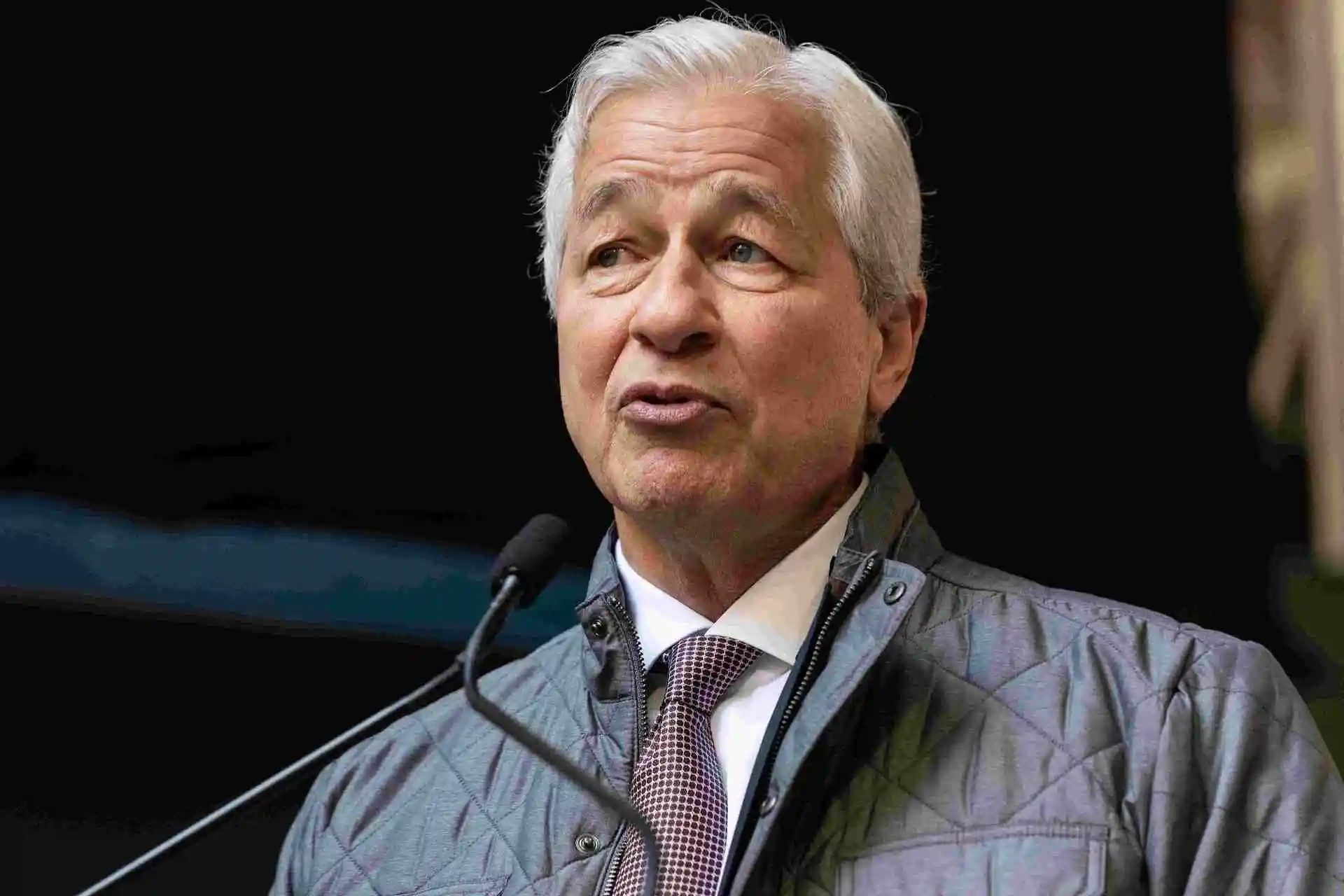

Throughout his tenure as JPMorgan Chase CEO Jamie Dimon has earned the dual distinction of being an influential financial leader and a very wealthy individual. The October 2023 estimation indicates Jamie Dimon possesses $2 billion in net worth demonstrating his capacity to lead and his expertise in analyzing complex economic environments. Through his position as the JPMorgan Chase CEO and his investment strategies he accumulated wealth which includes both basic employment pay and advanced financial management skills. The structure of Jamie Dimon’s financial wealth demands an examination as well as a study regarding his wealth management practices.

The Foundation of Jamie Dimon’s Wealth

Jamie Dimon achieved his wealth through multiple main sources:

Executive Compensation:

During his time as JPMorgan Chase CEO Dimon receives meaningful salary and bonus payments. His annual compensation received between 30 million and 35 million since becoming CEO of JPMorgan Chase.

The executive compenstion reaching between 30millionand35 million per year mainly consists of stock awards. Security of his wealth mirrors shareholders’ success because his financial prosperity rises proportionally to the bank’s business performance.

Stock Holdings:

Most of the wealth Dimon possesses flows from JPMorgan Chase stock possession. The substantial growth in JPMorgan Chase stock value has resulted in the multiplication of the stock shares he holds. His significant ownership stake in the company represents both his substantial accumulated wealth and his strong prediction regarding the bank’s continuous growth.

Investments and Diversification:

In addition to his controlled shares in JPMorgan Chase Dimon probably maintains a portfolio of diversified investments. He invests in real estate as well as private equity and different financial instruments created to minimize risk while generating financial returns.

Wealth Management and Planning Strategies

The management of large financial resources by Jamie Dimon requires extensive planning and calculation due to his elevated position in the business world. These are the essential steps that represent his approach towards managing and planning his wealth:

Diversification:

The bulk of Dimon’s assets float on JPMorgan Chase stock yet he would spread his investments across other sectors to minimize financial risks. His investment strategy includes distributing his funds between equities and bonds together with real estate and other investments which include hedge funds and private equity.

Estate Planning:

The $2 billion net worth of Dimon makes estate planning essential to maintain the efficiency of his wealth distribution to his descendants. To minimize taxes and maintain asset protection he may establish trusts coupled with family foundations as well as utilize other legal entities.

Tax Optimization:

People who possess high net worth like Dimon utilize advanced methods to reduce their tax obligations. Dimon can protect his wealth through donations to charities in addition to tax-deferred saving plans and strategic handling of capital gains. The charitable nature of Dimon might find him using donor-advised funds and charitable trusts to combine tax benefits with his funding of important causes.

Philanthropy:

Jamie Dimon together with his wife Judith Kent Dimon demonstrate substantial philanthropic activities. Jamie Dimon and his wife Judith Kent have dedicated their resources to backing multiple philanthropic enterprises which focus on education and healthcare and community advancement. Dimon dedicates some of his wealth to charitable donations which might be channeled through either his family foundation or other defined charitable programs.

Long-Term Financial Goals

The financial planning activities of Jamie Dimon surpass short-term wealth management because he sets his sights on developing long-term objectives.

Retirement Planning:

The leader at JPMorgan Chase has most likely developed a retirement strategy despite not having publicly revealed his retirement timeline. The plan ensures that his money will remain sufficient to fulfill his current needs and support his charitable donations for the extended future.

Legacy Building:

In his position as a leading figure in the financial world Jamie Dimon dedicates his efforts to creating enduring heritage. Beyond JPMorgan Chase activities he dedicates himself to executing both charitable giving and mentoring people as part of his lasting legacy.

Family Wealth Preservation:

Dimon faces protecting his family legacy through financial stability across multiple generations as his main goal. Family wealth preservation requires Dimon to establish trusts together with education funds and multiple mechanisms that support wealth growth and protection.

Risks and Mitigation Strategies

Caring for a fortune worth $2 billion entails specific obstacles and potential dangers. The following approach would be Dimon’s solution to these issues:

Market Volatility:

The major portion of Dimon’s wealth depends on JPMorgan Chase stock thereby subjecting him to market price changes. As part of his risk management strategy he would choose to invest in multiple types of securities together with hedging instruments.

Regulatory Changes:

Regulatory changes affecting tax laws together with banking rules will alter Dimon’s financial status. Financial and legal experts alongside continual market education would help Dimon address the different risks he faces.

Economic Downturns:

Having vast experience as a financial executive allows Dimon to lead economic cycles with expertise. His wealth management strategy would emphasize enduring stability together with resistance instead of immediate profits over extended periods.

Philanthropy: A Core Component of Dimon’s Wealth Plan

Philanthropic activities represent the vital cornerstone of how Jamie Dimon manages his wealth portfolio. Together with Judith he supports various charities that focus on education and healthcare and economic development. When the Dimons engage in charitable activities they aim to make both financial and societal transformations that endure throughout communities. Their charitable giving accounts for a major portion of their total wealth by using either family foundations or other structured donation mechanisms.

Conclusion

Jamie Dimon possesses $2 billion net worth due to his prestigious career achievements and his skillful financial planning and disciplined wealth organization techniques. The financial plan of Jamie Dimon evidently covers diverse investment strategies combined with tax reduction methods as well as estate management and significant philanthropic activities. Since his position as an influential leader in finance Jamie Dimon demonstrates a proper wealth management method which demonstrates the path to combining monetary achievement with societal investment responsibility. Through his time at JPMorgan Chase and his philanthropic activities Jamie Dimon will create an enduring legacy that surpasses his current net worth.

Browse our latest blog: https://www.networthmama.com/