businesses and developers require accurate and real-time currency conversion to facilitate international transactions. Whether you’re running a SaaS platform, an e-commerce website, or a financial application, integrating a currency API can enhance efficiency and user experience. This guide will walk you through the process of integrating a currency rate API into your software, ensuring smooth global transactions.

Understanding Currency APIs and Their Importance

A currency API provides real-time and historical exchange rates, allowing businesses to convert currencies seamlessly. These APIs fetch data from central banks and financial institutions, ensuring accuracy in currency conversion. Some of the primary benefits of integrating a currency rate API into your system include:

- Real-time Exchange Rates: Ensures users get the latest conversion values.

- Automated Conversions: Reduces manual errors in financial transactions.

- Multi-Currency Support: Essential for SaaS platforms, e-commerce, and fintech applications.

- Cost Efficiency: Eliminates the need for expensive in-house currency conversion solutions.

Choosing the Right Currency API for Your Software

Before integration, selecting a reliable currency API is crucial. Consider the following factors:

- Data Accuracy: Ensure the API sources its exchange rates from trustworthy institutions like central banks.

- Update Frequency: Look for APIs that provide real-time or frequent updates.

- API Documentation: Well-structured documentation helps in seamless implementation.

- Scalability & Pricing: Choose an API that scales with your application and fits your budget.

- Security Features: Ensure it supports secure data transmission through HTTPS.

Recommended Currency APIs

Here are some reliable currency APIs for developers:

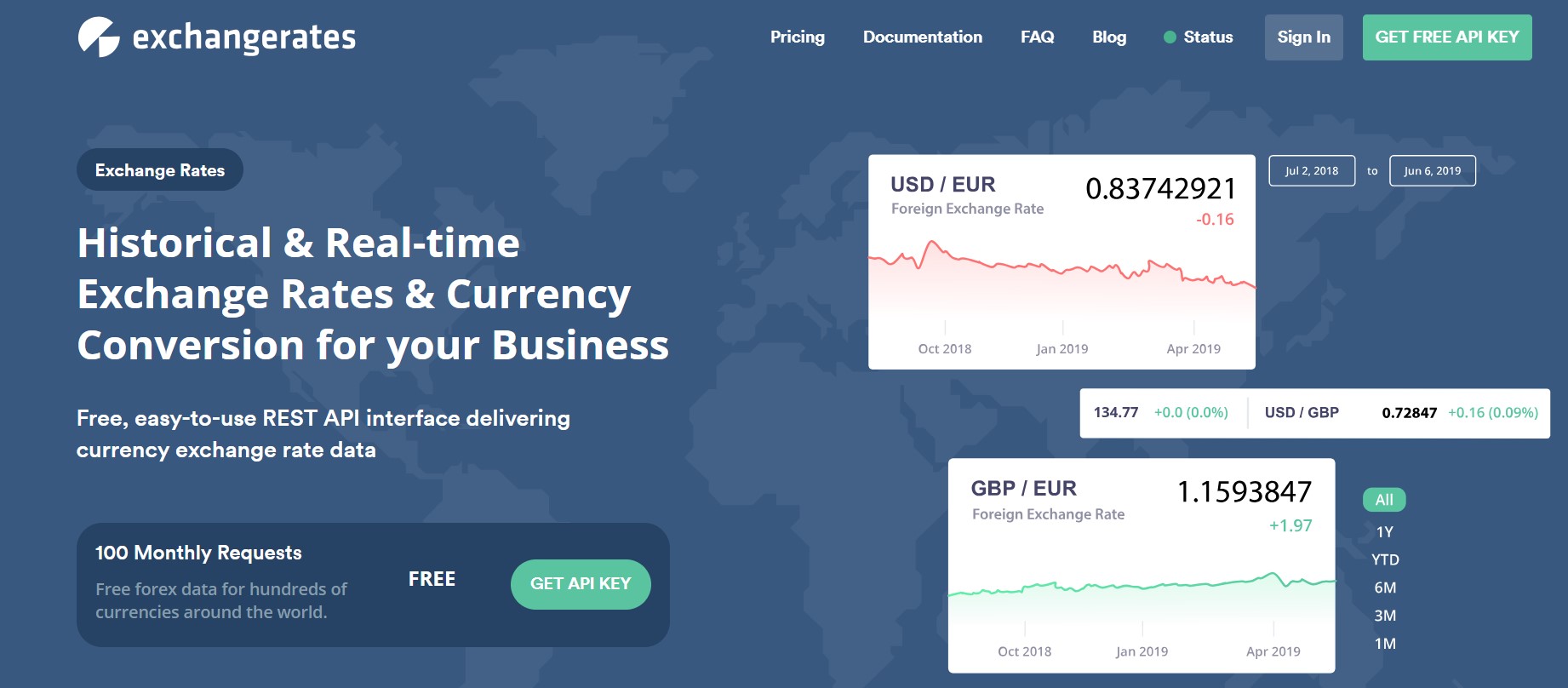

- ExchangeRatesAPI.io – Offers real-time and historical exchange rate data with simple integration.

- Open Exchange Rates – Provides accurate and developer-friendly currency exchange rates.

- Fixer.io – A lightweight API with support for multiple currencies and historical rates.

- Currency Layer – Delivers live exchange rates and forex market data.

Steps to Integrate a Currency API into Your Software

1. Register and Get Your API Key

Most currency API providers require you to sign up and obtain an API key. This key is used to authenticate your requests and ensure secure access to exchange rate data.

2. Choose the API Endpoint

Depending on your application needs, you might need different API endpoints:

- Latest Exchange Rates: Fetch real-time conversion rates.

- Historical Data: Retrieve past currency values.

- Currency Conversion: Convert one currency to another automatically.

- Time-Series Data: Analyze trends in exchange rates over time.

Example API request for real-time exchange rates:

https://api.exchangeratesapi.io/latest?base=USD&symbols=EUR,GBP,JPY3. Implement API Calls in Your Software

Developers can integrate the currency rate API using different programming languages such as Python, JavaScript, or PHP. Here’s a simple example using Python:

import requests

API_KEY = "your_api_key"

url = f"https://api.exchangeratesapi.io/latest?access_key={API_KEY}&base=USD"

response = requests.get(url)

data = response.json()

print(data["rates"]["EUR"])4. Handle API Responses

API responses typically return data in JSON format. Ensure your application correctly processes the response to extract exchange rates and display them in your UI.

Example JSON response:

{

"base": "USD",

"date": "2025-02-12",

"rates": {

"EUR": 0.85,

"GBP": 0.75,

"JPY": 110.12

}

}5. Implement Error Handling

API integration should include error handling mechanisms to manage scenarios like invalid API keys, rate limits, and server downtime. Example:

if response.status_code != 200:

print("Error fetching data, please try again later.")6. Automate Currency Updates

To ensure your application remains up to date, schedule periodic API requests using CRON jobs (Linux) or background tasks in your programming language.

Best Practices for Using a Currency API

- Cache API Responses: To reduce API call frequency and enhance performance.

- Respect API Rate Limits: Avoid exceeding the allowed number of API requests per minute.

- Use Secure Connections: Always request data over HTTPS to protect sensitive information.

- Test Before Deployment: Ensure the integration works seamlessly in a staging environment before going live.

Conclusion

Integrating a currency API into your software enables seamless global transactions, providing accurate and automated currency conversions. By selecting a reliable currency rate API, implementing API calls effectively, and following best practices, developers can enhance their SaaS, e-commerce, or fintech applications with real-time exchange rate capabilities.

🚀 Ready to integrate a powerful currency exchange API into your software? Try ExchangeRatesAPI.io today and get real-time exchange rates with seamless integration! 🌍💰