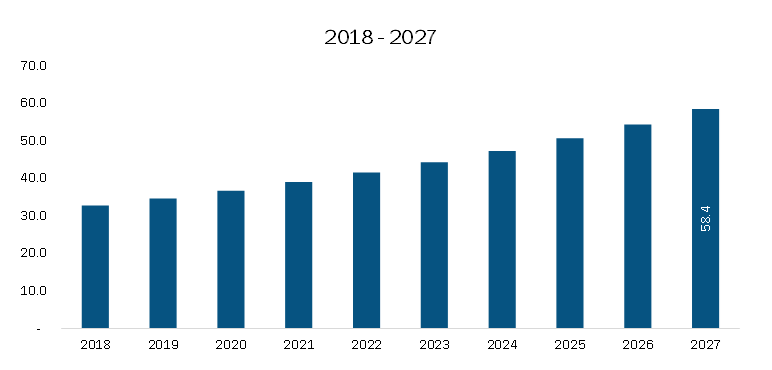

Growth of the North America Nutritional Bars Market

The North America nutritional bars market is projected to expand from US$ 2,200.46 million in 2022 to US$ 2,881.06 million by 2028, reflecting a CAGR of 4.6% over the forecast period.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 – https://www.businessmarketinsights.com/sample/BMIRE00028067

Innovation and Product Launches Driving Market Expansion

Consumer awareness regarding nutrition and ingredient quality has surged in recent years, prompting nutritional bar manufacturers to introduce innovative products. To remain competitive, companies are investing in strategic product developments and new launches.

For instance, in 2022, LUNA, a women-focused brand by Clif Bar & Company, introduced a new range of bars containing 2.5 grams of prebiotics—making them the first of their kind to include prebiotics. Research suggests that consuming 5 grams or more of fiber-rich prebiotics can enhance gut health by fostering the growth of beneficial bacteria, supporting digestion.

North America Nutritional Bars Market Overview

The North America nutritional bars market growth is attributed to the rising preference for on-the-go snacking, meal replacement, functional food, and indulgence. Consumers looked for healthier alternatives with high nutritional value in food and beverages to boost immunity during the COVID-19 pandemic. The rising demand for nutritional bars, including protein bars, high-fiber bars, and meal replacement bars, from young adults and athletes, is also driving the market growth in this region. These nutritional bars enhance the performance and stamina of athletes and fitness lifestyle users. Further, the growing number of health and fitness-conscious individuals has increased the demand for functional products such as nutritional bars. According to the US Bureau of Labor Statistics, average daily participation rates in sports and exercise grew by 3.6% between 2003 and 2015. An increasing number of sports participants in the US is likely to boost the demand for energy bars in North America during the forecast period. Also, the popularity of sugar-free, gluten-free, and low-carb nutritional bars is growing across the region.

Moreover, the rising vegan population and veganism are boosting the demand for plant-based nutritional bars. Thus, leading manufacturers are launching plant-based nutritional bars to cater to consumers’ demands. For instance, in June 2020, RXBAR, a Kellogg subsidiary, launched its first plant-based nutritional bar. This bar contains 10g of plant protein obtained from peas and almonds. Such product innovations by manufacturers are expected to boost the North America nutritional bars market growth during the forecast period.

North America Nutritional Bars Strategic Insights

Strategic insights for the North America Nutritional Bars provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

North America Nutritional Bars Report Scope

| Report Attribute | Details |

| Market size in 2022 | US$ 2,200.46 Million |

| Market Size by 2028 | US$ 2,881.06 Million |

| Global CAGR (2022 – 2028) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered | By Type • Protein Bars • High-Fiber Bars By Category By Distribution Channel |

| Regions and Countries Covered | North America • US • Canada • Mexico |

| Market leaders and key company profiles | • Clif Bar & Co • General Mills Inc • Kind LLC • Mars Inc • Perfect Bar LLC • Premier Nutrition Co LLC • Rise Bar Inc • The Kellogg Co • The Quaker Oats Co • The Simply Good Foods Co |

North America Nutritional Bars Regional Insights

The geographic scope of the North America Nutritional Bars refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.