Options trading well hedges risk and offsets the income in financial markets. The numerous strategies of using options by traders include the short straddle and the iron butterfly strategy, which are well known for helping traders with market movements, volatility, and time decay in their trades. Selling options and minting bucks from limited price movements are the things shared by both. However, different trading environments distinguish them from each other. The different aforementioned strategies will be explored in detail, about how they perform, the risks associated, and when to use them.

Understanding the Short Straddle Strategy

What is the Short Straddle?

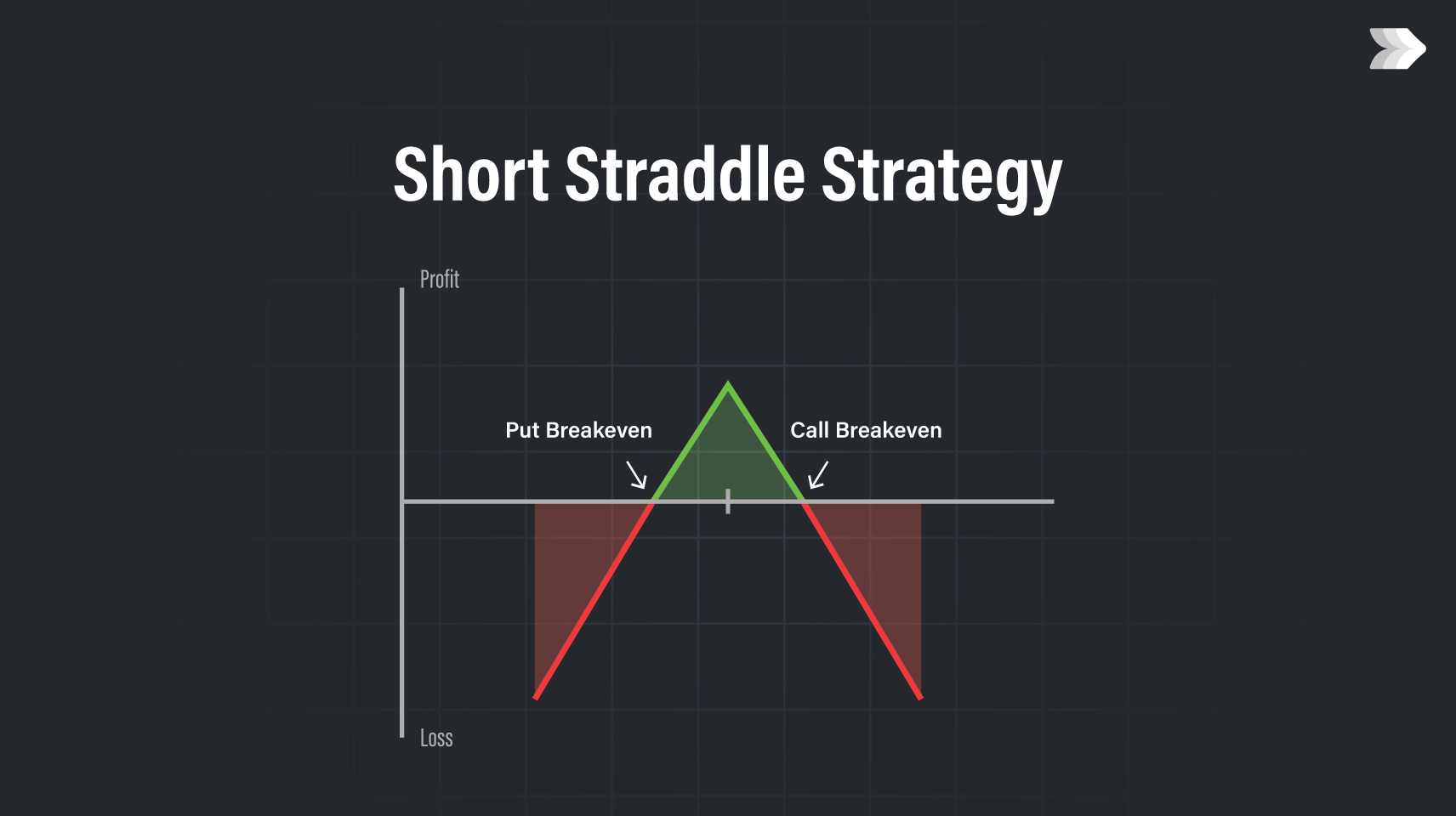

Short straddle strategy is the options trading strategy where an investor sells a call and puts an option at the same strike price and expiration date. These strategies act well for traders who have a bearish sentiment regarding the market in relation to volatility and foresee that the asset would stay near the strike price by the due date.

How does it work?

– Sell a Call Option – The trader sells an at-the-money (ATM) call option, collecting a premium.

– Sell a Put Option – Simultaneously, the trader sells an ATM put option, collecting another premium.

– Profit from Low Volatility – The goal is for the underlying asset to stay close to the strike price, allowing both options to expire worthless and enabling the trader to keep the premiums received.

Benefits of the Short Straddle

High Premium Collecting – The trader sells a call and a put, and therefore the joint premium collection creates a space for income generation.

Profiting from Time Decay (Theta) – An option loses its value over time, and should the asset remain around the strike price, then both options will then decay in equal amounts benefiting the trader.

Neutral Market Strategy- The strategy yields a high kind of price movement as an low-volatility environment produces so much less price movement.

Disadvantages of the Short Straddle Strategy

Unlimited Loss Potential- All losses will be quite large if the asset moves significantly in either direction.

Margin Requirements: In the treatment of risk, mainly a broker would require high margin amounts because of the strategy being a selling of options.

Effect on Volatility- If the market volatility suddenly increases, one may also suffer losses as this increases the option prices.

Understanding the Iron Butterfly Strategy

What is an Iron Butterfly?

An advanced options trading strategy known as iron butterfly consists of four different options contracts. This is a mixture of a short straddle and an additional protective call and put to cap potential risk.

How Does It Work?

Sell an ATM Call Option – This generates premium income.

Buy an Out-of-the-Money (OTM) Call Option – This protects against a rapid upward swing.

Buy an OTM Put Option – Against strong downward movements.

Advantages of the Iron Butterfly Strategy

Limited Risk-the iron butterfly has a defined risk from having long call and put positions, unlike a short straddle.

Profits from Time Decay – Like the short straddle, this strategy profits from the gradual decline in the value of options premiums.

Lower Margin Requirements-As losses are capped, brokers generally require lower margin compared to an uncovered short straddle.

Risks of the Iron Butterfly Strategy

Less Profit Potential, net credit received will be less than a short straddle as other options are bought for protection.

Complex Execution requires knowledge to manage four option contracts.

Requires Stability will be profitable only if the asset remains within a very small range of the strike price.

When to Use Each Strategy

Use the Short Straddle Strategy When:

- You expect minimal movement in the underlying asset.

- You are comfortable with the potentially unlimited risk.

- You want to maximize premium collection and can handle the margin requirements.

- Use the Iron Butterfly Strategy.

- You prefer minimal risk to a precisely defined maximum loss.

- You anticipate that price movement will be slight and confined to a limited range.

- You hope to strike a satisfactory balance between risk and reward.

Conclusion

Both short straddle strategy and iron butterfly strategy come in handy as tools for the options trader. On the one hand, a short straddle suits an investor keen on getting high premium income and having an appetite for risk; meanwhile, the iron butterfly is the tool that presents a conservative approach because it also has defined risk and uses lower margins.