Market Overview:

The fintech market is experiencing rapid growth, driven by digital financial inclusion, ai & automation, and regulatory innovation.

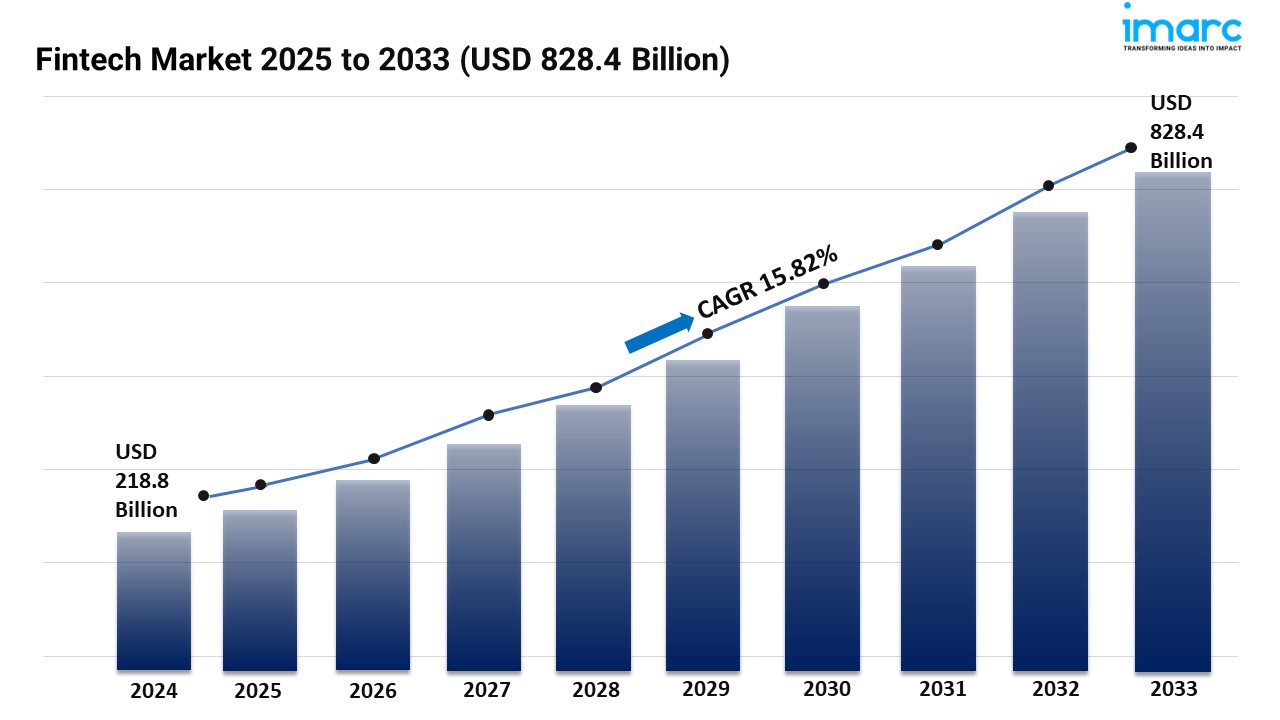

According to IMARC Group’s latest research publication, “Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033“, The global fintech market size was valued at USD 218.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 828.4 Billion by 2033, exhibiting a CAGR of 15.82% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/fintech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Fintech Industry:

- Digital Financial Inclusion:

The Fintech market is quite motivated by pushing digital economic inclusion, especially in emerging economies. Mobile banking, digital wallets and Peer-to-loan platforms extend access to financial services for the signed population. This trend is inspired by the need to bridge traditional banking and anbaked. Demand is not just for technology; This is for accessible and affordable financial solutions that strengthen individuals and small businesses. There is fuel for rapid use of dynamic smartphones and increasing availability of internet connection. Focus on digital financial inclusion pursues fintech companies to develop user -friendly interfaces and culturally relevant solutions.

- AI & Automation:

The integration of artificial intelligence (AI) and automation changes the fintech landscape, improves efficiency and privatization. AI-I-operated chatbots, fraud detection systems and algorithm trading platforms are streamlined and the customer improves the experiences. This trend is fast, more accurate and inspired by the need for cost -effective financial services. Demand is not just for digital devices; It is for intelligent systems that provide individual insights and automate complex processes. This dynamic machine is fuel from learning and progress in data analysis. Financing at AI and automation promotes fintech companies to invest in state -art -art technologies and computer science skills.

- Regulatory Innovation:

The Fintech market is heavily influenced by regulatory innovation, for rapid speeds of technological changes with governments and regulatory bodies. Sandbox, open bank initiative and digital identification structure promote a more favorable environment for fintech innovation. This trend is motivated by the need to balance innovation with consumer protection and economic stability. Demand is not just for deregulation; This is for smart regulation that encourages competition and promotes responsible innovation. It gets fuel from the need to adapt to dynamically developed digital economics and address new risks. Financing on regulatory innovation is pushing fintech companies to contact decision makers and comply with regulatory frameworks.

Leading Companies Operating in the Global Fintech Industry:

- Adyen N.V.

- Afterpay Limited (Block Inc.)

- Avant LLC

- Cisco Systems Inc.

- Google Payment Corp.

- International Business Machines Corporation

- Klarna Bank AB

- Microsoft Corporation

- Nvidia Corporation

- Oracle Corporation

- Paypal Holdings, Inc.

- Robinhood Markets Inc.

- SoFi Technologies Inc

- Tata Consultancy Services

Fintech Market Report Segmentation:

By Deployment Mode:

- On-premises

- Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

- Banking

- Insurance

- Securities

- Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145