In today’s competitive market, offering consumer financing for field service businesses is becoming increasingly vital. This financing model allows service providers, including contractors, HVAC companies, and electricians, to offer flexible payment options to their customers. It’s an attractive solution for clients who may not have the immediate funds to pay for large, unexpected service expenses. By providing access to financing, field service businesses can increase conversion rates, build customer loyalty, and ultimately grow their revenue.

The Importance of Consumer Financing for Field Service Businesses

The growth of consumer financing for field service businesses is due to several key factors. First, it enables companies to close deals faster. Instead of customers hesitating due to upfront costs, they can choose a flexible payment plan that works for them. Secondly, offering financing boosts customer satisfaction, as it shows a commitment to helping clients manage costs. Lastly, financing attracts a broader customer base, including those who might have previously felt they couldn’t afford high-cost repairs or services.

Customer Financing For Roofers: A Crucial Tool for Success

The roofing industry is one of the most impacted by the need for customer financing for roofers. Roof repairs or replacements often involve significant costs, and many homeowners may not have the resources to cover them immediately. By offering financing options, roofers can differentiate themselves from their competitors, making it easier for clients to commit to a project without the financial burden upfront.

For roofers, offering customer financing not only helps increase sales but also improves the overall customer experience. Homeowners can choose from different financing plans that suit their budgets, such as low monthly payments or deferred interest rates. This flexibility fosters trust and loyalty, encouraging customers to return to the same roofer in the future.

Why Customer Financing is Vital for Small Businesses

Many small businesses, especially those in the service industry, struggle to make large-ticket sales because customers are hesitant to pay for services upfront. Offering customer financing for small businesses opens new avenues for these companies to increase sales, improve cash flow, and gain a competitive edge. Whether it’s a landscaper, a plumber, or a cleaning company, small businesses benefit immensely from providing flexible payment options.

Small businesses often rely on financing programs to boost their revenue and extend their market reach. With the ability to offer financing to customers, they can attract a wider audience and allow more people to access their services. Additionally, it makes it easier for businesses to weather the challenges of cash flow, especially when payment plans are spread out over time.

In-Home Services Consumer Financing: Providing Comfort and Convenience

In-home services consumer financing is a particularly effective strategy for businesses providing services in a customer’s home, such as HVAC installations, appliance repairs, or plumbing work. Consumers are more likely to accept financing when they are receiving a service in the comfort of their own homes, as these services can often be expensive. With in-home services consumer financing, businesses can provide payment options that cater to the needs of their customers while still maintaining a high level of service.

For example, companies providing in-home services can offer zero-interest financing for 12 or 24 months, or low monthly payments that make large expenses more manageable. Customers appreciate the convenience of financing when they’re dealing with essential services that need immediate attention. With flexible payment terms, businesses can ensure that customers don’t delay services because of financial constraints.

Offering Financing to Customers for Roofers: The Benefits and Strategies

When roofers decide to offer financing to customers, they open the door to a range of benefits. Not only does it enable them to close more deals, but it also ensures customers are more likely to make purchasing decisions sooner. Roof repairs, installations, and maintenance are often necessary, but the associated costs can be daunting. Offering financing helps alleviate that burden, making roof replacements and repairs much more affordable.

By using financing solutions, roofers can customize their offerings to different customer needs, ensuring they have something for everyone. Whether it’s a 12-month same-as-cash offer or a 24-month low-interest option, roofers have the flexibility to cater to different financial situations.

Additionally, roofers who partner with third-party financing companies can offer quick approvals and competitive interest rates. With financing options available at the point of sale, customers can immediately see how affordable a roofing project can be.

Point Of Sale Financing For Contractors: A Modern Necessity

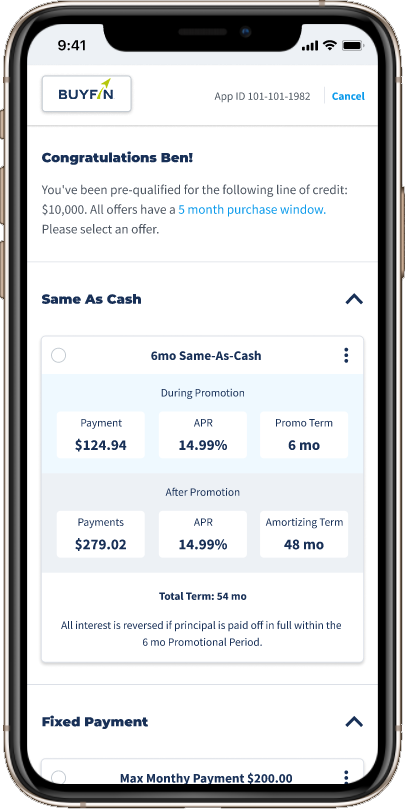

Point of sale financing for contractors is a modern solution that has been gaining traction in recent years. This type of financing allows contractors to offer immediate, flexible payment options directly at the moment of the transaction. Whether the contractor is an electrician, plumber, or general contractor, point-of-sale financing allows them to convert leads into customers quickly by offering easy payment terms.

For contractors, offering point-of-sale financing reduces friction during the purchasing process. Instead of customers needing to go through lengthy loan approval processes or search for outside lenders, contractors can offer financing directly through a partner, making the process seamless and fast. Point-of-sale financing also enables contractors to increase average sale sizes, as customers are more likely to purchase additional services or higher-priced upgrades when they have access to easy financing options.

How to Implement Financing Options in Field Services

Implementing consumer financing for field service businesses requires several key steps. First, businesses must research and partner with reputable financing providers that align with their brand and customer base. These providers will typically offer a range of financing options such as installment plans, deferred interest, or revolving credit lines, which businesses can then present to customers.

Secondly, businesses need to clearly communicate the financing options available to their customers. This can be done through promotional materials, websites, or by simply informing customers during consultations or service appointments. Lastly, businesses must train their staff on how to present financing options in a way that is transparent, easy to understand, and customer-friendly.

Conclusion

In conclusion, offering consumer financing for field service businesses, customer financing for roofers, and point-of-sale financing for contractors is a smart strategy that can greatly enhance sales, improve customer satisfaction, and provide a competitive edge. It allows businesses to cater to a broader range of customers, ensuring that more people can access and afford the services they need. With the right financing partner and strategy, businesses can thrive in an increasingly demanding market.