The finance sector in 2025 is witnessing unprecedented growth, driven by rapid digitalization, evolving regulatory frameworks, and the expanding role of technology in financial services. Among the most in-demand roles are Credit Analyst, Risk Analyst, Investment Banking Analyst, and Credit Rating Analyst, each offering strong career growth and lucrative salaries. These positions are highly sought after by multinational corporations (MNCs), banks, fintech firms, and consulting giants, reflecting a robust job market for skilled finance professionals. The demand is especially high in India, where the financial ecosystem is booming, and companies are competing for top talent to navigate complex financial landscapes.

Financial Modeling Course in Delhi

How a Finance Course Can Help Secure a 100% Job

To meet the needs of this dynamic market, specialized finance courses—particularly those focused on financial modeling—have become essential. A comprehensive financial modeling course equips candidates with practical skills in Excel, financial analysis, valuation, and forecasting, all of which are critical for roles like Credit Analyst, Risk Analyst, and Investment Banking Analyst. Institutes such as SLA Consultants India offer targeted programs in Delhi (110046), combining hands-on training with industry-relevant curriculum. These courses often include placement support, increasing the likelihood of securing a job immediately after completion, especially with the growing number of MNCs seeking job-ready candidates.

Financial Modeling Training Course in Delhi

Financial Modeling Course & Free SAP FICO Certification: Summer Offer 2025

SLA Consultants India is currently offering a “Summer Offer 2025,” which includes a free SAP FICO certification alongside its Financial Modeling Course in Delhi[6]. This dual certification is particularly valuable, as SAP FICO expertise is highly regarded in corporate finance and accounting roles. The course covers core topics such as financial statement analysis, business valuation, budgeting, and scenario analysis, making graduates attractive to employers in banking, consulting, and fintech. The added SAP FICO certification further enhances employability, opening doors to roles in financial planning, reporting, and ERP implementation—a major plus for candidates aiming for MNC placements.

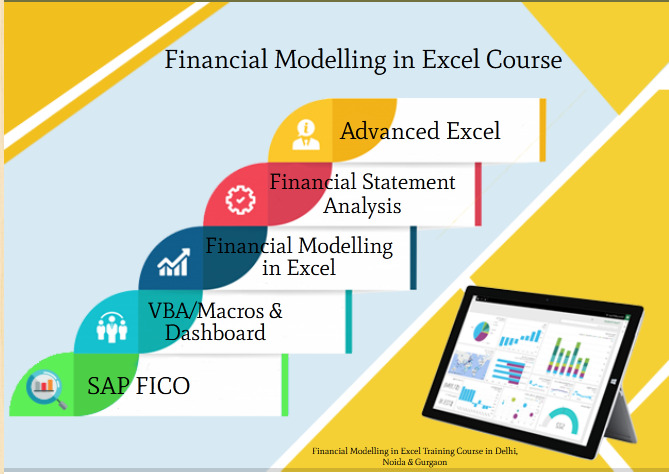

Financial Modelling in Excel with SAP FICO Training Programme Modules

Module 1 – Advanced Excel

Module 2 – Financial Statement Analysis & Corporate Finance

Module 3 – Financial Modeling

Module 4 – Advanced Dashboard & VBA / Macros Programming Objective

Module 5 – SAP FICO

Career Prospects in MNCs: Credit Analyst, Risk Analyst, and More

Graduates of these programs are well-positioned for roles in top MNCs as Credit Analysts, Risk Analysts, Investment Banking Analysts, and Credit Rating Analysts. These jobs involve evaluating creditworthiness, assessing financial risks, structuring investment deals, and providing strategic financial advice. The combination of financial modeling skills and SAP FICO knowledge makes candidates versatile and adaptable, capable of thriving in diverse financial environments. With the Indian financial sector’s rapid expansion and the global demand for finance expertise, a specialized finance course from a reputable institute like SLA Consultants India can be a decisive step toward a rewarding, future-proof career. For more details Call: +91-8700575874 or Email: hr@slaconsultantsindia.com