The COVID-19 pandemic was unprecedented in influencing global economies and stock markets, further exacerbating a boom in overall market volatility, stock market crashes, and widespread economic uncertainty. It has caused governments and financial institutions worldwide to implement diverse pandemic response policies to mitigate the economic impact alongside stabilizing financial markets. With monetary and fiscal interventions in place, such policies have been the principal agents steering the stock market towards recovery. The pandemic has also demonstrated the usage of sophisticated trading strategies, like technical analysis and knowledge of best chart patterns for trading, to bring an end to uncertainty over the market. This article explains the relation between the policies adopted due to the pandemics that help recovery within the stock market by focusing on how traders may utilize chart patterns in an unstable situation.

The Immediate Aftermath of the Pandemic on Stock Markets

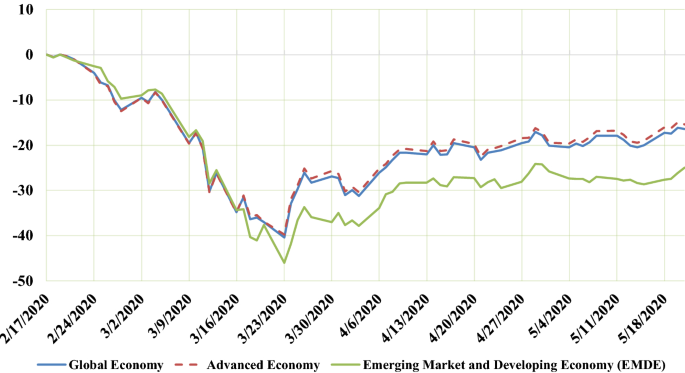

The early months of 2020 are when the coronavirus spread rapidly across the globe, and equities witnessed perhaps the fastest drop ever recorded in history. S&P 500 and Dow Jones Industrial Average fell over 30 percent within a few weeks. Investors were already worried about the complete breakdown of the world economy; lockdowns across nations added more fears over corporate earnings, unemployment, and general prospects of various industries.

Monetary Policies: Central Banks’ Role in Liquifying Markets

Major pandemic measures initiated by central banks include heavy monetary policies to revitalize financial markets and stabilize national economies. In the United States, it has acted very swiftly by reducing interest rates to near-zero, launching unprecedented large-scale asset acquisition plans (quantitative easing), and infusing cash into financial institutions.

These measures not only calmed investor fears but also ensured the functioning of credit markets and provided capital to companies; it somewhat mitigated the risk of a credit crunch propped up businesses struggling with the sharp shutdowns in the economy and injected liquidity into the system.

Fiscal Stimulus Packages: Government Initiatives in Recovery Support

Besides the monetary packages, fiscal stimulus packages in all expansive forms were introduced by governments worldwide to aid businesses, households, and workers. In the United States, for instance, there was a $2.2 trillion CARES Act, providing direct payouts to people, extension of unemployment benefits and money relief to businesses of different kinds under the Paycheck Protection Program. Such stimulus packages were also extended to other parts of the world, such as Europe and Asia.

The rebounding stock market opened its floodgates of opportunities for traders. It meant the identification of critical points when market psychology shifted from the predominantly related act of fear to optimism. Better chart patterns like “Ascending Triangle” or “Bullish Flag” helped traders catch on to breakout potentials when markets recovered under government efforts at revival.

Vaccine rollouts and accelerating market recovery

That was the juncture when vaccines for COVID-19 were developed and released to the general public in late 2020 and 2021. The reporting of actual vaccines by companies like Pfizer, Moderna, and AstraZeneca was already due in the markets; that would then bring hope to investors, whereby a gradual return to the norm and economic recovery was anticipated by investors.

Some of the major chart formations that emerged during this time included the “Golden Cross, in which a short-term moving average for the stock crosses above its long-term average to signal that the market’s upward trend might be just on the horizon. Others, like the “Symmetrical Triangle,” helped investors to follow continuation patterns, which further fueled upward momentum in stocks in recovery.

Technology and Advances in Access to the Stock Market

While the pandemic had a disturbing impact on many industries, it did accelerate the adoption of technology in financial markets. Online trading platforms, mobile applications, and robo-advisors have also seen significant increases in usage as retail investors continue to come to the stock market in times of high volatility. Thus, rising commission-free trading and ease of access to technical analysis can allow even more people to participate in the recovery of stock markets.

Impact Of Behavioral Economics on Market Sentiment

Behavioral economics was also another aspect that impacted the recovery of the stock market during the pandemic. Investor sentiments in these periods fluctuated between fear and greed as markets changed based on new information regarding the virus, government policies, or the economy. Most such emotional responses created trading opportunities as markets overreacted to news and eventually corrected themselves.

In such a scenario, chart patterns formed a means of identifying where stock prices had moved overboard in one particular direction to start reversing. Several patterns, like the “Double Top” and “Bearish Engulfing,” were used by traders in their endeavor to predict the downtrends so that they could avail themselves of the short-selling opportunities when the markets became overly euphoric.

Long-term Consequences on Stock Markets Stability

As the world moves out of the pandemic, what has been the long-term implication of pandemic response policies on the stability of the stock market? What does it mean for central banks to unwind stimulus measures without spoiling the financial markets? How do governments handle rising debt levels? A strategy must demonstrate resilience and diversity to successfully hold through a pandemic.

Conclusion

Technological changes, fiscal stimulus, and monetary interventions proved instrumental in the stock market recuperation post-pandemic. At the time of market fluctuations, understanding the best chart patterns for trading can help traders know the opportunities and risks. As the global economy will be coming up from the aftermath of a pandemic, it is expected that those lessons learned during the pandemic shall play an important role in future trading strategies and constant usage of chart patterns as very significant tools in managing market volatility.