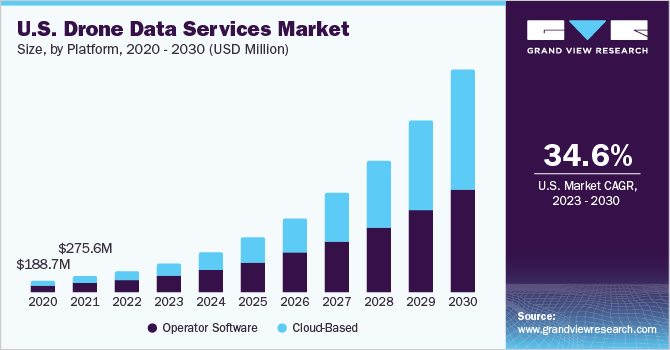

The global drone data service market size is expected to reach USD 15.05 billion by 2030, expanding at a CAGR of 39.0% from 2023 to 2030, according to a new report by Grand View Research, Inc The growth can be attributed to the growing usage of information acquired by drones in operational and big data analytics. The increasing need for UAV imagery analysis is presumed to impact the global drone imagery processing software industry positively and add a new horizon in imagery storage technologies.

The increasing adoption of drones in commercial sectors is leading to a revolution in big data cloud services. Launching a drone to capture images is the preliminary step in the drone information acquisition process. The captured images then require correction, calibration, processing, storage, and efficient evaluation.

The increasing need to evaluate imagery is a key factor driving the adoption of drone imagery software and cloud-based applications, which possess the ability to upload, share, store, and process aerial images. Moreover, there has been a steep increase in the use of cloud-based in-memory computing platform amongst businesses as it accelerates analytics, processes, and predictive capabilities.

By gathering information on a larger scale, service providers can now process unprecedented levels of detailed information and turn it into actionable information. UAV companies, such as PrecisionHawk, are transforming their business processes to enhance their focus on drone data processing rather than UAV manufacturing.

Gather more insights about the market drivers, restrains and growth of the Global Drone Data Services Market

Drone Data Services Market Report Highlights

- The industry requires significant improvements in various processes, such as increased fusion of data, compression, encryption, and on-board processing, as the software to perform analytics directly from imagery is still in the research phase

- Big data generated by drones is of vital importance in various sectors, including monitoring construction activities, ortho-rectification, and creation of Digital Surface Models (DSMs) and Digital Terrain Models (DTMs).

- North America accounted for the largest market share of 39.8% in 2022 and is presumed to retain dominance over the forecast period.

- Over the next three years, agricultural firms and construction companies are expected to harness the capabilities of aerial surveillance through drones on a large scale as these industries have not yet explored the benefits of imagery optimally

- Drone imagery service providers across the globe are expected to transform themselves from being straight up services companies to holistic data analytics companies.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, In May 2023, Thales USA and Northern Plains UAS Test Site, in partnership with Airspace Link, introduced localized surveillance data to registered unmanned Aerial Systems (UAS) operators on Vantis. Vantis is North Dakota’s extensive network for unmanned aircraft systems (UAS) beyond visual line-of-sight operations. This strategic partnership aims to effectively manage, distribute, and present Vantis airspace monitoring data in near real-time to registered UAS operators, enabling enhanced situational awareness and operational efficiency.

List of Key Players of Drone Data Services Market

- 4DMapper

- com

- Airware Limited

- DronecloudTM

- DroneDeploy

- DRONIFI

- Pix4D SA

- PrecisionHawk Inc.

- Sentera

- Skycatch, Inc.

Order a free sample PDF of the Drone Data Services Market Intelligence Study, published by Grand View Research.