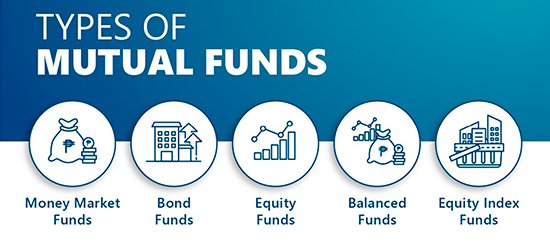

Investing in types of mutual funds has become an attractive option for many, thanks to their potential to provide impressive returns and systematic investment options. However, navigating the myriad options can be challenging. Here, we break down eight key types and compare their benefits to help you understand which might align with your financial goals.

Equity Mutual Funds

These mutual funds primarily invest in stocks. The returns from equity mutual funds depend on the performance of the company’s shares in which the fund has invested. It’s important to Mutual Funds Compare regularly to ensure consistent performance. Typically, the long-term gains from equity funds can be substantial, but they also come with higher risks compared to other types.

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,12,000

- After five years (compounded annually): ₹1,76,234

Debt Mutual Funds

Debt funds invest in fixed-income securities like government bonds, corporate bonds, and money market instruments. These are generally safer than equity funds, providing regular income with less volatility.

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,08,000

- After five years (compounded annually): ₹1,46,933

Money Market Mutual Funds

Money market funds invest in short-term, high-quality investments issued by government and corporate entities. These funds aim to offer high liquidity with a bit more yield than savings accounts.

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,06,000

- After five years (compounded annually): ₹1,33,823

Hybrid Mutual Funds

These funds invest in a mix of equity and debt. The proportion of each can be balanced based on the investor’s risk appetite and market conditions. Hybrid funds can be conservative (more debt), balanced, or aggressive (more equity).

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,10,000

- After five years (compounded annually): ₹1,61,051

Index Funds

Index mutual funds replicate the performance of a specific index, like Nifty 50 or Sensex. They invest in the same stocks and in the same proportion as the index, offering returns parallel to the market index performances.

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,11,000

- After five years (compounded annually): ₹1,68,611

Sectoral/Thematic Funds

These mutual funds focus on specific sectors like technology, finance, or healthcare. These can offer high returns during the sector’s booming phases, but also come with higher risks if the sector faces downturns.

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,13,000

- After five years (compounded annually): ₹1,84,255

Liquid Funds

Similar to money market funds, liquid funds invest in short-term instruments but are designed to let investors park their surplus money for very short periods, usually up to 91 days.

Performance Example:

- Investment: ₹1,00,000

- After three months: ₹1,01,250

- After one year: ₹1,05,000

Tax-Saving ELSS Funds

Equity-linked savings schemes (ELSS) offer tax benefits under Section 80C of the Income Tax Act. These funds come with a three-year lock-in period and, being equity-linked, carry similar risks and returns as equity funds.

Performance Example:

- Investment: ₹1,00,000

- After one year: ₹1,14,000

- After three years: ₹1,48,154

Summary

Understanding the eight types of mutual funds—Equity, Debt, Money Market, Hybrid, Index, Sectoral, Liquid, and Tax-Saving ELSS—is crucial for aligning your investment goals with the appropriate funds. Regular Mutual Funds Compare based on their performance, risk factors, and investment horizon can guide investors towards making informed choices.

When deciding to invest, always remember that the pros and cons of trading in the Indian financial market must be comprehensively gauged. This can help manage risks and optimize returns tailored to individual financial goals and risk tolerance.

Disclaimer: Investing in mutual funds involves market risks, including the possible loss of principal. It is essential for investors to understand the risks involved and seek professional advice if needed before making any investment decisions in the Indian financial market.