Market Overview and Dynamics

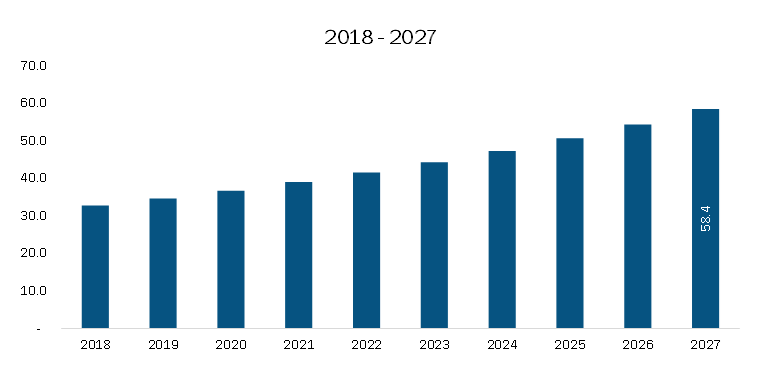

The European food safety testing market is expected to grow significantly, reaching US$ 9,146.8 million by 2028, up from an estimated US$ 5,758.8 million in 2021, representing a CAGR of 6.8% from 2021 to 2028. Key drivers of this growth include the rising incidence of foodborne illnesses and the expansion of the European food and beverage industry. However, the market faces challenges, notably the limitations of current food safety testing methods, which may hinder growth.

Download Full PDF Sample Copy of Market Report @- https://www.businessmarketinsights.com/sample/TIPRE00026204

The food and beverage industry encompasses the distribution, packaging, and processing of food products, and it is increasingly leveraging advanced technologies to create value-added offerings. With changing lifestyles and more hectic schedules, there has been an uptick in the consumption of ready-to-eat meals. Despite significant disruptions in various sectors due to the COVID-19 pandemic in 2020, the food and beverage industry was among the few that reported growth. Specifically, the fast-moving consumer goods (FMCG) sector, particularly food products, saw double-digit growth in 2020. While some sectors like oilseeds and grains experienced a drop in demand from the foodservice industry, the reopening of foodservice platforms and higher selling prices are expected to positively impact market dynamics moving forward.

The fruit, vegetables, and specialty foods sector, which includes fresh, frozen, and canned goods, also saw growth during the pandemic due to strong consumer demand. In particular, the dairy sector—already highly susceptible to foodborne illnesses due to microbial contamination in dairy products—saw notable growth. The vulnerability of dairy products to pathogens like bacteria has made safety testing critical. The growing consumption of dairy products is expected to drive demand for food safety testing services, further boosting market growth.

The COVID-19 pandemic had a notable impact on Europe, with countries like the UK, France, and Russia experiencing some of the highest infection rates. The UK, in particular, faced significant economic challenges due to widespread lockdowns, and various industries, including foodservice, were hit hard. Despite this, the food and beverage sector showed resilience, as consumers shifted towards packaged and processed foods, including frozen products. As lockdown restrictions began to ease in several European countries, such as Denmark and Italy, the food and beverage sector began its recovery. This recovery is expected to drive the European food safety testing market in the coming years.

In summary, while challenges like limited testing methods persist, the continued growth of the food and beverage industry, combined with the rising demand for food safety and testing solutions, presents a positive outlook for the European food safety testing market through 2028.

Strategic Insights for Europe Food Safety Testing Industry

The Europe Food Safety Testing market is evolving rapidly, driven by growing consumer awareness, regulatory demands, and advancements in technology. Strategic insights in this sector provide a comprehensive, data-driven analysis of the current landscape, highlighting key trends, market dynamics, and regional variations. This analysis is crucial for stakeholders to make informed, future-proof decisions.

Key Market Trends and Drivers:

- Regulatory Compliance: The tightening of food safety regulations across Europe is one of the major drivers of the food safety testing market. Stricter standards for contaminants, additives, and allergens push companies to invest in advanced testing solutions.

- Technological Advancements: Innovations in testing technologies, including real-time testing, blockchain traceability, and AI-driven data analytics, are reshaping the market. These innovations help reduce testing time, improve accuracy, and ensure better food quality and safety.

- Consumer Awareness and Demand for Transparency: With increasing concerns about food safety and quality, consumers are demanding greater transparency from food producers. This has led to a surge in demand for food testing services to verify product claims, such as organic or non-GMO.

- Rising Incidents of Foodborne Illnesses: The increasing prevalence of foodborne illnesses is driving the need for more robust testing protocols to ensure public health and compliance with health and safety regulations.

Regional Insights: Europe, with its diverse regulatory environment and consumer preferences, presents unique challenges and opportunities for food safety testing providers. Understanding regional nuances is essential for market positioning:

- Western Europe shows strong demand driven by high regulatory standards, consumer trust in quality, and innovation in testing technologies.

- Eastern Europe is emerging as a growth market, with improving regulations and increasing investments in food safety testing infrastructure.

- Northern Europe has a high level of market maturity, with advanced testing technologies and robust regulatory frameworks leading the way in ensuring food safety.

Key Players and Competitive Landscape: The market is characterized by both established players and innovative startups. Companies such as Eurofins Scientific, SGS SA, and Intertek Group lead the sector, providing a wide range of testing services. Emerging players focus on developing specialized testing methods or leveraging AI and machine learning for more efficient and accurate results. Partnerships, mergers, and acquisitions are prevalent as companies seek to expand their service offerings or regional presence.

Strategic Recommendations:

- Leverage Technological Innovations: Companies should invest in cutting-edge technologies, such as blockchain and AI, to enhance the accuracy and speed of food safety tests, making their offerings more competitive in a rapidly changing market.

- Focus on Consumer Transparency: Developing services that offer end-to-end traceability and certification of food products will cater to the growing demand for transparency in the food supply chain.

- Target Untapped Markets: Companies should explore opportunities in emerging markets, particularly in Eastern Europe and regions with growing food safety awareness, where there is increasing demand for advanced testing solutions.

- Collaborate and Partner: Strategic partnerships with food manufacturers, retailers, and regulators can help testing companies expand their reach, innovate, and stay ahead of regulatory changes.

Europe Food Safety Testing Report Scope

| Attribute | Details |

| Market Size (2021) | US$ 5,758.8 Million |

| Market Size (2028) | US$ 9,146.8 Million |

| CAGR (2021–2028) | 6.8% |

| Historical Data | 2019–2020 |

| Forecast Period | 2022–2028 |

| Segments Covered | By Contaminant, Technology, Food Type |

| Contaminants | Pathogens, Pesticides, Toxins, GMOs |

| Technologies | Traditional, Rapid |

| Food Types | Meat, Poultry & Seafood, Dairy, Cereals & Grains, Processed Food, Fruits & Vegetables |

| Regions Covered | Europe (UK, Germany, France, Russia, Italy, Rest of Europe) |

| Key Companies | SGS SA, Eurofins Scientific, Intertek, TÜV SÜD, TÜV NORD, Bureau Veritas, NEOGEN, ALS Limited |

Regional Insights: Europe Food Safety Testing

The geographic scope of food safety testing in Europe encompasses a range of distinct regional markets, each with its own regulatory frameworks, consumer preferences, and economic conditions. Understanding these local nuances is essential for businesses to effectively compete and thrive in this diverse landscape. For example, regional variations in food standards, testing requirements, or consumer demand for traceability and safety assurances can significantly influence strategic approaches.

By recognizing underserved areas or adapting services to align with specific local needs, businesses can expand their market presence and deliver more relevant solutions. A focused regional strategy enables optimized resource allocation, targeted marketing efforts, and stronger positioning against local competitors—ultimately driving growth and ensuring compliance in key European markets.

Key Market Segments

By Contaminant:

The Europe food safety testing market is categorized into pathogens, pesticides, toxins, GMOs, and others. Among these, the pathogens segment—further classified into salmonella, E. coli, listeria, and others—held the largest market share in 2021. However, the GMOs segment is expected to record the highest compound annual growth rate (CAGR) during the forecast period.

By Technology:

The market is bifurcated into traditional and rapid testing technologies. The rapid segment is further divided into PCR-based testing, immunoassay-based testing, and others. In 2021, rapid testing held a larger market share and is projected to grow at a higher CAGR from 2021 to 2028.

By Food Type:

Based on food type, the market is segmented into meat, poultry, and seafood products; dairy products; cereals and grains; processed food; fruits and vegetables; and others. The meat, poultry, and seafood segment accounted for the largest share in 2021. Nonetheless, the fruits and vegetables segment is expected to witness the fastest growth over the forecast period.

Key Companies and Sources

Leading companies referenced in the preparation of this report include:

- SGS SA

- Eurofins Scientific

- Intertek Group Plc

Reasons to Purchase This Report

- Identify key investment opportunities by analyzing market trends in the Europe food safety testing sector over the coming years.

- Gain comprehensive insights into the demand drivers across various segments, helping to pinpoint growth areas.

- Enhance your understanding of the market through analysis of key trends, technological innovations, and regulatory developments.

- Discover the major channels influencing market expansion and capitalize on emerging opportunities to drive revenue growth.

- Allocate resources effectively by aligning with ongoing national programs and strategic initiatives across Europe.

EUROPE FOOD SAFETY TESTING MARKET SEGMENTATION

| Segment | Sub-Segments |

| By Contaminant | Pathogens (Salmonella, E. coli, Listeria, Others), Pesticides, Toxins, GMOs, Others |

| By Technology | Traditional, Rapid (PCR-Based, Immunoassay-Based, Others) |

| By Food Type | Meat, Poultry & Seafood, Dairy, Cereals & Grains, Processed Food, Fruits & Vegetables, Others |

| By Country | Germany, Russia, UK, France, Italy, Rest of Europe |

| Company Profiles | SGS SA, Eurofins Scientific, Intertek Group Plc, TÜV SÜD, TÜV NORD GROUP, Bureau Veritas, NEOGEN Corp., ALS Limited |

Can you see this our reports –

Europe Halal Cosmetics Market — Europe Halal Cosmetics Market Trends, Size, Segment and Growth by Forecast to 2030

Europe Stevia Market — Europe Stevia Market Trends, Size, Segment and Growth by Forecast to 2030

Europe Neurovascular Devices Market — Europe Neurovascular Devices Market Trends, Size, Segment and Growth by Forecast to 2030

Europe Dental Market — Home

Europe Railway Cyber Security Market — Europe Railway Cyber Security Market Trends, Size, Segment and Growth by Forecast to 2030

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio

Akshay

Senior Market Research Expert at Business Market Insights