The e-invoicing system has been introduced as an obligatory system and is now one of the main steps in digitizing the tax system in Saudi Arabia over the years, and this has happened through sophisticated advances. Starting from 2021, it shall become mandatory for any Saudi business to issue an invoice electronically according to the rules of the Saudi Tax and Customs Authority (ZATCA) regarding issuing invoices. The move targets tax compliance that has reduced fraud and increased transparency within the impact ERP systems.

Thus, companies ought to ensure that their invoicing processes comply with e-invoicing platforms, which would directly affect the manner they manage their financial systems. This regulation requirement creates a need for updating existing impact ERP systems with these changes for the enterprises. One of the most important tools hit by this kind of changing requirement will include ERP software which takes into account all aspects of business operations-from invoicing through inventory, and finance down to the customer-in-the-supply-chain.

Integrating e-invoicing within the Impact ERP Systemswill lead to, in essence, the change in how business is conducted in Saudi Arabia. As ERP systems are often the foundation upon which business processes are built and around which they are streamlined, organizations now have to reconfigure their ERP solutions in line with the adoption of e-invoicing. That is, invoices should be generated, stored, and moved electronically in the appropriate format; thus, ERP software in Saudi Arabia needs to be upgraded to interface directly with ZATCA’s System FATOORAH; so that there is, in turn, real-time reporting and data exchange between the businesses and tax authority.

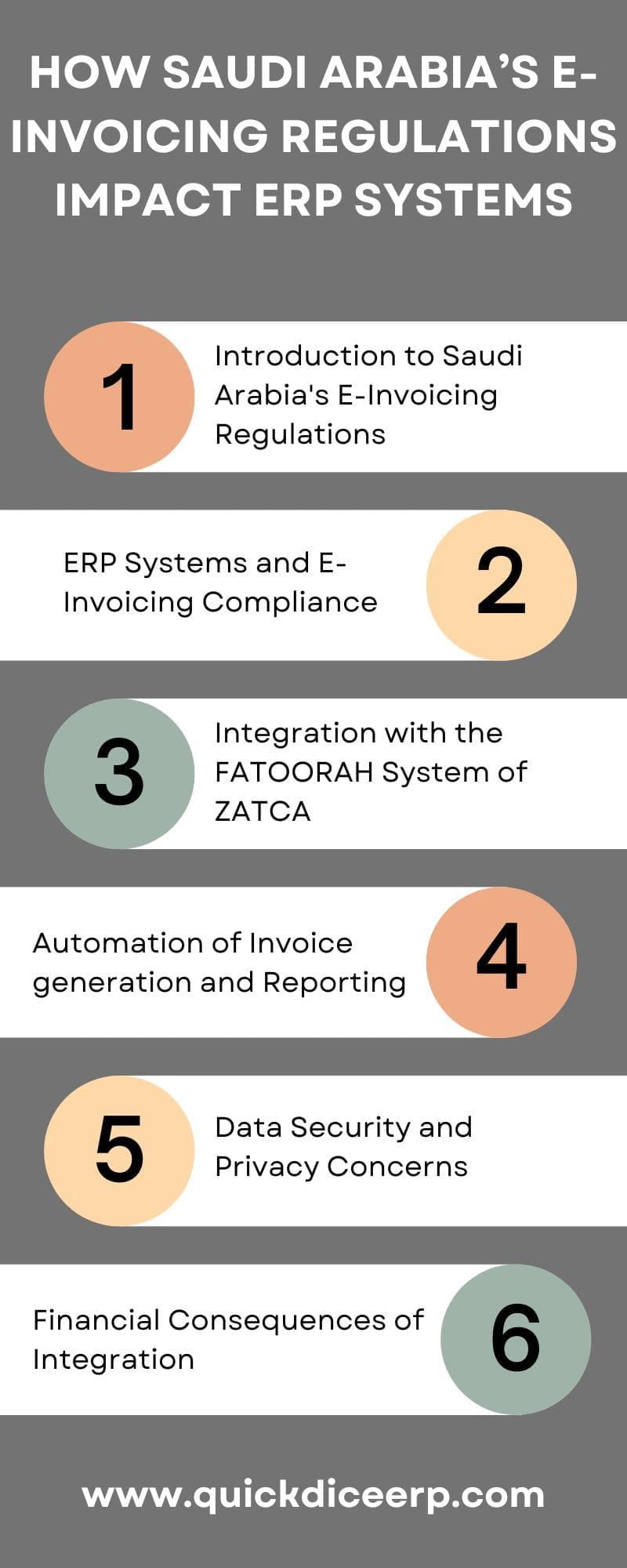

Here are Some of The Ways Saudi Arabia’s E-invoicing Regulations Impact ERP systems

1. Introduction to Saudi Arabia’s E-Invoicing Regulations

In 2021, Saudi Arabia made it compulsory for businesses to provide e-invoices, with the intention of improving compliance to tax obligations, reducing tax evasion, and making the process of invoicing. E-invoice stipulations came down to issuing, storing, and exchanging electronic invoices through the FATOORAH system established by the Saudi Tax and Customs Authority (ZATCA). In effect, businesses that operate within Saudi Arabia must incorporate the electronic invoicing capabilities of the falling systems into their legacy ERP systems. Here, long-awaited regulatory action shifts how the controls of invoices affect every aspect of business.

2. ERP Systems and E-Invoicing Compliance

ERP comprises almost all business operations as well as finances and accounts. Hence, businesses must amend their ERP systems to enable them produce electronic invoices in the format required by the e-invoicing regulations in Saudi Arabia. Integrating the ERP systems with ZATCA’s platform will allow real-time reporting and verification of invoices with the appropriate tax authorities. For businesses, this would mean an end to manual processes and the era of automated ones wherein compliance with the new tax regulations has been assured against the possibility of errors or fraud.

3.Integration with the FATOORAH System of ZATCA

ERP has a very significant implication for e-invoicing regulations introduced in Saudi Arabia since they now require integration with the FATOORAH platform. Such an ERP must be able to generate invoices in a structured format, either in UBL or XML, to assign it through an API to the FATOORAH system. Such an integrated solution lets businesses comply with ZATCA guidelines and avoid penalties while keeping invoicing, reporting, and tax compliant smooth processes.

4. Automation of Invoice generation and Reporting

The biggest benefit in terms of e-invoicing integrated within the Impact ERP Systems is the automating invoice generation along with report writing. Prior to the mandates, businesses could usually resort to manual processes or a mixed bag of systems for invoice creation. In the case of e-invoicing, an ERP system generates invoices automatically in real-time doing away with human errors and in turn, speeding up the process. Besides, tax reporting can be readily automated so that ERP solutions can ensure compliance for businesses with Saudi tax regulations. These are avenues offered to the businesses in order to concentrate on core functions instead of having administrative invoice attention fully consumed.

5. Data Security and Privacy Concerns

It is essential to link the ERP system with the ZATCA to ensure that sensitive data will exchange with ZATCA; hence why enterprises need to comply with data protection rules and regulations to move towards real e-invoicing where transactions will need to link with ZATCA through invoices. This means that invoice data transmission will have to accompany encryption and authentication protocols implemented by such Impact ERP Systems securing against the access of entities. Same for the systems with regards to matter retention should accommodate Saudi Arabia’s retention policy for invoices. On the other hand, a whining cloud of data security in ERP systems haunts the mixed environment of really private and public. Security in ERP systems is currently very important as no data breach should cause any operation’s business interruption through cyber threats.

6. Financial Consequences of Integration

For those businesses that have already adopted ERP, there will be additional adaptation costs for e-invoicing. The ERP vendors might provide updates or modifications that would tailor the ERP into meeting Saudi Arabia’s e-invoicing regulations; nevertheless, it would come with a price. The business will also have to set aside some funds for training programs for their people so that they will be able to operate using the new ERP system, and thus add to the operational costs. Nevertheless, such high initial costs may ultimately result in long-term savings as they are investments in business efficiency, fewer errors in transaction orders, and avoiding expensive penalties for non-compliance.

7. Real-Time Tax Reporting and Auditing

E-invoicing integration offers tax authority real-time reporting, thus further accuracy and transparency of the filing process. With the invoices integrated with ZATCA’s FATOORAH system, the businesses provide the tax authority with current, real-time data for auditing in the short term. ERP systems automate audits, reducing the time businesses spend and simplifying corporate responsibilities. The real-time report also allows instant access to tax information by businesses and the ability to make corrections, if necessary, before final submission and thus greatly reduces the chances of discrepancies in tax.

8. Improving Operational Efficiency

Not only do e-invoices provide compliance with the set regulations, but also the e-invoicing systems integrated with ERP actually simplify the overall invoicing and finances workflow process for organizations. With automated and direct exchange of data between the ERP system and FATOORAH of ZATCA, there is no more requirement for paper invoices, hence, reducing all administrative overheads and processing times for invoices. Processing of overdue invoices will also automatically activate the required follow-up actions, as well as track their payment statuses. This improves cash flow control, decreases the chances of human error, and highly raises the overall operational efficiency of any business.

Conclusion

The advent of E-invoicing as regulations for businesses in Saudi Arabia has unequivocally altered the context of doing business in the Kingdom. These rules require companies to change their invoicing processes to comply with the FATOORAH system by ZATCA, which, in essence, translates to a change in the management of financial data in businesses. Impact ERP Systems plays a key role in this because it is the connector for different sides of the business, including invoicing, regulatory tax reporting, and inventory management. Businesses must maneuver their ERP systems to fit the changes imposed by the new e-invoicing regulations, which require the generation and exchange of e-invoices with the tax authority in real time. Integration of tax reporting becomes easy and reduces the chances of error or absence of invoices, considering Impact ERP Systems.

These changes are going to do operational and financial damage to Impact ERP Systems. Existing ERP software must include features to handle e-invoicing, such as secure data transmission and real-time data retrieval via the ZATCA platform. This may have start-up costs attached to it, but the returns will be overwhelming. Businesses would essentially spend more in the short run automating the processes involved in invoicing within an organisation with resulting reduced paperwork and allow for better cash flow management.

In fact, the eventual integration of e-invoicing in Saudi Arabia into ERP systems will benefit companies positively in a way that it adds to smootheness, transparency, and accuracy in invoicing and taxation. Adopting the new e-invoicing regulations signals further progression toward digital transformation within businesses, after which only bad companies would fail in the effort.