Executive Summary and BRICS Heavy Construction Equipment Market Analysis (2023–2031):

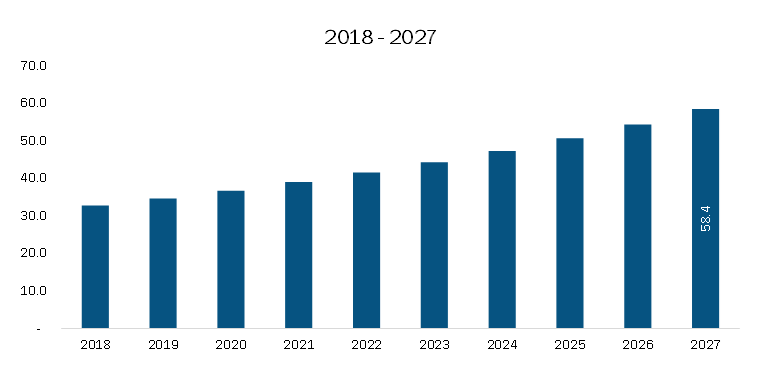

The BRICS heavy construction equipment market is poised for significant growth, with the market size projected to increase from USD 64.80 million in 2024 to USD 105.16 million by 2031, reflecting a compound annual growth rate (CAGR) of 6.23% during the forecast period.

Download Full PDF Sample Copy of Market Report @- https://www.businessmarketinsights.com/sample/BMIRE00031239

This upward trend is driven by a combination of factors, including robust government investments in infrastructure development, a surge in construction activities, and accelerating urbanization across BRICS nations. Among these, China stands out as a key contributor to market expansion. Its construction and infrastructure sector has undergone major transformation, propelled by rapid economic progress and the country’s emergence as a global economic leader. As a result, China remains one of the largest and most influential construction markets globally, playing a pivotal role in shaping the trajectory of the BRICS heavy construction equipment market.

In March 2024, the government of China announced its target to fund US$ 173 billion (CNY 1.2 trillion) in transport infrastructure projects by the end of 2024. Furthermore, in March 2024, the Yangtze River Delta region government announced an investment of US$ 19.6 billion (CNY 140 billion) to build 32 railway infrastructure projects. In February 2024, the Shanghai government announced its target to initiate work on 24 projects with a combined investment of US$ 5.8 billion (CNY 42.1 billion).

According to the government’s transportation network planning outline, China aimed to add 400 airports by 2035, an increase from ~240 airports in 2022. China’s 32 large and busy airports are suffering from capacity overload, and 40 of the country’s 50 largest airports need renovation or expansion, according to the Civil Aviation Administration of China (CAAC). China’s 14th Five-Year Plan covers 140 airport projects, including greenfield construction, relocation, renovation, and expansion by the end of 2025. With such sustained investments and a focus on innovation toward infrastructure, China continues to shape its construction sector to accommodate escalating development and assert its positive impact on the heavy construction equipment market.

BRICS Heavy Construction Equipment Market Segmentation Analysis

The heavy construction equipment market in BRICS countries is segmented based on machinery type, propulsion type, power output, and end-use industry.

- By Machinery Type:

The market is categorized into earthmoving equipment, material handling equipment, heavy construction vehicles, and others. Among these, the earthmoving equipment segment accounted for the largest market share in 2024. - By Propulsion Type:

The market is divided into internal combustion engine (ICE) and electric-powered equipment. In 2024, the ICE segment dominated the market. - By Power Output:

Segmentation by power output includes less than 100 HP, 101–200 HP, 201–400 HP, and above 401 HP. The 201–400 HP category captured the largest market share in 2024. - By End-Use Industry:

The market is segmented into building and construction, forestry and agriculture, energy and power, mining, and others. The building and construction segment emerged as the leading end-user, holding the largest share in 2024.BRICS Heavy Construction Equipment Market Outlook

- India’s infrastructure and construction sector has witnessed remarkable growth and evolution in recent years, propelled by rapid economic development. The construction industry encompasses both real estate and urban development. While real estate includes commercial spaces, residential buildings, retail centers, hospitality, and recreational parks, the urban development segment covers critical public services such as sanitation, water supply, education, transportation, and healthcare infrastructure.

- Between FY2024 and FY2030, India is set to invest approximately US$ 1.723 trillion (INR 143 trillion) in infrastructure projects. In the Interim Budget for 2024–2025, the government increased the capital investment outlay for infrastructure by around 11.1%, reaching US$ 133.86 billion—equivalent to about 3.4% of the country’s GDP.

- The development of smart cities and the growing need for modern urban infrastructure are significantly driving the demand for construction equipment. Urban centers like Bangalore, Hyderabad, and Mumbai are actively working on enhancing their water and wastewater treatment systems, fueling construction activity across these regions. Additionally, major airports such as Indira Gandhi International Airport in Delhi and Chhatrapati Shivaji Maharaj International Airport in Mumbai have undergone extensive upgrades and expansions, reflecting the broader trend of infrastructure modernization.

- This surge in infrastructure projects is expected to be a major catalyst for the growth of the heavy construction equipment market in India, positioning it as a key contributor to the BRICS construction equipment landscape over the forecast period.

BRICS Heavy Construction Equipment Market Country Insights

- Based on Geography, the BRICS Heavy Construction Equipment Market comprises of Brazil, Russia, India, China, South Africa, Egypt, Indonesia, and UAE. The China held the largest share in 2024.

- According to the government’s transportation network planning outline, China aimed to add 400 airports by 2035, an increase from ~240 airports in 2022. China’s 32 large and busy airports are suffering from capacity overload, and 40 of the country’s 50 largest airports need renovation or expansion, according to the Civil Aviation Administration of China (CAAC). China’s 14th Five-Year Plan covers 140 airport projects, including greenfield construction, relocation, renovation, and expansion by the end of 2025. With such sustained investments and a focus on innovation toward infrastructure, China continues to shape its construction sector to accommodate escalating development and assert its positive impact on the heavy construction equipment market.

- The government of China plays a pivotal role in driving the demand for heavy construction equipment through its extensive infrastructure investment programs. Major initiatives such as the Belt and Road Initiative (BRI), Made in China 2025, and the 13th Five-Year Plan prioritize large-scale infrastructure projects, including highways, railways, airports, ports, and bridges. These projects are crucial for China’s economic development and require construction machinery for site preparation, construction, and maintenance.

BRICS Heavy Construction Equipment Market – Company Profiles

Key players in the BRICS heavy construction equipment market include Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery, among others. These companies are actively pursuing strategies such as geographic expansion, product innovation, and mergers and acquisitions to enhance their product offerings and strengthen their market position. Their focus remains on delivering advanced and efficient construction equipment to meet the growing infrastructure demands across BRICS nations. - Research Methodology – BRICS Heavy Construction Equipment Market

The analysis presented in this report is based on a rigorous research methodology, which includes both primary and secondary research techniques. - 1. Secondary Research

The initial phase of the research involved extensive secondary data collection to gain a thorough understanding of the market landscape. Key sources used include: - Official company websites, annual and financial reports, investor presentations, and broker reports.

- Industry-specific publications, white papers, and trade journals.

- Market databases, government publications, and statistical resources.

- News articles, company press releases, and webcasts relevant to major market participants.

This foundational data was used to identify industry trends, key players, market segmentation, and emerging opportunities within the BRICS heavy construction equipment market.

Can you see this our reports –

Europe E-Commerce Automotive Aftermarket Market – https://postyourarticle.com/europe-e-commerce-automotive-aftermarket-market-trends-size-segment-and-growth-by-forecast-to-2030/

Europe Cannabis Market – https://sites.google.com/view/businessmarketinsights-79/home

Europe Medical Equipment Maintenance Market – https://businessmarketins02.blogspot.com/2025/04/europe-medical-equipment-maintenance.html

Europe Electric Trucks Market – https://postyourarticle.com/europe-electric-trucks-market-trends-size-segment-and-growth-by-forecast-to-2030/

Europe Food Safety Testing Kits Market – https://www.openpr.com/news/3968477/europe-food-safety-testing-kits-market-trends-size-segment

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio

Akshay

Senior Market Research Expert at Business Market Insights