“Global Sustainable Finance Market Size, Share, and Trends Analysis Report—Industry Overview and Forecast to 2031

Executive Summary:

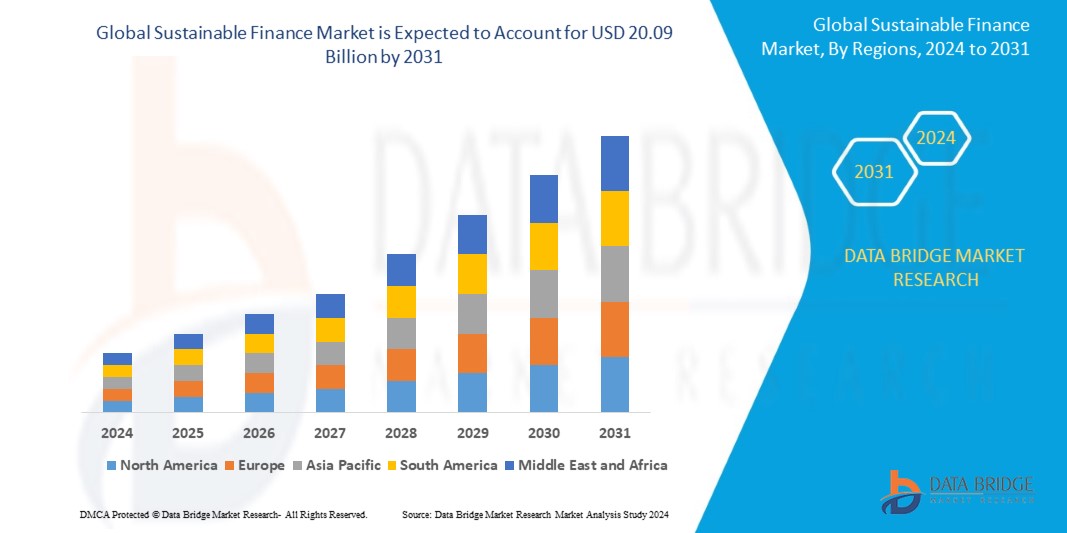

Data Bridge Market Research analyses that the global sustainable finance market which was USD 4.56 billion in 2023, would rocket up to USD 20.09 billion by 2031, and is expected to undergo a CAGR of 20.36% during the forecast period.

Sustainable Finance Market Set for Significant Growth Amid Rising Industry Demand, New Research Reveals

New comprehensive research on the Sustainable Finance Market highlights promising growth prospects fueled by evolving consumer preferences and technological advancements. The latest market analysis projects a robust CAGR over the next five years, driven by increasing adoption across key sectors and expanding geographic reach. Market players are focusing on innovation and strategic partnerships to capitalize on emerging opportunities, positioning the Sustainable Finance Market as a critical component in the broader industry landscape.

The study further identifies key trends shaping the market dynamics, including the rise of sustainable solutions and digital transformation initiatives. Regional insights reveal strong growth potential in North America and Asia-Pacific, supported by favorable regulatory environments and infrastructure development. This in-depth report offers valuable data and actionable insights for stakeholders, enabling informed decision-making and strategic planning to navigate the competitive terrain of the Sustainable Finance Market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Sustainable Finance Market report.

Download Full Report: https://www.databridgemarketresearch.com/reports/global-sustainable-finance-market

Sustainable Finance Market Overview

The sustainable finance market is experiencing rapid growth due to increasing awareness about environmental and social issues, as well as a shift towards sustainable investment practices globally. Sustainable finance involves financial products and services that aim to integrate environmental, social, and governance (ESG) criteria into investment decisions. This market is driven by the growing demand for sustainable and responsible investment options from both individual and institutional investors.

**Segments**

– **Green Bonds**: Green bonds are debt instruments where the proceeds are used for environmentally friendly projects such as renewable energy, sustainable transportation, and energy efficiency.

– **Sustainable Loans**: These are loans provided to finance projects with positive environmental or social impacts, such as sustainable agriculture, affordable housing, or clean technology initiatives.

– **Socially Responsible Investing (SRI)**: SRI focuses on investing in companies that are committed to positive social impact, ethical practices, and good corporate governance.

– **Environmental, Social, and Governance (ESG) Integration**: This segment involves considering ESG factors in investment analysis and decision-making processes to identify risks and opportunities related to sustainability issues.

**Market Players**

– **Banking Institutions**: Major banks and financial institutions are increasingly offering sustainable finance products and services to meet the growing demand from customers for ethical investment options.

– **Asset Management Firms**: Asset managers are incorporating ESG criteria into their investment strategies and offering ESG-focused funds to cater to socially responsible investors.

– **Insurance Companies**: Insurance firms are integrating sustainability principles into their underwriting practices and investing in sustainable projects to manage environmental and social risks.

– **FinTech Startups**: Fintech companies are leveraging technology to develop innovative sustainable finance solutions, such as digital platforms for impact investing and ESG analytics tools for portfolio management.

In conclusion, the sustainable finance market is poised for significant growth as investors increasingly prioritize sustainability considerations in their investment decisions. The adoption of sustainable finance practices not only aligns with global sustainability goals but also presents opportunities for financial institutions to tap into a growingThe sustainable finance market is currently witnessing a rapid expansion, driven by a variety of factors. One of the primary drivers of this growth is the increasing awareness among investors about the importance of environmental and social issues. As climate change and social inequality continue to be pressing global challenges, more investors are seeking opportunities to align their investment portfolios with their values by supporting sustainable and responsible initiatives. This shift in investor sentiment is reshaping the financial landscape and creating new opportunities for market participants across various segments.

Green bonds have emerged as a popular instrument within the sustainable finance market. These bonds are designed to fund projects that have a positive impact on the environment, such as renewable energy installations, energy-efficient buildings, and sustainable infrastructure. The issuance of green bonds has been on the rise in recent years, with both public and private sector entities tapping into this market to finance green projects. The success of green bonds has not only provided a new avenue for capital raising but has also highlighted the potential for financial innovation in support of sustainability goals.

Sustainable loans are another key segment within the sustainable finance market, offering financing for projects that deliver environmental or social benefits. From sustainable agriculture to affordable housing developments, these loans play a vital role in supporting initiatives that contribute to a more sustainable future. Financial institutions that provide sustainable loans are not only meeting the demand for responsible financing options but also positioning themselves as key players in the transition to a low-carbon and socially inclusive economy.

Socially responsible investing (SRI) is gaining traction as investors seek to support companies with strong ethical practices and positive social impacts. SRI strategies involve screening investments based on ESG criteria and actively engaging with companies to drive positive change. This approach not only allows investors to generate financial returns but also create meaningful social and environmental outcomes through their investment decisions. As more investors prioritize ethical considerations in their portfolios, the demand for SRI products and services is expected to continue growing in the coming years.

The integration of environmental, social, and governance (ESG) factors into investment decision**Market Players**

– BlackRock, Inc.

– Refinitiv

– Acuity Knowledge Partners

– NOMURA HOLDINGS, INC

– Aspiration Partners, Inc.

– Bank of America

– BNP Paribas

– Goldman Sachs

– HSBC Group

– KPMG International

– South Pole

– Deutsche Bank AG

– Stripe, Inc.

– Tred Earth Limited

– Triodos Bank UK Ltd.

– UBS

– Starling Bank

– Clarity AI

The integration of environmental, social, and governance (ESG) factors into investment decision-making processes has become a crucial aspect of sustainable finance. By considering ESG criteria, investors can better assess the risks and opportunities associated with sustainability issues, leading to more informed and responsible investment decisions. This approach not only benefits the environment and society but also enhances the long-term financial performance of investment portfolios. Market players such as BlackRock, Inc., Goldman Sachs, and HSBC Group have been at the forefront of integrating ESG considerations into their investment strategies, signaling a growing recognition of the importance of sustainability in the financial industry.

Moreover, regulatory developments and industry initiatives have further propelled the integration of ESG factors into investment practices. Regulatory bodies are increasingly emphasizing the disclosure of ESG information by companies, enhancing transparency and accountability in the financial markets. Industry-led initiatives, such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Principles for Responsible Investment (PRI

The Sustainable Finance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-sustainable-finance-market/companies

Regional Outlook

North America:

The Sustainable Finance Market in North America is driven by advanced technological infrastructure, strong consumer demand, and supportive government policies. The United States holds the largest share due to early adoption and robust investment.

Europe:

Europe showcases steady growth in the Sustainable Finance Market, supported by strict regulatory frameworks, sustainability initiatives, and innovation-led economies. Key contributors include Germany, the U.K., and France.

Asia-Pacific:

Asia-Pacific is the fastest-growing region for the Sustainable Finance Market, fueled by population growth, urbanization, and industrial expansion. China, India, and Japan are major markets with high potential.

Latin America:

Growth in Latin America is moderate but rising, driven by expanding middle-class populations and increasing awareness of Sustainable Finance Market applications. Brazil and Mexico are the leading countries.

Middle East & Africa:

The Sustainable Finance Market in this region is gaining momentum due to infrastructural developments, diversification efforts, and rising investments. The UAE, Saudi Arabia, and South Africa are key players.

Competitive Landscape

BlackRock, Inc. (U.S.), Refinitiv (U.S.), Acuity Knowledge Partners (U.S.), NOMURA HOLDINGS, INC (Japan), Aspiration Partners, Inc. (U.S.), Bank of America (U.S.), BNP Paribas (France), Goldman Sachs (U.S.), HSBC Group (U.K.), KPMG International (Netherlands), South Pole (Switzerland), Deutsche Bank AG (Germany), Stripe, Inc. (U.S.), Tred Earth Limited (U.K.), Triodos Bank UK Ltd. (U.K.), UBS (Switzerland), Starling Bank (U.K.), Clarity AI (U.S.)

Future Trends— Global Sustainable Finance Market

Upcoming Technologies:

The Sustainable Finance Market will witness rapid adoption of cutting-edge technologies such as artificial intelligence, machine learning, the Internet of Things (IoT), blockchain, and automation. These technologies are expected to enhance operational efficiency, enable real-time data-driven decisions, and introduce innovative products and services.

Consumer Behavior Changes:

The Sustainable Finance Market will be shaped by changes in consumer preferences toward offerings that are experience-driven, convenient, and personalized. Increasing demand for transparency, digital engagement, and value-driven purchases will push companies to innovate their marketing and product strategies.

Sustainability Trends:

Sustainability will be a critical focus, with consumers and regulators alike driving demand for eco-friendly materials, energy-efficient processes, and circular economy initiatives. Businesses are anticipated to prioritize green innovations to reduce carbon footprints and meet stricter environmental regulations.

Expected Innovations:

The market is expected to see significant innovations, including smart products, integration of advanced analytics for predictive insights, and development of new materials or solutions tailored to emerging needs. Collaboration between technology firms and industry leaders will accelerate these innovations.

Why This Report is Valuable

This report provides in-depth industry insights that help stakeholders understand the current market landscape, key drivers, challenges, and growth opportunities within the Sustainable Finance Market. It offers regional and segment-wise forecasts that enable precise market planning and targeted investment strategies tailored to specific geographic areas and product/service segments.

The report includes comprehensive competitor benchmarking, allowing businesses to evaluate their position relative to key players, understand competitive strategies, and identify gaps or opportunities for differentiation. Additionally, it delivers actionable strategic recommendations based on market trends and data analysis to support informed decision-making, optimize business growth, and enhance market presence.

Top 15 FAQs About the Global Sustainable Finance Market Research Report

- What key segments are analyzed in the Sustainable Finance Market report?

- Which regions show the highest growth potential in the Sustainable Finance Market ?

- What time frame does the Sustainable Finance Market report cover for forecasts?

- What are the major drivers influencing the growth of the Sustainable Finance Market?

- Who are the leading competitors in the Sustainable Finance Market?

- How is market size estimated for the Sustainable Finance Market?

- What research methodologies are used to compile the Sustainable Finance Market report?

- Does the report discuss regulatory impacts on the Sustainable Finance Market?

- Are emerging technologies covered in the Sustainable Finance Market analysis?

- How does consumer behavior affect the Sustainable Finance Market trends?

- What sustainability trends are impacting the Sustainable Finance Market?

- Does the report include a SWOT analysis of key players in the Sustainable Finance Market?

- How frequently is the Sustainable Finance Market report updated?

- Can the Sustainable Finance Market report be customized for specific business needs?

- What are the future opportunities and challenges identified in the Sustainable Finance Market?

Browse More Reports:

https://www.databridgemarketresearch.com/jp/reports/global-organic-quinoa-market

https://www.databridgemarketresearch.com/jp/reports/europe-intercom-devices-market

https://www.databridgemarketresearch.com/pt/reports/middle-east-and-africa-surgical-power-tools-market

https://www.databridgemarketresearch.com/fr/reports/global-standalone-mounted-video-encoders-market

https://www.databridgemarketresearch.com/pt/reports/north-america-liquid-chromatography-devices-market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

Tag

Sustainable Finance Market Size, Sustainable Finance Market Share, Sustainable Finance Market Trend, Sustainable Finance Market Analysis, Sustainable Finance Market Report, Sustainable Finance Market Growth, Latest Developments in Sustainable Finance Market, Sustainable Finance Market Industry Analysis, Sustainable Finance Market Key Player, Sustainable Finance Market Demand Analysis“