IMARC Group, a leading market research company, has recently releases report titled “Trade Credit Insurance Market Report by Component (Product, Services), Coverages (Whole Turnover Coverage, Single Buyer Coverage), Enterprises Size (Large Enterprises, Medium Enterprises, Small Enterprises), Application (Domestic, International), Industry Vertical (Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, Automotive, and Others), and Region 2025-2033” The study provides a detailed analysis of the industry, including the global trade credit insurance market trends, share, size, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How Big Is the Trade Credit Insurance Market?

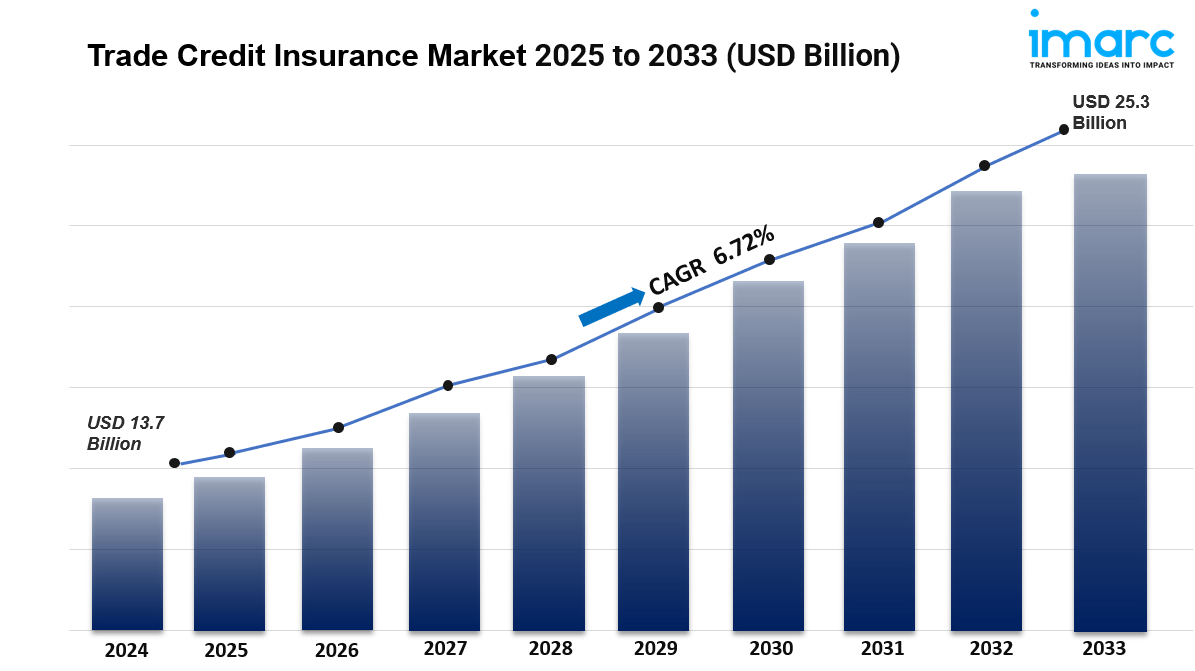

The global trade credit insurance market size reached USD 13.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033.

Global Trade Credit Insurance Market Trends:

The trade credit insurance market is poised for significant evolution as various trends emerge, influencing both demand and service delivery within the sector. One of the most prominent trends is the growing recognition of trade credit insurance as an essential risk management tool for businesses operating in increasingly complex and interconnected global markets. Companies are becoming more aware of the potential financial repercussions of buyer defaults, prompting them to seek comprehensive coverage that can safeguard their receivables. The trend towards globalization is also driving demand, as businesses look to expand their reach into new markets while managing the associated risks. Furthermore, there is a noticeable shift towards customized insurance solutions, with insurers offering more tailored policies that address the specific needs and risk profiles of individual businesses. This personalization is being facilitated by advancements in technology, enabling insurers to provide more flexible and responsive coverage options. Additionally, the rise of e-commerce and digital transactions is reshaping the landscape of trade credit insurance, as insurers adapt their offerings to cater to the unique challenges posed by online sales and cross-border transactions. As these trends continue to unfold, the trade credit insurance market is expected to thrive, providing businesses with the tools they need to navigate the complexities of modern trade while minimizing financial exposure. With a focus on innovation, customization, and risk mitigation, the future of trade credit insurance looks promising as it aligns with the evolving needs of businesses in an increasingly dynamic global economy.

Factors Affecting the Growth of the Trade Credit Insurance Industry:

Increasing Global Trade and Economic Uncertainty:

The trade credit insurance market is experiencing notable growth driven by the increasing volume of global trade coupled with economic uncertainties that businesses face in today’s environment. As companies expand their operations internationally, they encounter various risks associated with extending credit to buyers in foreign markets. These risks include political instability, currency fluctuations, and changes in regulatory environments, which can adversely affect payment timelines and creditworthiness. Trade credit insurance provides businesses with a safety net, protecting them against potential defaults and ensuring that they can maintain cash flow even in challenging conditions. The heightened awareness of these risks has led to a growing demand for trade credit insurance as businesses seek to mitigate potential losses and secure their receivables. Additionally, the post-pandemic recovery phase has prompted many companies to reassess their risk management strategies, further driving the adoption of trade credit insurance. As global trade continues to expand and economic uncertainties persist, the trade credit insurance market is likely to see sustained growth, with increasing emphasis on protecting businesses from financial exposure.

Technological Advancements in Risk Assessment:

Technological advancements are significantly reshaping the trade credit insurance market, particularly in the realm of risk assessment and underwriting processes. Insurers are increasingly leveraging big data analytics, artificial intelligence (AI), and machine learning to enhance their ability to assess the creditworthiness of potential buyers. These technologies allow insurers to analyze vast amounts of data from various sources, including financial statements, payment histories, and market trends, to make more informed underwriting decisions. This shift towards data-driven decision-making not only improves the accuracy of risk assessments but also enables faster policy issuance and claims processing, enhancing overall customer experience. Furthermore, digital platforms are making it easier for businesses to access trade credit insurance, compare policies, and manage their coverage more effectively. As technology continues to evolve, insurers that embrace these innovations will be better positioned to meet the demands of a dynamic market, ultimately driving growth in the trade credit insurance sector. The integration of technology into risk assessment processes is expected to streamline operations and improve the efficiency of trade credit insurance, making it more accessible and appealing to businesses of all sizes.

Regulatory Changes and Market Adaptation:

Regulatory changes are playing a pivotal role in shaping the trade credit insurance market, influencing how insurers operate and how businesses utilize these products. Governments and regulatory bodies are increasingly focusing on enhancing transparency and accountability in financial markets, which can impact the terms and conditions of trade credit insurance policies. For instance, regulations aimed at preventing fraud and ensuring fair practices may require insurers to adopt more stringent underwriting criteria and disclosure practices. As a result, businesses may need to adapt their credit management strategies to align with these evolving regulations. Additionally, regulatory support for trade credit insurance, such as government-backed schemes or incentives for businesses to obtain coverage, can stimulate demand for these products. In regions where economic conditions are volatile, regulatory frameworks that promote trade credit insurance can provide businesses with the confidence to extend credit to customers, fostering economic growth. As the regulatory landscape continues to evolve, trade credit insurers must remain agile and responsive to changes, ensuring that they can effectively support their clients while navigating compliance requirements. The interplay between regulation and market dynamics will be crucial in shaping the future of the trade credit insurance market.

Request For A Sample Copy Of This Report: https://www.imarcgroup.com/trade-credit-insurance-market/requestsample

Trade Credit Insurance Market Segmentation:

Breakup by Component:

- Product

- Services

Breakup by Coverages:

- Whole Turnover Coverage

- Single Buyer Coverage

Breakup by Enterprises Size:

- Large Enterprises

- Medium Enterprises

- Small Enterprises

Breakup by Application:

- Domestic

- International

Breakup by Industry Vertical:

- Food and Beverages

- IT and Telecom

- Metals and Mining

- Healthcare

- Energy and Utilities

- Automotive

- Others

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to high consumer spending power and a strong presence of major cosmetic brands.

Top Trade Credit Insurance Market Leaders:

The trade credit insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- American International Group Inc.

- Aon plc

- Axa S.A.

- China Export & Credit Insurance Corporation, Chubb Limited (ACE Limited)

- Coface

- Euler Hermes (Allianz SE)

- Export Development Canada

- Nexus Underwriting Management Ltd.

- QBE Insurance Group Limited

- Willis Towers Watson Public Limited Company and Zurich Insurance Group Ltd.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=4666&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145