Mexico Consumer Lending Market Overview

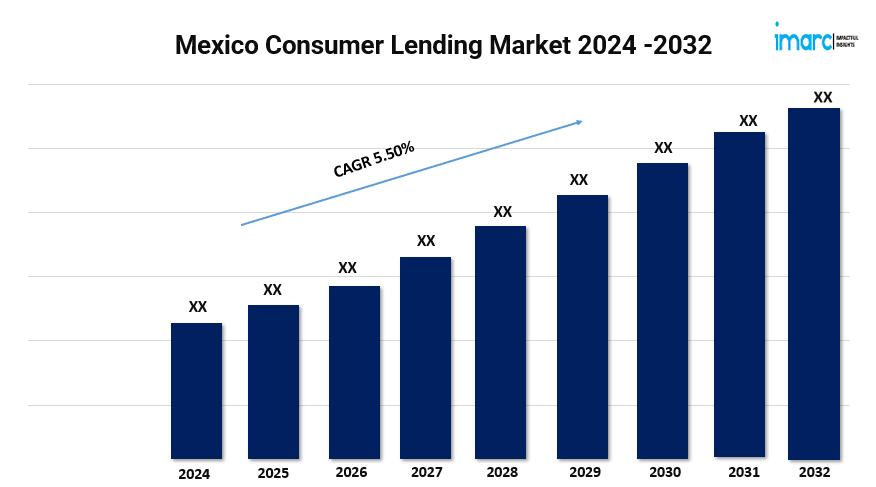

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 5.50% (2024-2032)

Mexico’s consumer lending market is a dynamic and growing sector, fueled by increasing consumer spending power, financial inclusion initiatives, and the rise of digital banking and fintech. According to IMARC Group, the Mexico consumer lending market size is projected to exhibit a growth rate (CAGR) of 5.50% during 2024-2032.

Grab a sample PDF of this report: https://www.imarcgroup.com/mexico-consumer-lending-market/requestsample

Mexico Consumer Lending Industry Trends and Drivers:

The Mexico consumer lending market is expanding rapidly, owing to several interconnected factors. Primarily, the market is driven by the increasing access to financial services as well as a rising middle-class population. Besides this, digital platforms for loan applications and approvals are made possible by factors like faster urbanization along with better internet coverage. In line with these factors, the growing demand for personal loans, credit cards, and mortgages among individuals seeking better lifestyles or to finance large purchases is significantly boosting the Mexico consumer lending market. Additionally, government initiatives promoting financial inclusion and enabling fintech companies to offer micro-loans and peer-to-peer lending services are acting as pivotal growth drivers. This transition is helping underbanked populations access to credit, stimulating overall market development.

A notable trend shaping the Mexico consumer lending market is the integration of advanced technologies like AI and blockchain in the lending process. These innovations streamline credit risk assessment and enhance security, improving both lender efficiency and borrower experience. Moreover, the increasing adoption of mobile-based financial solutions aligns with consumer preferences for convenience and speed, further accelerating market growth. As consumers shift toward digital channels, traditional banks and financial institutions are expanding their online services to remain competitive. Apart from this, the market is also witnessing a surge in environmentally conscious lending programs, such as green loans, reflecting the rising consumer and corporate focus on sustainability. Consequently, the convergence of these factors is anticipated to propel the expansion of the Mexico consumer lending market in the coming years.

We explore the factors propelling the Mexico consumer lending market growth, including technological advancements, consumer behaviors, and regulatory changes.

Mexico Consumer Lending Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Personal Loans

- Credit Card

- Auto Lease

- Home/ Mortgage Loans

- Others

Application Insights:

- Individual Use

- Household Use

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145