The Europe Laboratory Information Management Systems (LIMS) Market is poised for significant growth, driven by technological advancements, increasing automation, and the need for efficient data management in laboratories. Below is a comprehensive analysis of the market, including key drivers, segmentation, and strategic insights:

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞: https://www.businessmarketinsights.com/sample/TIPRE00027965

Market Overview

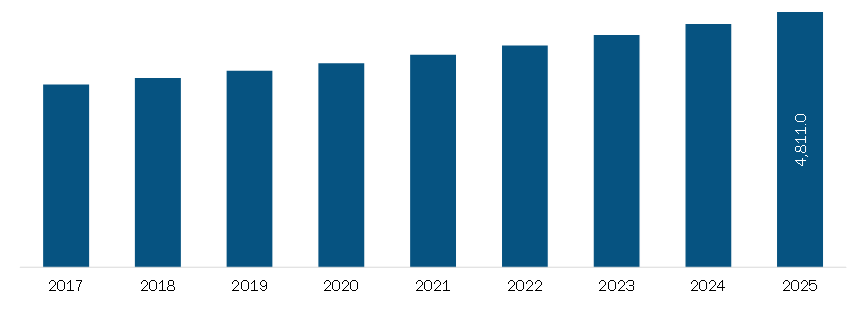

- Market Size: The LIMS market in Europe was valued at US 228.16 million in 2021 and is projected to reach US 228.16 million in 2021 and is projected to reach US 476.17 million by 2028, growing at a CAGR of 11.1% during the forecast period.

- Key Drivers:

- Rising adoption of laboratory automation to minimize human errors and improve efficiency.

- Increasing demand for data integration and secure data management solutions.

- Growing regulatory compliance requirements in pharmaceutical and biotechnology industries.

- The COVID-19 pandemic accelerated the adoption of cloud-based and remote LIMS solutions.

- Expansion of pharmaceutical R&D activities and clinical trials.

Market Segmentation

- By Type

- Standalone LIMS: Traditional systems focused on specific laboratory functions.

- Integrated LIMS: Systems that integrate with other enterprise solutions like ERP and EHR for seamless data flow.

- By Deployment

- Web-Based Delivery Mode: Accessible via web browsers, offering flexibility and remote access.

- Cloud-Based Delivery Mode: Scalable, cost-effective, and ideal for multi-location operations.

- On-Premise Delivery Mode: Installed locally, offering higher control and customization.

- By Component

- Software: Core LIMS platforms for data management and workflow automation.

- Services: Includes implementation, training, and support services.

- By Application

- Sample Management: Tracking and managing laboratory samples.

- Workflow Automation: Streamlining laboratory processes.

- Records Management: Maintaining accurate and compliant records.

- Decision Making: Data analytics for informed decision-making.

- Enterprise Resource Planning: Integrating LIMS with broader business operations.

- Logistics Management: Managing sample transportation and storage.

- By End-User

- Pharmaceutical Companies: Largest end-users due to high R&D and regulatory requirements.

- Contract Research Organizations (CROs): Increasingly adopting LIMS for clinical trials and research.

- Hospitals & Clinics: Growing adoption for diagnostic and patient care purposes.

- Others: Includes academic research institutes and food testing laboratories.

- By Country

- Germany: Leading market due to strong pharmaceutical and biotechnology sectors.

- UK: Significant growth driven by healthcare digitization and government initiatives.

- France: Increasing adoption in clinical research and diagnostics.

- Italy: Emerging market with growing investments in healthcare infrastructure.

- Spain: Rising demand for LIMS in pharmaceutical and biotechnology industries.

- Rest of Europe: Steady growth in smaller economies.

Impact of COVID-19

- The pandemic highlighted the need for remote and cloud-based LIMS solutions, enabling laboratories to operate efficiently despite lockdowns.

- Increased testing volumes and data management challenges accelerated LIMS adoption.

- Collaborations between LIMS providers and healthcare organizations, such as LabWare’s partnership with the UK’s National Health Service, played a critical role in pandemic response.

Competitive Landscape

Key players in the Europe LIMS market include:

- Thermo Fisher Scientific Inc.

- Abbott

- Illumina, Inc.

- LabLynx, Inc.

- LabVantage Solutions, Inc.

- Accelerated Technology Laboratories, Inc.

- LabWare

- Autoscribe Informatics

These companies are focusing on product innovation, strategic partnerships, and expanding their presence in emerging markets to gain a competitive edge.

Strategic Insights

- Focus on Automation: Laboratories should invest in LIMS to automate workflows, reduce errors, and improve efficiency.

- Cloud-Based Solutions: Cloud-hosted LIMS offer scalability, remote access, and cost-effectiveness, making them ideal for post-pandemic operations.

- Data Integration: Integrating LIMS with EHR and ERP systems can enhance data sharing and decision-making capabilities.

- Regulatory Compliance: LIMS providers should emphasize compliance with European regulations like GDPR and ISO standards to attract pharmaceutical and biotechnology clients.

- Emerging Markets: Vendors should target smaller European economies with growing healthcare and research sectors.

- Collaborations: Partnerships with healthcare providers and research institutions can drive innovation and market penetration.

Future Outlook

- The Europe LIMS market is expected to witness sustained growth due to increasing automation, digital transformation in healthcare, and the rising volume of laboratory data.

- Vendors offering advanced features like AI-driven analytics, IoT integration, and mobile compatibility will gain a competitive advantage.

- The market will continue to evolve with the adoption of next-generation technologies, ensuring long-term profitability for stakeholders.

By leveraging these insights, industry players can position themselves strategically to capitalize on the growing demand for LIMS in Europe.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio:

Akshay

Senior Market Research Expert at Business Market Insights