“Mobile Payment Technologies Market Size, Share, and Trends Analysis Report—Industry Overview and Forecast to 2030

According to Data Bridge Market Research firms, the Digital Wallets Market is set to achieve robust growth, supported by emerging economies and digital transformation. Companies operating in the Contactless Payment Solutions Market are leveraging advanced technologies to enhance productivity and meet consumer expectations. The demand for customized solutions is rising, further driving expansion in the Mobile Commerce Market. Leading industry players are focusing on research-backed strategies to strengthen their market position. As competition intensifies, businesses in the Smartphone Payment Systems Market are utilizing detailed market research reports to understand shifting trends, consumer behavior, and future opportunities in the Cashless Transaction Market.

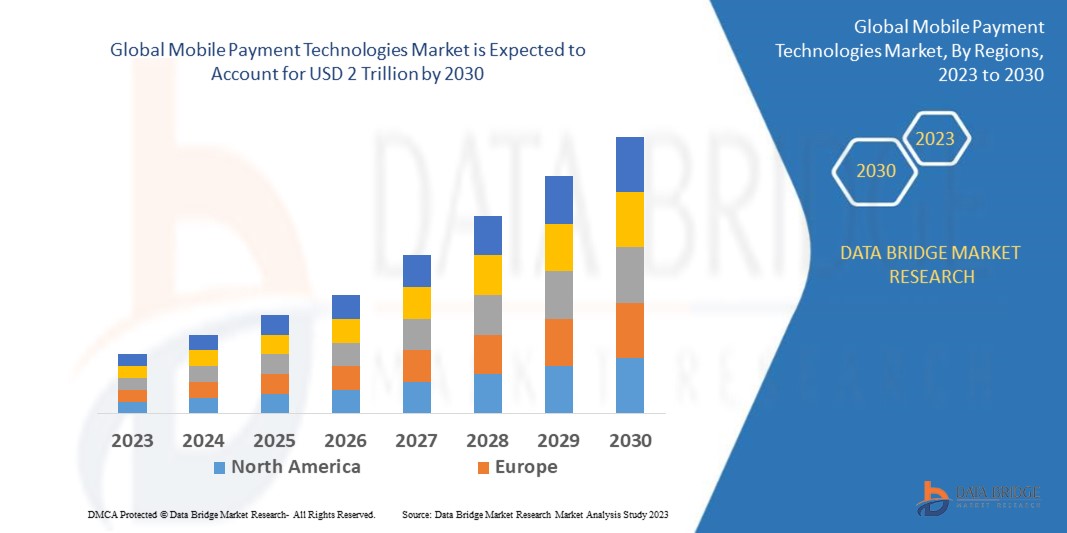

The Mobile Payment Technologies Market is poised for significant growth, with a market outlook highlighting substantial growth potential driven by emerging opportunities in key sectors. This report provides strategic insights, demand dynamics, and revenue projections, offering a comprehensive view of the future landscape, technology disruptions, and adoption trends shaping the industry’s ecosystem evaluation. According to Data Bridge Market Research Data Bridge Market Research analyses that the Global Mobile Payment Technologies Market which was USD 33 Million in 2022 is expected to reach USD 89 Billion by 2030 and is expected to undergo a CAGR of 37.00% during the forecast period of 2022 to 2030

Leading market research reports highlight the growing use of advanced solutions in the NFC Payment Market to improve efficiency and sustainability. Businesses are adapting to regulations, integrating technology, and refining their strategies to stay competitive in the QR Code Payment Market. The rise of digital transformation has reshaped the E-Wallet Market, pushing companies to invest in automation and smarter business models. With demand rising, companies in the Fintech Payment Solutions Market are focusing on innovation and customer engagement to stand out. As the industry expands, the Digital Banking Market presents endless possibilities for businesses ready to embrace change.

Our comprehensive Mobile Payment Technologies Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/global-mobile-payment-technologies-market

**Segments**

– Based on payment mode, the mobile payment technologies market can be segmented into contact-based payments, and contactless payments. Contact-based payments involve the use of physical contact between the payment device and the point of sale terminal, including methods like NFC (Near Field Communication) and QR code payments. Contactless payments, on the other hand, enable transactions to occur without physical contact, utilizing technologies such as RFID (Radio-Frequency Identification) and biometrics for authentication.

– When considering the type of transaction, the market can be divided into peer-to-peer (P2P) payments, merchant payments, and bill payments. P2P transactions involve funds moving directly from one individual to another through a mobile platform, while merchant payments focus on transactions between consumers and businesses. Bill payments refer to the settling of invoices or recurring charges through mobile devices.

**Market Players**

– Key participants in the mobile payment technologies market include Apple Inc., Alphabet Inc. (Google), Samsung Electronics Co., Ltd., PayPal Holdings, Inc., Visa Inc., Mastercard Incorporated, Alipay (Ant Financial), WeChat Pay (Tencent), Square, Inc., and Amazon.com, Inc. These companies are at the forefront of driving innovation in mobile payment solutions, offering secure and convenient options for consumers and businesses alike. From e-wallet services to mobile banking apps, these players are continuously enhancing their offerings to meet the evolving needs of the market.

The dynamic landscape of the mobile payment technologies market is shaped by factors such as the increasing adoption of smartphones, the proliferation of digital payment options, and the growing demand for secure and seamless transaction experiences. As consumers seek convenience and flexibility in their payment methods, mobile technologies play a pivotal role in transforming the way transactions are conducted. With the rise of contactless payments and the integration of biometric authentication, the market is witnessing a shift towards faster, more secure, and user-friendly mobile payment solutions. The ongoing advancements in mobile technology, coupled with the changing regulatory environment and the emergence ofThe mobile payment technologies market is a dynamic and rapidly evolving sector driven by the increasing integration of smartphones into daily life. As smartphone penetration continues to rise globally, consumers are increasingly turning to their mobile devices for a wide range of transactions, from shopping to bill payments. This trend is further fueled by the proliferation of digital payment options that offer convenience, security, and flexibility. Mobile payment technologies are reshaping the payments landscape by enabling seamless, contactless transactions that reduce the need for physical cash or cards.

Key players in the mobile payment technologies market are at the forefront of innovation, constantly introducing new features and services to meet the evolving needs of consumers and businesses. Companies such as Apple, Google, Samsung, and PayPal are leveraging their vast user bases and technological expertise to create secure and user-friendly mobile payment solutions. These players offer a range of services, from e-wallets to mobile banking apps, that allow users to make payments, transfer funds, and manage their financial transactions with ease.

One of the key trends driving the growth of the mobile payment market is the increasing adoption of contactless payments. Contactless technologies such as NFC and RFID enable users to make fast and secure transactions by simply tapping their smartphones or cards on a compatible terminal. This not only enhances convenience for consumers but also provides a more hygienic and efficient payment experience, especially in light of the ongoing COVID-19 pandemic. As businesses and consumers embrace contactless technologies, the demand for mobile payment solutions that offer seamless transactions is expected to continue to grow.

Another significant trend in the mobile payment market is the integration of biometric authentication for enhanced security. Biometric technologies such as fingerprint scanning and facial recognition are increasingly being used to verify user identities and authorize transactions, adding an extra layer of security to mobile payments. By combining biometric authentication with encryption and tokenization technologies, mobile payment providers are able to offer highly secure transaction experiences that protect user data and prevent fraud.

In conclusion, the mobile payment technologies market is a dynamic and fast-growing sector**Market Players**

– Google (Alphabet Inc.) (U.S.)

– Alibaba Group Holdings Limited (China)

– Amazon.com Inc. (U.S.)

– Apple Inc. (U.S.)

– American Express Company (U.S.)

– M Pesa (India)

– Money Gram International (U.S.)

– PayPal Holdings Inc. (U.S.)

– Samsung Electronics Co. Ltd. (South Korea)

– Visa Inc. (U.S.)

– WeChat (Tencent Holdings Limited) (China)

The mobile payment technologies market is witnessing significant growth and transformation driven by various technological advancements and changing consumer preferences. The adoption of smartphones and digital payment options is on the rise globally, leading to an increased reliance on mobile devices for a wide array of transactions. This trend is further supported by the convenience, security, and flexibility offered by mobile payment solutions provided by key players in the market.

Google, Apple, Samsung, PayPal, and other leading companies are continuously innovating to meet the evolving needs of consumers and businesses in the mobile payment sector. With offerings ranging from e-wallets to mobile banking apps, these market players are enhancing the user experience by providing secure and seamless payment options. The integration of contactless payment technologies like NFC and RFID, coupled with biometric authentication methods, is driving the market towards faster, more secure, and user-friendly payment experiences.

The demand for contactless payments is growing rapidly, especially amidst the COVID-19 pandemic, where hygiene and efficiency are paramount. Contact

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in Mobile Payment Technologies Market : https://www.databridgemarketresearch.com/reports/global-mobile-payment-technologies-market/companies

Key Questions Answered by the Global Mobile Payment Technologies Market Report:

- How will the increasing adoption of Mobile Payment Technologies Market in high-performance computing impact the overall market growth?

- How much is the global Mobile Payment Technologies Market worth? What was the market value in 2024?

- Who are the major players operating in the Mobile Payment Technologies Market? Which companies are the front runners?

- Which recent industry trends can be implemented to generate additional revenue streams?

- How will AI, IoT, and 5G advancements influence the Mobile Payment Technologies Market in the next five years?

- What are the key drivers fueling the growth of the Mobile Payment Technologies Market?

- What are the major challenges and barriers faced by the Mobile Payment Technologies Market?

- How is technological innovation shaping the future of Mobile Payment Technologies Market products?

- What is the impact of government regulations and policies on the Mobile Payment Technologies Market?

- How do supply chain disruptions affect the Mobile Payment Technologies Market?

- What are the regional differences in demand for Mobile Payment Technologies Market products?

- How do revenue streams vary across different sectors of the Mobile Payment Technologies Market?

- What role does technology play in enhancing growth and efficiency in the Mobile Payment Technologies Market?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/global-corporate-banking-solutions-market

https://www.databridgemarketresearch.com/reports/global-nutritional-analysis-for-bakery-products-market

https://www.databridgemarketresearch.com/reports/global-engine-flush-market

https://www.databridgemarketresearch.com/reports/global-cleanroom-fluorescent-lighting-market

https://www.databridgemarketresearch.com/reports/global-peripheral-circulatory-disease-treatment-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 982

✉ Email: corporatesales@databridgemarketresearch.com

Tag

Mobile Payment Technologies Market Size, Mobile Payment Technologies Market Share, Mobile Payment Technologies Market Trend, Mobile Payment Technologies Market Analysis, Mobile Payment Technologies Market Report, Mobile Payment Technologies Market Growth, Latest Developments in Mobile Payment Technologies Market, Mobile Payment Technologies Market Industry Analysis, Mobile Payment Technologies Market Key Players, Mobile Payment Technologies Market Demand Analysis“