The Europe Biosimilars Market is experiencing significant growth, driven by several key factors, including the increasing prevalence of chronic diseases, rising approvals of biosimilars, and strategic collaborations among manufacturers. Below is an updated analysis of the market trends, drivers, and challenges based on the latest available information:

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞: https://www.businessmarketinsights.com/sample/BMIRE00028358

Market Growth Overview

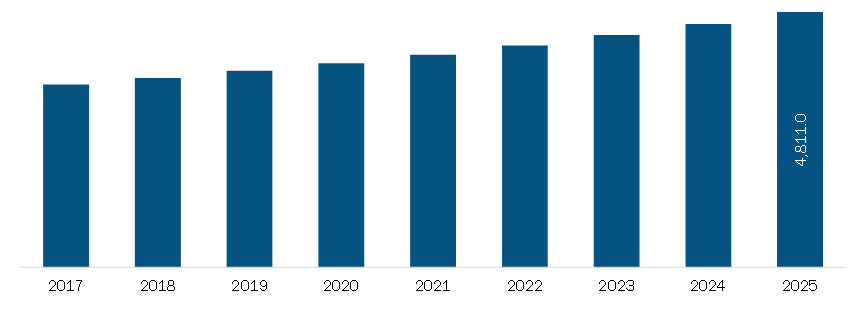

- The Europe biosimilars market was valued at US 10,344.86 million in 2022 and is projected to reach US 10,344.86 million in 2022 and is projected to reach US 115,125.91 million by 2030, growing at a CAGR of 35.1% during the forecast period (2022–2030) 16.

- This growth is fueled by the expiration of patents for blockbuster biologics, which creates opportunities for biosimilar manufacturers to introduce cost-effective alternatives 610.

Key Drivers of Market Growth

- Increasing Prevalence of Chronic Diseases

- Chronic diseases such as cancer, diabetes, and autoimmune disorders are on the rise in Europe, driving demand for affordable treatment options like biosimilars. For instance, over 4 million new cancer cases were reported in Europe in 2020, highlighting the need for cost-effective therapies 610.

- Rising Approvals of Biosimilars

- Regulatory bodies like the European Medicines Agency (EMA) have streamlined the approval process for biosimilars, ensuring they meet stringent safety and efficacy standards. As of 2023, the EMA has approved over 72 biosimilars, significantly more than the U.S. FDA 69.

- Strategic Collaborations and Partnerships

- Collaborations between biosimilar manufacturers and biopharmaceutical companies are accelerating product development and market penetration. For example:

- Samsung Biologics partnered with Pfizer in June 2023 for the large-scale manufacturing of a multi-product biosimilar portfolio, including oncology and immunology drugs 16.

- Sandoz (a Novartis division) collaborated with Evotec Biologics in May 2023 to develop and manufacture multiple biosimilars, with production expected to ramp up within 12–18 months 16.

- Collaborations between biosimilar manufacturers and biopharmaceutical companies are accelerating product development and market penetration. For example:

- Patent Expirations of Blockbuster Biologics

- The expiration of patents for high-revenue biologics such as Avastin, Rituxan, and Humira is creating lucrative opportunities for biosimilar manufacturers. For instance, Humira’s patent expiry in Europe has opened the door for biosimilar alternatives, significantly reducing treatment costs 610.

Market Challenges

- High Manufacturing Costs and Complexity

- The production of biosimilars involves complex processes and significant investments, often ranging from 100millionto100millionto250 million per product. This high cost can hinder market entry for smaller players 811.

- Regulatory and Intellectual Property Hurdles

- Biosimilar manufacturers face challenges related to patent litigation and regulatory uncertainties. Originator biologics often have complex patent portfolios, which can delay biosimilar market entry 13.

- Slow Adoption in Some Regions

- Despite regulatory support, some European countries exhibit slow adoption of biosimilars due to conservative prescribing practices and a lack of awareness among healthcare professionals 13.

Emerging Trends

- Expansion into Non-Oncology Therapeutic Areas

- While oncology remains the dominant segment, biosimilars are increasingly being developed for autoimmune diseases, diabetes, and inflammatory disorders, offering cost-effective treatment options for a broader patient population 13.

- Focus on In-House and Contract Manufacturing

- Companies are investing in in-house manufacturing to maintain quality control and reduce supply chain risks, while others are leveraging contract manufacturing to expedite time-to-market and reduce costs 69.

- Government Initiatives and Reimbursement Policies

- European governments are implementing policies to incentivize the use of biosimilars. For example, Germany has introduced automatic substitution laws for biosimilars, significantly boosting their adoption 16.

Regional Insights

- Germany holds the largest market share in Europe, driven by its robust healthcare system, early regulatory approvals, and favorable reimbursement policies 113.

- Italy is another key market, with a high prevalence of chronic diseases and government initiatives promoting biosimilar adoption 910.

Conclusion

The Europe biosimilars market is poised for robust growth, driven by the increasing demand for affordable biologics, strategic collaborations, and supportive regulatory frameworks. However, challenges such as high manufacturing costs and slow adoption in certain regions need to be addressed to fully realize the market’s potential. The expiration of patents for blockbuster biologics and the expansion into non-oncology therapeutic areas present significant opportunities for market players 1613.

For further details, you can refer to the original sources cited in this analysis.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

Author’s Bio:

Abhishek

Senior Market Research Expert at Business Market Insights