Venmo has become one of the most popular digital payment platforms, offering seamless transactions for individuals and businesses. However, users often wonder: is there a limit on Venmo? Understanding the Venmo transfer limit is crucial to making smooth transactions without unexpected disruptions. Below, we explore all the details regarding Venmo daily send limit, transfer restrictions, and how you can maximize your Venmo transactions.

How Much Can You Venmo in One Day?

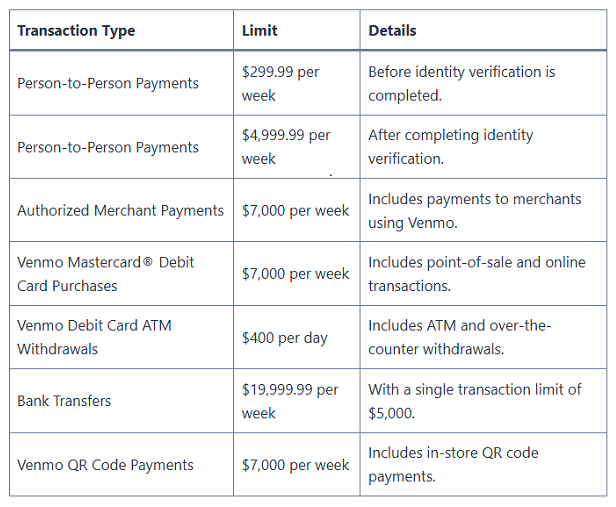

The Venmo daily limit depends on whether your account is verified. If your account is unverified, your sending capacity is limited. However, once you complete identity verification, your Venmo payment limit increases significantly.

- Unverified Accounts: You can send up to $299.99 per week.

- Verified Accounts: The Venmo daily send limit is $4,999.99 per week for person-to-person payments.

- Purchases from Authorized Merchants: Additional $6,999.99 per week for purchases using Venmo at participating merchants.

Thus, your combined weekly limit can reach up to $11,999.99 when including payments to merchants.

How Much Can You Send on Venmo for Free?

Venmo transactions are generally free when using a linked bank account, debit card, or Venmo balance. However, using a credit card incurs a 3% fee. Here’s how much you can send for free:

- Person-to-Person Transactions: Free (if using a bank, debit card, or balance).

- Instant Transfers to Your Bank: 1.75% fee (minimum $0.25, maximum $25 per transaction).

- Standard Transfers to Your Bank: Free (takes 1-3 business days).

To maximize your free transactions, always use your Venmo balance or linked bank account instead of a credit card.

Venmo Person-to-Person Limit

The Venmo daily limit for sending money to another user is $4,999.99 per week if your account is verified. If you are unverified, the limit remains at $299.99 per week. Payments to businesses or online purchases have separate limits.

How Do I Know My Venmo Limit?

To check your Venmo transfer limit, follow these steps:

- Open the Venmo app.

- Tap on your profile picture.

- Navigate to Settings > Payment Limits.

- Here, you can see your current Venmo daily limit, weekly limits, and spending capacity.

How to Increase Venmo Limit

To increase your Venmo payment limit, you need to verify your identity. Here’s how:

- Open the Venmo app.

- Go to Settings.

- Select Identity Verification.

- Provide your full name, date of birth, Social Security Number (SSN), and address.

- Submit your information for review.

Once verified, your Venmo daily send limit and weekly limits will increase significantly.

Venmo Transfer Limit Tax Implications

With the IRS tightening reporting requirements, Venmo payments exceeding $600 per year for goods or services are subject to tax reporting. If you receive payments above this threshold, Venmo may issue a 1099-K form for tax purposes.

- Personal transactions (e.g., gifts, reimbursements): Not taxable.

- Business transactions (sales, services rendered): Taxable, subject to IRS reporting.

To manage tax obligations, ensure proper documentation of your transactions.

How to Verify a Venmo Account

To unlock higher Venmo payment limits, you need to complete verification:

- Open the Venmo app.

- Go to Settings > Identity Verification.

- Enter your legal name, date of birth, SSN, and address.

- Submit your details.

Verification typically takes a few minutes, but in some cases, it may take longer. Once verified, your Venmo transfer limit will increase automatically.

Venmo Limit Per Week

Your Venmo weekly send limit depends on verification status:

- Unverified accounts: Limited to $299.99 per week.

- Verified accounts: Can send up to $4,999.99 per week to individuals.

- Merchant purchases: Additional $6,999.99 per week limit.

These limits reset on a rolling weekly basis, meaning transactions are counted from the date and time they were made.

Venmo Payment Declined: What to Do?

If your Venmo payment is declined, consider the following reasons:

- Exceeded Daily/Weekly Limits: Check if you’ve hit your Venmo daily limit.

- Insufficient Balance: Ensure your Venmo balance or linked bank account has enough funds.

- Credit Card Limit on Venmo Reached: If using a credit card, verify if you’ve reached your card’s limit.

- Security Flags: Unusual transactions may trigger security checks. Wait and try again later.

- Bank Issues: Ensure your linked bank account or card is active and has no restrictions.

If your payment is still declining, contact Venmo Support for further assistance.

Conclusion

Understanding your Venmo transfer limit is essential for smooth financial transactions. By verifying your identity, you can increase your Venmo daily send limit, ensure compliance with IRS regulations, and avoid declined payments. Always use a bank account or Venmo balance to avoid unnecessary fees and make the most of your transactions.