Venmo has become one of the most popular peer-to-peer payment platforms, allowing users to send and receive money effortlessly. However, many users wonder, how much can you Venmo in one day? Understanding Venmo limits is crucial to managing transactions efficiently and avoiding unexpected restrictions.

Venmo Limits Explained

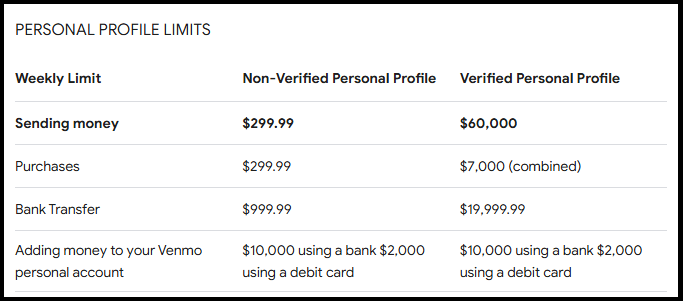

Venmo imposes different limits based on whether your identity has been verified. The limits apply to both sending and receiving money. Below is a breakdown of the Venmo transfer limit structure.

Unverified Users

If you have not verified your identity, Venmo restricts your transactions significantly:

- Venmo maximum transfer per week: $299.99

- Venmo limit per transaction: $299.99

- Venmo transfer limits on purchases: Not available for unverified users

Verified Users

Once you complete identity verification, Venmo increases your transaction limits:

- Venmo maximum transfer per week: $60,000

- Venmo transfer limit per day: Varies by transaction type

- Venmo limit for person-to-person transfers: $4,999.99 per week

- Venmo maximum transfer for merchants and purchases: $7,000 per week

- Venmo withdrawal limit to bank accounts: $19,999 per week ($5,000 per transaction)

How Much Can You Send on Venmo in a Day?

The daily limit on Venmo depends on the type of transaction:

- Person-to-person payments: While no official daily cap exists, the total weekly Venmo transfer limit

- Merchant payments and authorized purchases: You can spend up to $7,000 weekly, meaning theoretically up to $1,000 daily if evenly distributed.

- Bank transfers: The Venmo maximum transfer to a bank is $5,000 per transaction, with an overall weekly cap of $19,999.

Does Venmo Have a Limit for Instant Transfers?

Venmo offers Instant Transfers, allowing users to move funds to a linked debit card within minutes. The limits for this service are:

- $5,000 per transaction

- $10,000 per week

- Minimum instant transfer amount: $0.26

If your transaction exceeds the Venmo transfer limits, you must use a standard bank transfer, which typically takes 1-3 business days.

Venmo Limits for TD Bank Customers

Users who bank with TD Bank might wonder about the max Venmo TD Bank per day limits. Venmo does not impose unique restrictions based on the bank, but TD Bank’s own policies could affect transactions. Always check with your bank regarding external transfer limitations.

Increasing Your Venmo Limit

To access higher transaction limits:

- Verify your identity through the Venmo app.

- Link a verified bank account or debit card.

- Ensure your account remains in good standing by avoiding flagged or suspicious transactions.

Conclusion

Understanding Venmo transfer limits is essential for seamless transactions. While unverified users face tight restrictions, completing identity verification allows for higher limits. Whether you’re sending money to friends, making purchases, or transferring funds to a bank, knowing how much you can send on Venmo helps you plan transactions effectively. Always verify limits within the app, especially if you rely on Venmo maximum transfers frequently.

FAQs

1. What is the Venmo limit for business transactions?

For business accounts, Venmo imposes a $25,000 weekly limit on transactions.

2. Can I increase my Venmo limit beyond $60,000 per week?

No, $60,000 is the maximum limit for verified users. However, alternative payment methods may offer higher limits.

3. Does Venmo have a limit for international transactions?

Yes, Venmo only works within the U.S., meaning international transfers are not allowed.

4. Can I send $10,000 in one day on Venmo?

No, as the person-to-person Venmo transfer limit is capped at $4,999.99 per week.

5. Why was my Venmo transaction declined despite being under the limit?

Venmo may flag transactions for security reasons. Contact Venmo support if you encounter unexpected declines.