes Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest U.S. meat substitutes market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

The report has segmented the market into the following categories:

Analysis by Type:

- Tofu and Tofu Ingredients

- Tempeh

- Textured Vegetable Protein (TVP)

- Seitan

- Quorn

- Others

Analysis by Source:

- Soy

- Wheat

- Mycoprotein

- Others

Analysis by Category:

- Frozen

- Refrigerated

- Shelf-Stable

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Health and Food Stores

- Convenience Stores

- Others

Regional Analysis:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the market is characterized by significant innovation and intense rivalry among key players. Companies are currently focusing on improving product quality, expanding plant-based protein portfolios, and enhancing distribution networks to capture a larger market share. Additionally, partnerships with retailers and food service chains are playing a critical role in increasing accessibility. For instance, in June 2024, Tender Food Inc., an alternative meat products startup, announced a strategic partnership with Clover Food Lab, a major U.S.-based food chain, to expand its product availability in Boston. This partnership introduced Tender’s products to 11 Clover Food Lab locations in the area. Moreover, leading firms are actively investing in advanced food technologies to replicate traditional meat’s taste and texture. Furthermore, the entry of new competitors and growing consumer demand are driving competition, fostering continuous improvement and market expansion.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145