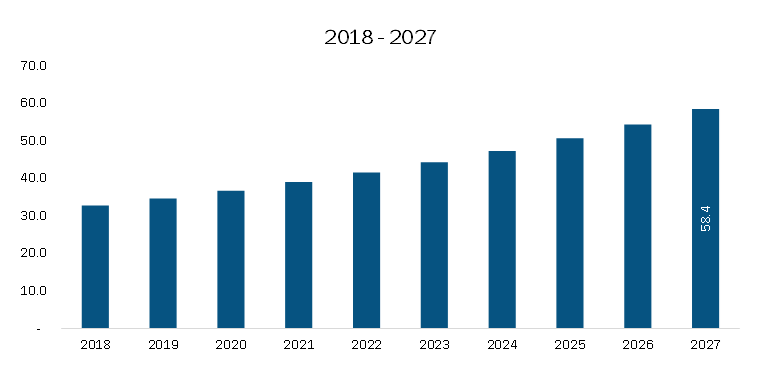

The branded generics market in Europe is expected to grow from US$ 45.81 billion in 2022 to US$ 81.30 billion by 2028; it is estimated to grow at a CAGR of 10.0% from 2022 to 2028. The increasing prevalence of chronic diseases, rising healthcare expenditures, and the growing acceptance of cost-effective alternatives are driving this growth. Additionally, government initiatives to promote the use of branded generics and favorable regulatory policies are further fueling market expansion.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 – https://www.businessmarketinsights.com/sample/BMIRE00026048

Players in the pharmaceutical industry are adopting various strategies, including product differentiation, to reduce development costs and maximize profits. Product differentiation involves developing innovative products based on an existing product by enhancing its features, performance, and efficacy. Product differentiation paves the way for strengthening product pipeline and lifecycle management. As generic drugs contain the same active pharmaceutical ingredients as the brand-name products, differentiation in color, shape, taste, inactive ingredients, preservatives, and packaging result in high demand for branded generics. Therefore, differentiation in the final product is expected to offer lucrative growth opportunities for the competitive players in the market in the coming years.

Additionally, prominent players operating the market are offering low-cost branded generics to remain competitive in the market. For instance, in July 2020, Takeda Pharmaceutical Company announced a joint venture with Teva Pharmaceuticals Industries Ltd. to commercialize complex generics products, specialty assets, and other pipeline generic medicines. Further, key players in the branded generics segment offer low-cost branded generics to remain competitive in the Europe market. This can be achieved by strategically sourcing raw materials from emerging economies and partnering with suppliers. All these factors would provide lucrative opportunities for the overall branded generics market growth during the forecast period.

Strategic Insights: Europe Branded Generics

The Europe Branded Generics market presents a dynamic landscape shaped by evolving trends, key industry players, and regional nuances. Data-driven strategic insights provide stakeholders—including investors, manufacturers, and decision-makers—with a competitive edge by identifying untapped opportunities and developing differentiated value propositions.

By leveraging advanced analytics, these insights enable industry players to anticipate market shifts and adapt their strategies proactively. A forward-thinking approach is crucial for long-term success, ensuring businesses stay ahead in an evolving regulatory and competitive environment.

Ultimately, well-informed strategic insights empower stakeholders to make data-backed decisions that drive profitability and business growth in the European branded generics market.

Europe Branded Generics Regional Insights

The geographic scope of the Europe Branded Generics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Branded Generics Market Segmentation

The Europe branded generics market is categorized based on therapeutic application, distribution channel, drug class, formulation type, and country.

- Therapeutic Application

- Segmented into:

- Oncology

- Cardiovascular Diseases

- Diabetes

- Neurology

- Gastrointestinal Diseases

- Dermatology Diseases

- Analgesics & Anti-Inflammatory

- Market Share (2022): The others segment held the largest share.

- Distribution Channel

- Includes:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Drug Stores

- Market Share (2022): Retail pharmacies dominated the market.

- Drug Class

- Segmentation:

- Alkylating Agents

- Antimetabolites

- Hormones

- Anti-Hypertensive

- Lipid-Lowering Drugs

- Anti-Depressants

- Anti-Psychotics

- Anti-Epileptic

- Others

- Market Share (2022): The others segment led the market.

- Formulation Type

- Categories:

- Oral

- Parenteral

- Topical

- Others

- Market Share (2022): The oral segment was the largest.

- Country-Wise Segmentation

- Countries Analyzed:

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio:

Akshay

Senior Market Research Expert at Business Market Insights