Saudi Arabia’s e-invoicing is the future of change that is expected to transform the companies’ financial operations. As a result of the Kingdom’s efforts towards modernization and going digital, e-invoicing is steadily becoming one of the cornerstones of the Kingdom’s economy. As technology advances Saudi Arabia is well-positioned to embrace new technologies that will enhance efficiency, transparency, and compliance in the process of invoicing. This Future of E-Invoicing in Saudi Arabia in the business processes involved in invoicing is not only convenient but is also in alignment with the Kingdom’s vision of a sustainable and future economy.

As more and more companies in Saudi Arabia adopt e-invoicing, the future of e-invoicing is expected to bring out several trends and enhancements. The application of e-invoicing software Saudi Arabia is also slowly evolving to meet the growing demand for effective, paperless, and secure financial transactions. The new technology that is rapidly growing such as artificial intelligence, blockchain, and cloud-based systems will help businesses to improve their invoicing systems to match the current tax laws and regulations as well as increase efficiency. With these developments, the future of e-invoicing in KSA remains bright and promising in the future.

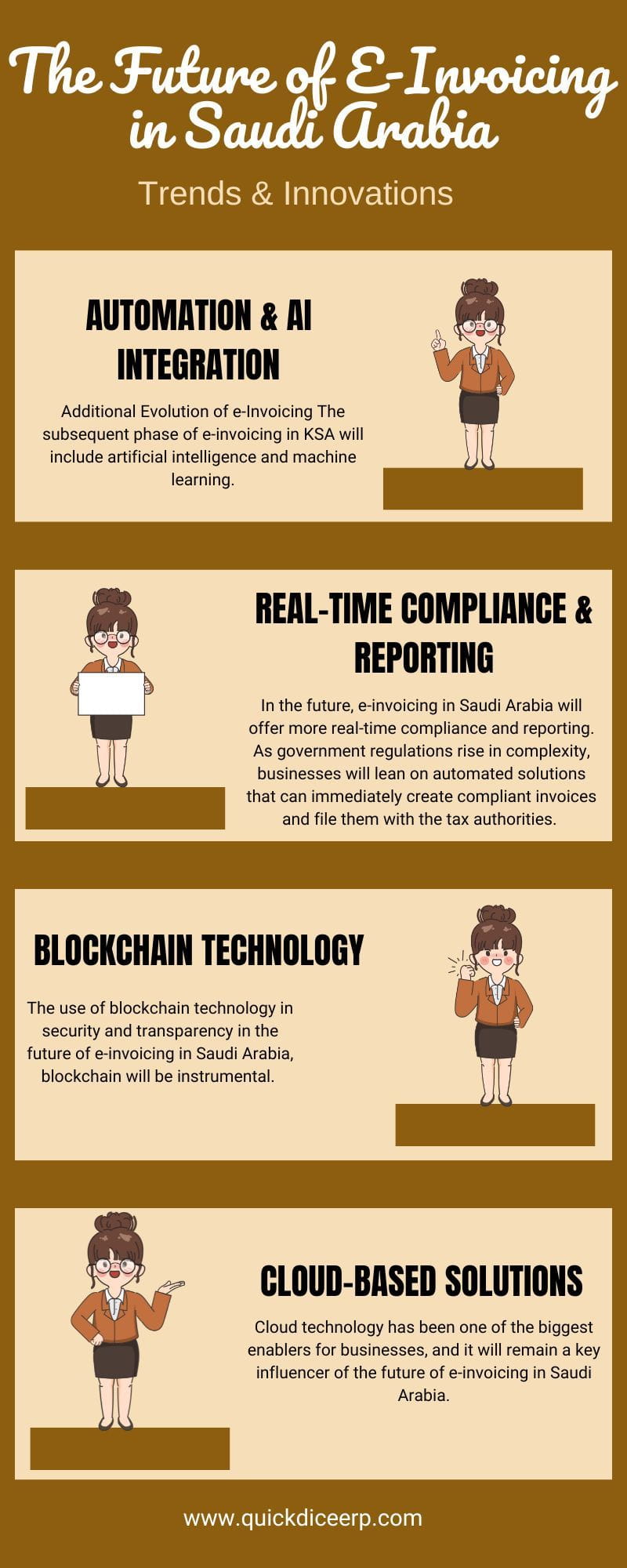

The Future of E-Invoicing in Saudi Arabia: Trends and Innovations

The Rise of E-Invoicing Software in Saudi Arabia

In the recent past, the Saudi government has been working hard to improve the nation’s tax systems. The introduction of the obligatory use of e-invoicing for companies is one of the most significant moves toward the paperless financial management system. The new regulations have been introduced in Saudi Arabian companies and e-invoicing software not only assists companies to follow these regulations but also to automate business processes and minimize paper use.

The future of e-invoicing in Saudi Arabia will observe more and more companies implementing complex e-invoicing solutions. These platforms make invoicing easier, manage transactions, and guarantee that taxes are paid in real-time. E-invoicing will therefore be an important strategic solution for companies that want to improve their systems or adopt new ones in a rapidly evolving digital environment.

Key Trends Shaping E-Invoicing in Saudi Arabia

1. Automation and AI Integration:

Additional Evolution of e-Invoicing The subsequent phase of e-invoicing in KSA will include artificial intelligence and machine learning. These technologies will assist in the automation of invoice processing, identification of deviations, and even forecasting of future problems. This change in the business world will not only improve invoice accuracy but also save time and reduce the effort required by businesses.

2. Real-Time Compliance and Reporting:

In the future, e-invoicing in Saudi Arabia will offer more real-time compliance and reporting. As government regulations rise in complexity, businesses will lean on automated solutions that can immediately create compliant invoices and file them with the tax authorities.

3. Blockchain Technology for Security and Transparency:

The use of blockchain technology in security and transparency in the future of e-invoicing in Saudi Arabia, blockchain will be instrumental. This way it will be transparent to the businesses to track invoices with complete records that cannot be altered. As the issues of security become more important, the use of blockchain in e-invoicing will expand to make invoices immune to alteration and easily verifiable.

4. Cloud-Based Solutions:

Cloud technology has been one of the biggest enablers for businesses, and it will remain a key influencer of the future of e-invoicing in Saudi Arabia. Cloud solutions make integration with other business applications and systems easier. They offer seamless connections, improving flexibility, scalability, and collaboration with internal departments and external parties.

5. Integration of E-invoicing across the border:

As the Kingdom of Saudi Arabia keeps on improving its trade relations with other countries, cross-border e-invoicing will be more significant. The future will come with e-invoicing systems that will enable cross-border transactions with the business meeting international tax laws and standards without having to go through the many processes involved in manual invoicing.

Innovations to Watch for in the Future of E-Invoicing in Saudi Arabia

1. Enhanced Data Analytics:

Improving Data Analysis As the e-invoicing software becomes smarter, this means that firms will be able to gain better insights into their invoice data. This will make it easier to make decisions, forecast, and budget, thereby enhancing the general performance of the business.

2. Mobile E-Invoicing Solutions:

With the development of mobile technology, more e-invoicing solutions will be mobile-compatible. This integration will allow businesses to control their invoicing from anywhere, anytime. Consequently, this flexibility proves advantageous in today’s mobile world.

3. ERP integration:

Conclusion:

In conclusion, the future of e-invoicing in Saudi Arabia appears bright. Moreover, it holds great potential to transform financial transactions, offering new opportunities. As more Saudi companies adopt innovative e-invoicing software, they can expect improved accuracy, compliance, and security. These advancements will streamline business processes, aligning with the Kingdom’s push for digital transformation. Additionally, technologies like artificial intelligence and blockchain will further drive these changes, improving efficiency and security in the process. Ultimately, these developments will make Saudi Arabia’s economic landscape more transparent and efficient. As a result, it will be better positioned at the forefront of innovative financial services.

In the future, the companies that will embrace the future of e-invoicing will enjoy a competitive advantage. To succeed in this new world, companies must stay updated on emerging trends. Additionally, selecting the right e-invoicing solutions will be crucial for success. As e-invoicing continues to emerge, companies across Saudi Arabia must embrace its potential to improve their businesses. By adopting e-invoicing now, they can better adapt to changes and stay ahead in a shifting landscape. Additionally, embracing this technology helps ensure compliance with future legal requirements. It also prepares businesses for upcoming changes.