Mexico Consumer Lending Market Overview

Base Year: 2024

Historical Years: 2019-2024

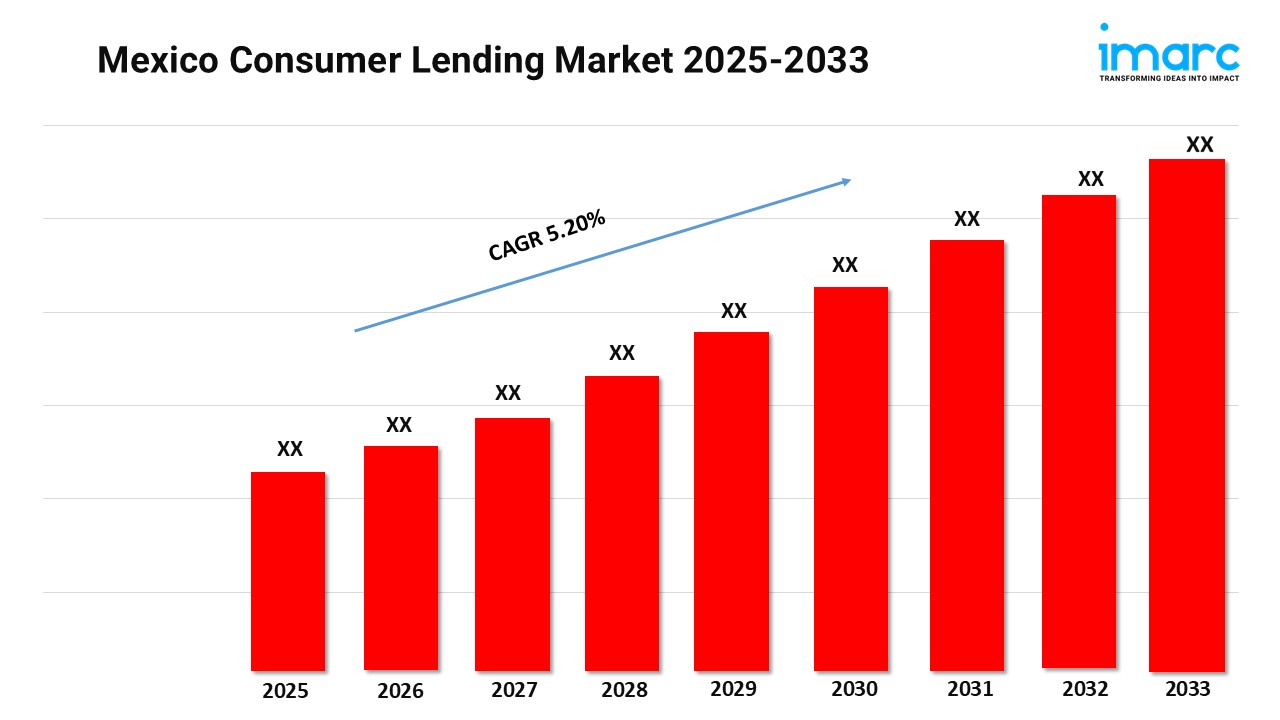

Forecast Years: 2025-2033

Market Growth Rate: 5.20% (2025-2033)

The Mexico consumer lending market is driven by rising disposable incomes, increasing financial inclusion, and growing demand for digital lending solutions. According to the latest report by IMARC Group, Mexico consumer lending market size reached USD 323.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 532.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033.

Mexico Consumer Lending Industry Trends and Drivers:

The Mexican consumer lending market is changing dramatically, propelled by rising financial inclusion, technological innovation, and changing consumer attitudes. Perhaps the most striking trend is the pace of fintech adoption, which is transforming consumer credit access. Online lending sites and mobile applications are simplifying the process of applying for and obtaining loans, sometimes with quicker approval and more lenient terms than at traditional banks. This trend is especially significant in a nation where much of the population is unbanked or underbanked. Fintech firms are employing non-traditional data sources like mobile phone usage and utility bills to determine creditworthiness, which allows them to lend to previously underserved segments. Further, the COVID-19 crisis ramped up digital lending as lockdowns and social distancing reduced face-to-face interactions and made digital financial services more desirable. Buy-now-pay-later (BNPL) products are also becoming popular, particularly with younger generations that like installment plans for making payments while shopping online. These trends are redefining the consumer lending landscape, enabling credit to become more accessible and convenient for more people.

The second important trend in the Mexico consumer lending market is the increasing demand for flexible and customized loan products. Consumers are looking more for customized financial products that match their individual needs and repayment abilities. This has resulted in the emergence of personalized loan choices, including adjustable interest rates, flexible repayment plans, and loan extensions. Conventional banks and non-banking financial companies are also adopting data analytics and artificial intelligence to provide more personalized lending. In addition to this, there is increased emphasis on financial literacy and openness, with lenders seeking to establish trust and ensure borrowers completely understand the terms of their loans and commitments. The market is also seeing an increase in green lending, where banks provide loans for green purchases, including electric cars and energy-efficient home renovations. As Mexico’s economy keeps recovering and growing, the consumer lending market is set to grow even further with the support of technological developments, regulation, and an increasing middle class. These trends highlight the need for innovation and customer-focused strategies in addressing the changing needs of Mexican consumers.

Grab a sample PDF of this report: https://www.imarcgroup.com/mexico-consumer-lending-market/requestsample

Mexico Consumer Lending Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Personal Loans

- Credit Card

- Auto Lease

- Home/ Mortgage Loans

- Others

Application Insights:

- Individual Use

- Household Use

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145