Market Overview and Dynamics

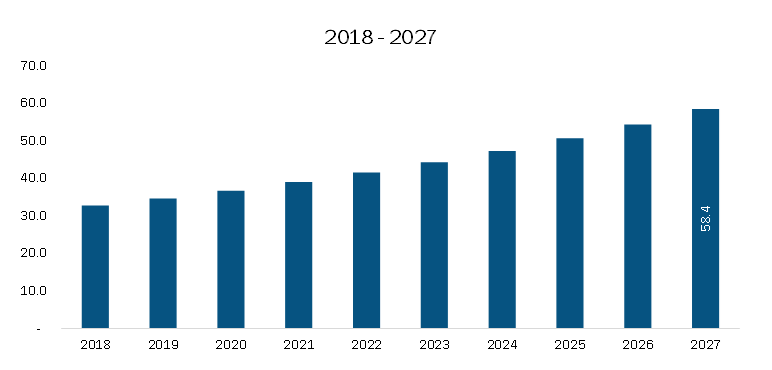

The North America synchronous condenser market is projected to grow from US$ 189.95 million in 2019 to US$ 199.92 million by 2027, reflecting a compound annual growth rate (CAGR) of 1.5% from 2020 to 2027. The market is witnessing steady growth due to the increasing transition of aging synchronous generators into synchronous condensers, driven by the need for grid stability and power quality enhancement.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 – https://www.businessmarketinsights.com/sample/TIPRE00020062

With the decline of traditional power generation sources, driven by aging infrastructure, environmental regulations, and growing competition from gas-fired turbines and renewable energy sources, the energy landscape in North America is shifting. Several aging coal-fired power plants across the region are being decommissioned, reducing the capacity for reactive power generation. This has led to a rising trend of repurposing existing power plants into synchronous condensers to ensure grid reliability and stability.

The adoption of synchronous condensers offers a cost-effective and efficient solution for providing reactive power and voltage support, especially in areas that were previously dependent on large thermal power plants. Additionally, advancements in technology, such as improvements in efficiency, automation, and remote monitoring, are further propelling market growth.

Furthermore, government policies and incentives supporting grid modernization and renewable energy integration are expected to fuel demand for synchronous condensers. Utilities and grid operators are increasingly investing in these systems to mitigate power fluctuations and ensure a stable energy supply. The rising penetration of renewable energy sources, such as wind and solar, also necessitates enhanced grid stability solutions, thereby fostering the demand for synchronous condensers.

Overall, the North America synchronous condenser market is poised for steady expansion, driven by the imperative to maintain grid stability, technological advancements, and the ongoing transition toward a more resilient and sustainable power infrastructure.

North America Synchronous Condenser Strategic Insights

Strategic insights for the North America Synchronous Condenser provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

Key Market Segments

The North America synchronous condenser market is segmented based on cooling type, reactive power rating, starting method, and application.

- Cooling Type: Among the different cooling methods, the hydrogen-cooled segment accounted for the largest market share in 2019. Hydrogen cooling is widely preferred due to its superior heat dissipation properties, lower density, and ability to reduce windage losses, which enhances overall efficiency. The increasing adoption of high-capacity synchronous condensers in power systems has driven the demand for hydrogen-cooled units.

- Reactive Power Rating: The above 200 MVAr segment held the largest share of the North America synchronous condenser market in 2019. These high-capacity condensers are essential for stabilizing large power grids, improving voltage regulation, and maintaining system inertia. The rising integration of renewable energy sources, such as wind and solar, has increased the need for large-scale reactive power support, further driving demand in this segment.

- Starting Method: The static frequency converter segment dominated the market in 2019. Static frequency converters (SFCs) provide efficient and smooth starting of synchronous condensers without causing disturbances in the power system. Their ability to offer precise speed control and reduced mechanical stress on the condenser components makes them a preferred choice for large-scale installations.

- Application: Based on application, the electrical utilities and grid operators segment held the largest market share in 2019. As grid stability becomes a growing concern with the increasing penetration of renewable energy, utilities and grid operators are investing in synchronous condensers to enhance power quality, maintain system reliability, and support transmission networks. The ability of synchronous condensers to provide inertia, voltage support, and reactive power compensation makes them a crucial component in modern power grids.

- North America Synchronous Condenser Market: Regional Insights

Understanding the geographic landscape of the North American synchronous condenser market is essential for businesses aiming to expand and compete effectively. Regional variations in consumer preferences—such as demand for specific plug types or battery backup durations—along with diverse economic conditions and regulatory frameworks, play a critical role in shaping market strategies.

By identifying underserved areas and tailoring offerings to local demands, businesses can unlock new growth opportunities. A well-defined market focus enables efficient resource allocation, precise marketing campaigns, and stronger positioning against regional competitors. Ultimately, adapting to local nuances drives sustainable growth and enhances market presence across North America.

North America Synchronous Condenser Report Scope

| Report Attribute | Details |

| Market Size in 2019 | US$ 189.95 Million |

| Market Size by 2027 | US$ 199.92 Million |

| Global CAGR (2020 – 2027) | 1.5% |

| Historical Data | 2017-2018 |

| Forecast Period | 2020-2027 |

| Segments Covered | By Cooling Type – Air-cooled – Hydrogen-cooled – Water-cooled By Reactive Power Rating – Up to 100 MVAr – 100-200 MVAr – Above 200 MVAr By Starting Method – Pony Motor – Static Frequency Converter By Application – Metal and Mining – Electrical Utilities and Grid Operators – Marine – Oil and Gas |

| Regions and Countries Covered | North America – US – Canada – Mexico |

| Market Leaders and Key Company Profiles | – ABB Ltd. – Brush Group – Eaton Corporation plc – FUJI ELECTRIC CO., LTD. – General Electric Company – IDEAL ELECTRIC POWER CO. – Mitsubishi Electric Power Products, Inc. (Mitsubishi Electric Corporation) – Siemens AG (Siemens Energy) – Voith GmbH & Co. KGaA – WEG ELECTRIC CORP. |

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio:

Akshay

Senior Market Research Expert at Business Market Insights