In today’s competitive marketplace, offering flexible and convenient financing options has become a powerful tool for growing your business. Whether you’re in the field services industry, a roofer, or a small business owner, providing customer financing options can significantly increase your sales and improve customer satisfaction. By offering financing, you enable your customers to afford services or products that may otherwise be out of their budget. In this article, we’ll explore how consumer financing for field service businesses, customer financing for roofers, customer financing for small businesses, and point of sale financing for contractors can lead to substantial business growth.

Why Consumer Financing is Important for Field Service Businesses

Field service businesses such as plumbing, HVAC, electrical services, and home repairs often face the challenge of convincing customers to commit to high-value services that require significant upfront costs. Offering Customer Financing For Small Businesses is a game-changer. Financing gives customers the ability to break down large bills into smaller, manageable payments, which makes them more likely to proceed with services immediately rather than postponing or forgoing them due to budget constraints.

With consumer financing, field service providers can:

- Increase conversion rates: Customers are more likely to say “yes” when they know they don’t have to pay the full amount upfront.

- Boost average order value: By offering financing options, businesses can upsell services and increase the overall ticket value.

- Enhance customer satisfaction: Flexible payment plans help customers feel more in control of their finances and more satisfied with the service.

Customer Financing for Roofers: A Smart Solution for Expensive Home Improvements

Roofing projects are often costly and can be a financial burden for homeowners. Offering customer financing for roofers allows your customers to invest in essential roof repairs or replacements without the stress of paying the entire sum upfront. Whether it’s a minor roof repair or a complete roof replacement, financing options can break the cost into manageable monthly payments, increasing the likelihood that customers will choose your services over competitors.

Customer financing helps roofing companies by:

- Closing deals faster: When customers can finance the project, they’re more likely to make a decision quickly.

- Improving cash flow: Roofing companies can maintain a steady cash flow by offering financing, which ensures timely payments even if customers opt for installment plans.

- Building trust and credibility: Offering financing demonstrates that you understand the financial pressures your customers face and that you are committed to making quality services more accessible.

Customer Financing for Small Businesses: Expanding Access to Your Products or Services

Small businesses, whether they are selling products or providing services, can greatly benefit from customer financing for small businesses. Many small business owners operate on tight budgets and may be hesitant to spend large sums of money on products or services that can enhance their operations. By offering financing options, you provide a way for customers to afford your offerings without having to pay everything upfront.

When small businesses offer financing, they can:

- Expand their customer base: Financing makes it easier for customers with limited budgets to access your products or services.

- Increase sales: Customers are more likely to make larger purchases when they have the option to pay over time.

- Build customer loyalty: Offering financing can help customers feel more connected to your business and more likely to return for future purchases.

Finance for Customers of Small Businesses: A Tool to Drive Growth

One of the most effective ways to drive sales and build long-term relationships with customers is by offering finance for customers of small businesses. Customers who have the option to finance their purchases are more inclined to buy more and make quicker decisions. This is especially important for small businesses that offer high-ticket items or services. With financing, customers are more likely to proceed with a purchase they might have otherwise delayed or skipped.

The advantages of offering financing to customers include:

- Increased revenue: More customers can afford your products or services, resulting in higher revenue.

- More repeat business: Financing options can encourage customers to return for more purchases in the future, knowing that they have manageable payment plans.

- Competitive edge: Offering financing makes your business stand out from competitors who don’t provide flexible payment options.

Offering Financing to Customers: A Must for Roofers

Offering financing to customers is essential for businesses in the roofing industry. Roof replacement or repair is often an unexpected expense for homeowners, and many may not have the cash readily available to cover the cost. By providing financing options, roofers make it easier for customers to afford quality roofing services.

The key benefits of offering financing to customers in the roofing industry include:

- Higher sales volume: Financing encourages more people to follow through on roofing projects, even if they might have otherwise delayed them.

- Quick approval process: Many financing options allow customers to get approved in minutes, enabling roofers to begin work faster.

- Improved customer retention: When customers see that you are providing them with flexible payment solutions, they are more likely to return for future projects and recommend your services to others.

Point of Sale Financing for Contractors: Streamlining Payments

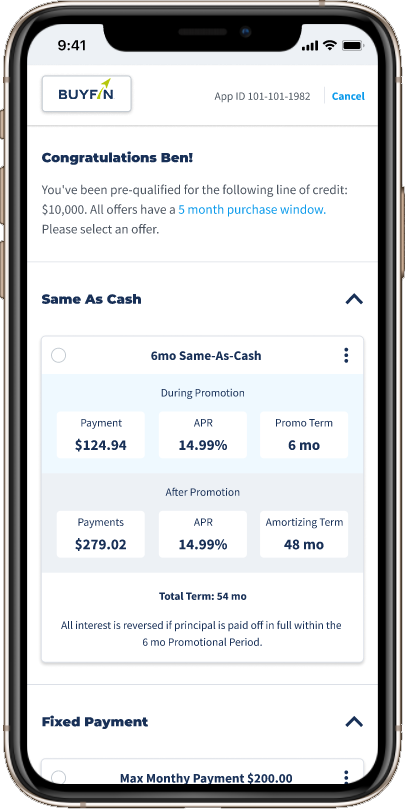

Point of sale financing for contractors is another crucial tool for contractors who want to close deals faster and provide more accessible services. Whether you’re a contractor offering home improvement services, electrical work, or construction, point of sale financing allows your customers to get approved for financing directly at the moment of purchase or agreement.

The benefits of point of sale financing for contractors include:

- Faster decision-making: When customers can immediately see that they have financing options, they are more likely to commit to the project.

- Increased conversion rates: Offering point of sale financing allows you to close sales faster and avoid losing potential customers who might hesitate due to cost concerns.

- Simplified process: The financing application is seamless and can be completed in real time, allowing contractors to focus more on the job and less on administrative tasks.

Conclusion: Financing Solutions for Business Success

Offering financing options is a game-changer for businesses across various industries. Whether you’re in the field services sector, roofing, small business, or construction, consumer financing for field service businesses, customer financing for roofers, and point of sale financing for contractors can enhance your sales, increase customer satisfaction, and improve cash flow. Financing provides a solution for customers who need assistance in making large purchases and can help your business grow by making your services or products more accessible to a wider range of customers. With flexible, affordable financing options, you can position your business for long-term success and profitability.