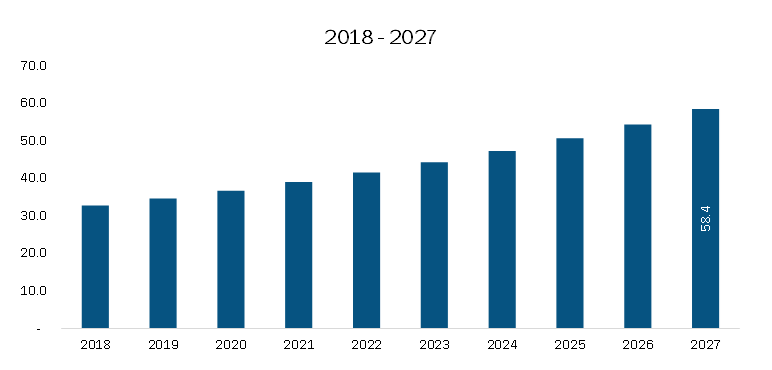

In 2018, the European plant protein market was valued at USD 5,808.5 million and is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2019 to 2027, reaching USD 9,452.5 million by 2027.

Download Full PDF Sample Copy of Market Report @- https://www.businessmarketinsights.com/sample/TIPRE00008912

Plant protein is a natural protein sourced from plants like soy, wheat, pea, and others. It plays a crucial role in building healthy muscles and tissues in the body, while also aiding in weight management. Compared to animal proteins, plant-based proteins are typically lower in calories and fat but richer in fiber and essential nutrients.

In 2018, the “Rest of Europe” region led the European plant protein market, followed by Germany. The Rest of Europe includes countries such as Spain, Austria, Poland, Portugal, and Turkey. These regions have experienced steady but notable growth in plant protein production and consumption. The demand for plant protein in these areas is expected to rise due to increased investment in research and development by manufacturers and expanding applications in sectors like food and beverages, cosmetics, personal care, and more. Furthermore, the growth of diverse product offerings is fueling market expansion in the Rest of Europe.

In Germany, the high-protein trend is gaining significant traction. A major driver for the plant protein market in the country is the growing shift toward wellness-oriented lifestyles among consumers. There has been a notable rise in the consumption of nutritional supplements and related products in recent years. Additionally, the increasing preference for vegan and vegetarian food options over meat products is further propelling the growth of the plant protein market in Germany.

The European plant protein market is experiencing a rapid evolution, shaped by a combination of changing consumer preferences, regulatory frameworks, and sustainability concerns. Strategic insights into this landscape can unlock a competitive edge for businesses, investors, and manufacturers looking to capitalize on emerging opportunities.

Key Trends:

- Sustainability and Environmental Concerns: European consumers are increasingly motivated by sustainability in their purchasing decisions. Plant-based proteins are seen as an eco-friendly alternative to animal-based products, with less environmental impact in terms of water usage, land consumption, and carbon emissions. This trend is leading to a surge in demand for plant proteins in various categories, from food and beverages to supplements and meat alternatives.

- Health and Wellness Focus: There’s a growing awareness of plant-based diets’ health benefits. High-protein diets, especially those derived from plants, are gaining popularity among health-conscious consumers. Plant proteins are being integrated into snacks, protein bars, dairy alternatives, and ready-to-eat meals, responding to consumer demands for healthier, functional foods.

- Innovative Product Development: Manufacturers are expanding their product portfolios to include plant-based options that mimic the taste and texture of traditional animal proteins. Advanced processing technologies are enabling the development of plant-based meats, dairy alternatives, and protein-rich beverages with improved taste profiles, nutritional value, and texture. This innovation is essential to competing in an increasingly crowded marketplace.

Key Players:

- Nestlé: A pioneer in plant-based protein products, with its “Garden Gourmet” line and partnerships to expand its portfolio.

- Oatly: A dominant player in the plant-based dairy sector, particularly with oat-based milk.

- Beyond Meat and Impossible Foods: Leaders in plant-based meat alternatives, constantly innovating to create products that can cater to a wide variety of tastes.

- Cargill: A major player in the plant protein supply chain, investing heavily in plant protein production technologies and distribution networks.

Regional Nuances:

- Western Europe: Countries like the UK, Germany, and France are leading the way in plant protein adoption, driven by high levels of consumer awareness and established retail infrastructure.

- Southern Europe: While plant-based consumption is growing, the pace is slower in countries like Italy and Spain, where traditional Mediterranean diets still dominate. However, awareness and availability are increasing.

- Eastern Europe: This region presents untapped potential, with rising interest in plant-based foods due to growing environmental concerns and lifestyle shifts. However, barriers include lower consumer awareness and fewer established product offerings.

Actionable Recommendations:

- Focus on Innovation: Companies that lead in product innovation, particularly in mimicking animal proteins, will be at the forefront of consumer interest. Investment in new technologies that improve flavor, texture, and nutritional content is crucial.

- Target Health-Conscious Consumers: With the rise of health-focused dietary choices, positioning plant proteins as part of a broader wellness trend can resonate well with millennials and Gen Z consumers who prioritize health and sustainability.

- Regional Tailoring: Recognize regional differences in consumption patterns. While Western Europe may be a saturated market, there is significant room for growth in Southern and Eastern Europe. Tailoring marketing strategies to address local cultural preferences and dietary habits can offer a competitive advantage.

- Collaborate with Key Players: Strategic partnerships with large food manufacturers and retailers can help scale operations quickly and ensure access to established distribution networks.

- Sustainability Marketing: Consumers are more likely to engage with brands that demonstrate a genuine commitment to sustainability. Highlighting the environmental benefits of plant-based proteins, along with transparency in sourcing and manufacturing practices, can build trust and brand loyalty.

Europe Plant Protein Report Scope

| Attribute | Details |

| Market Size in 2018 | US$ 5,808.5 Million |

| Market Size by 2027 | US$ 9,452.5 Million |

| Global CAGR (2019-2027) | 5.9% |

| Historical Data | 2016-2017 |

| Forecast Period | 2019-2027 |

| Segments Covered | By Source, By Type, By Application |

| Key Sources | Soy, Wheat, Pea |

| Key Types | Isolates, Concentrates, Protein Flour |

| Key Applications | Protein Beverages, Dairy Alternatives, Meat Alternatives, Protein Bars, Bakery |

| Regions Covered | Europe, UK, Germany, France, Russia, Italy, Rest of Europe |

| Market Leaders | E. I. Du Pont, Archer Daniels Midland, Kerry Group, DSM N.V., Axiom Foods, Cargill, Roquette, Ingredion, Glanbia plc |

The geographic scope of Europe Plant Protein pertains to the specific regions where a business operates and competes. It’s essential to understand local differences, such as varying consumer preferences (e.g., demand for particular product types or battery backup lengths), economic conditions, and regulatory landscapes. By tailoring strategies to meet the unique needs of each market, businesses can identify underserved regions and adjust their offerings accordingly. A focused market approach enables more efficient resource allocation, targeted marketing efforts, and stronger positioning against local competitors, fostering growth in those key areas.

Market Insights: Rising Consumer Awareness of Protein-Rich Foods

Proteins are essential for maintaining the structure and functions of the human body. Made up of amino acids connected by peptide bonds, proteins are crucial for cell repair, immune defense, and overall growth and development, especially in children, teenagers, and pregnant women. A higher protein intake supports better bone mass maintenance, reducing the risk of osteoporosis and fractures. It also boosts metabolism, aiding in weight management and weight loss. These health benefits have sparked growing consumer demand for protein-rich foods and beverages, particularly plant-based proteins, across Europe.

Source Insights:

The European plant protein market is categorized by source, including soy, wheat, pea, and others. Soy leads the market as the most popular plant protein source. Soy protein isolate, a refined form with at least 90% protein content, is created by removing fats and carbohydrates from defatted soy flour. This form of soy protein is used in products like infant soy formulas and meat and dairy alternatives. Soy protein concentrates, containing about 70% protein, are produced by removing part of the carbohydrates from defatted soybeans. Soy flour is made by grinding soybeans into powder.

Type Insights:

The European plant protein market is divided into three main types: isolates, concentrates, and protein flour. The concentrates segment accounted for a significant share of the market in 2018. Plant protein concentrates, extracted from sources like soy, wheat, pea, quinoa, oats, beans, and nuts using heat, acid, or enzymes, typically contain 60–80% protein. They are the least processed form of plant protein powder and are more affordable than isolates. These concentrates are easily absorbed by the body, making them popular for muscle recovery after exercise, which further drives market growth.

Application Insights:

The European plant protein market is segmented based on applications, including protein beverages, dairy alternatives, meat alternatives and extenders, protein bars, bakery products, and others. The meat alternatives and meat extenders segment holds the largest share. Beans, legumes, and soy are commonly used as meat substitutes. Pea protein isolates are frequently used by brands like Daiya, Gardein, Beyond Meat, and Just Mayo. The increasing demand for plant-based meat alternatives is driven by rising health concerns, growing vegan food preferences, and the rising awareness of obesity issues linked to meat consumption. This trend is fueling greater demand for plant proteins in the market.

Strategic Insights into the European Plant Protein Market

This comprehensive analysis of the European plant protein market provides data-driven insights into the industry’s landscape, highlighting current trends, major players, and regional nuances. The insights offer actionable strategies, helping businesses differentiate themselves from competitors by uncovering untapped market segments and creating unique value propositions. By utilizing data analytics, these insights enable industry stakeholders—investors, manufacturers, and others—to anticipate market shifts. Adopting a forward-looking approach, businesses can position themselves for long-term success in this dynamic market. Ultimately, these strategic insights empower stakeholders to make informed decisions, drive profitability, and meet their business objectives in the growing plant protein sector.

Regional Insights for Europe’s Plant Protein Market

The geographic scope of the Europe Plant Protein market focuses on the specific regions where businesses operate and compete. It is important to understand local differences, such as consumer preferences (e.g., demand for specific plant protein types or nutritional benefits), economic conditions, and regulatory frameworks. Tailoring strategies to these factors helps businesses better serve local markets. By identifying underserved regions and adapting offerings to meet local demands, businesses can optimize resource allocation, implement targeted marketing campaigns, and improve their competitive positioning, leading to growth in these regions.

Top of Form

| Segmentation | Categories |

| By Source | Soy, Wheat, Pea, Others |

| By Type | Isolates, Concentrates, Protein Flour |

| By Application | Protein Beverages, Dairy Alternatives, Meat Alternatives, Protein Bars, Bakery, Others |

| By Country | Germany, France, United Kingdom, Italy, Russia, Rest of Europe |

Can you see this our reports –

Europe Halal Cosmetics Market — Europe Halal Cosmetics Market Trends, Size, Segment and Growth by Forecast to 2030

Europe Stevia Market — Europe Stevia Market Trends, Size, Segment and Growth by Forecast to 2030

Europe Neurovascular Devices Market — Europe Neurovascular Devices Market Trends, Size, Segment and Growth by Forecast to 2030

Europe Dental Market — Home

Europe Railway Cyber Security Market — Europe Railway Cyber Security Market Trends, Size, Segment and Growth by Forecast to 2030

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio

Akshay

Senior Market Research Expert at Business Market Insights