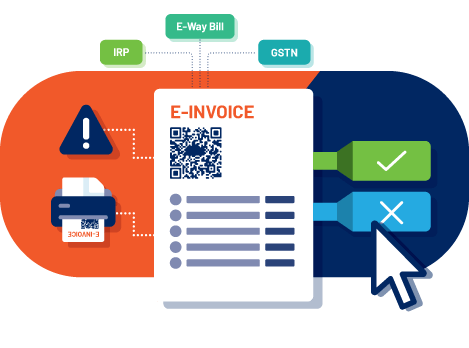

In today’s fast-paced digital world, businesses are increasingly adopting e-invoicing systems to streamline their financial processes and enhance efficiency.e invoicing solutions, or electronic invoicing, refers to the exchange of invoice documents in a digital format between buyers and sellers. This article explores the features, benefits, and implementation of e-invoicing solutions, shedding light on why they are becoming a cornerstone of modern business operations.

What is an E-Invoicing System?

An e-invoicing system is a digital platform that enables the generation, transmission, and storage of invoices electronically. Unlike traditional paper-based invoicing, e-invoicing uses a structured format, such as XML or EDI (Electronic Data Interchange), ensuring seamless integration with accounting software and ERP systems.

Key Features of E-Invoicing Systems:

- Automated Invoice Processing: Simplifies data entry and eliminates manual errors.

- Compliance with Tax Regulations: Ensures adherence to government mandates and reduces audit risks.

- Real-Time Tracking: Provides instant updates on the status of invoices.

- Integration Capabilities: Works with existing ERP and financial systems.

- Data Security: Uses encryption and secure transmission protocols to safeguard sensitive information.

Benefits of E-Invoicing Solutions

E-invoicing offers numerous advantages for businesses, ranging from cost savings to improved operational efficiency. Below are some of the key benefits:

1. Cost Efficiency

E-invoicing significantly reduces the costs associated with printing, Cordis Invoice (English) mailing, and storing paper invoices. It also minimizes the labor required for manual processing, allowing businesses to allocate resources more effectively.

2. Faster Payment Cycles

By automating invoice submission and approval processes, e-invoicing accelerates payment cycles. This helps businesses improve cash flow and reduce delays caused by human errors or lost invoices.

3. Improved Accuracy and Reduced Errors

Manual data entry is prone to errors, which can lead to payment disputes and delays. E-invoicing eliminates these risks by using automated systems that ensure data accuracy.

4. Environmental Sustainability

Replacing paper invoices with electronic versions supports eco-friendly practices by reducing paper consumption and waste.

5. Regulatory Compliance

Many governments worldwide are mandating e-invoicing to improve tax compliance and reduce fraud. E-invoicing systems help businesses meet these requirements seamlessly.

How to Implement an E-Invoicing Solution

Implementing an e-invoicing system requires careful planning and execution to ensure a smooth transition. Here are the steps to follow:

Step 1: Assess Business Needs

Evaluate your current invoicing process and identify areas where automation can add value. Consider the volume of invoices, integration requirements, and compliance needs.

Step 2: Choose the Right Solution

Select an e-invoicing platform that aligns with your business goals. Look for features such as multi-language support, scalability, and robust customer support.

Step 3: Integrate with Existing Systems

Ensure the e-invoicing system integrates seamlessly with your existing ERP and accounting software to avoid disruptions.

Step 4: Train Your Team

Provide training to employees on how to use the new system effectively. This will ensure smooth adoption and maximize the benefits of the e-invoicing solution.

Step 5: Monitor and Optimize

Regularly review the performance of the e-invoicing system and gather feedback from users to identify areas for improvement.

Popular E-Invoicing Solutions in the Market

Several e-invoicing platforms cater to businesses of all sizes. Some of the leading options include:

- SAP Ariba: Offers a comprehensive suite for procurement and invoicing.

- QuickBooks Online: Ideal for small and medium-sized businesses.

- Zoho Invoice: Provides an intuitive interface and customizable templates.

- Billtrust: Focuses on accounts receivable automation.

- FreshBooks: Combines invoicing with expense tracking and time management.

Conclusion

e invoicing system are transforming the way businesses handle their financial transactions. By adopting a reliable e-invoicing system, companies can achieve greater efficiency, reduce costs, and stay compliant with regulatory requirements. As the business landscape continues to evolve, embracing digital invoicing is no longer an option but a necessity for staying competitive.

Start your journey toward streamlined invoicing today and experience the numerous benefits of this innovative technology.