Manganese sulfate (MnSO₄) is an essential inorganic compound widely used across various industries, particularly in agriculture, animal feed, and the production of batteries. It serves as a key nutrient in fertilizers, helping to correct manganese deficiencies in soils, and is also used in feed additives for livestock. In recent years, the demand for manganese sulfate has surged due to its growing application in the production of lithium-ion batteries, particularly for electric vehicles (EVs). This has made manganese sulfate a crucial material in the global transition towards renewable energy and electrification.

Given its expanding use and the global push for more sustainable technologies, tracking the manganese sulfate price trend analysis has become essential for industries and investors alike. This article explores the historical price trends of manganese sulfate, key factors driving price movements, and future outlooks for this critical commodity.

Key Applications of Manganese Sulfate

Manganese sulfate has a broad range of applications, which influence its demand and pricing, including:

- Agriculture: One of the largest uses of manganese sulfate is as a micronutrient in fertilizers. It helps correct manganese deficiencies in soils, promoting healthy plant growth. This is especially important for crops like soybeans, wheat, and citrus fruits.

- Animal Feed: Manganese sulfate is added to animal feed as a trace mineral, essential for the development and reproduction of livestock, particularly poultry.

- Battery Production: With the rise of electric vehicles, manganese sulfate is increasingly used in the production of lithium-ion batteries, especially for cathode materials in NCM (nickel-cobalt-manganese) batteries.

- Chemical Manufacturing: Manganese sulfate is also used as a reagent in various chemical processes, including the production of other manganese-based chemicals, pigments, and ceramics.

- Water Treatment: In some cases, manganese sulfate is used in water treatment facilities to remove iron and manganese from water, ensuring potable water quality.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/manganese-sulfate-price-trends/pricerequest

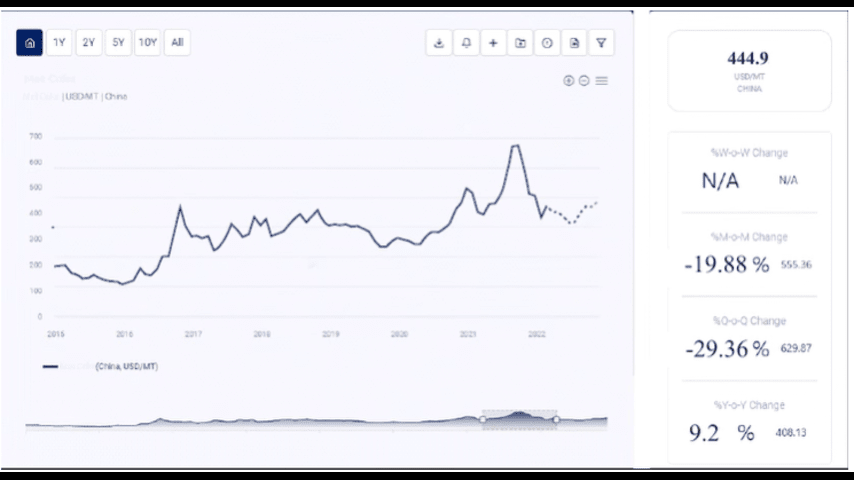

Historical Price Trends of Manganese Sulfate

Pre-2020 Pricing Overview

Before the global economic disruptions caused by the COVID-19 pandemic, manganese sulfate prices remained relatively stable, with fluctuations mainly driven by agricultural demand, availability of manganese ore, and production capacities. On average, manganese sulfate prices ranged between $500 and $800 per metric ton, depending on purity, region, and market conditions.

The agricultural sector played a key role in shaping the demand for manganese sulfate, with prices fluctuating according to seasonal planting activities and global crop output. Additionally, changes in manganese ore prices, which is the primary raw material for manganese sulfate, had a direct influence on the cost of production.

Impact of the COVID-19 Pandemic (2020-2021)

The COVID-19 pandemic disrupted global supply chains, affecting the production and distribution of essential chemicals, including manganese sulfate. Some key factors that influenced the price trends during this period include:

- Supply Chain Disruptions: Global lockdowns and restrictions on transportation severely disrupted the supply chains for manganese ore and manganese sulfate. Mining operations in key producing regions like South Africa were interrupted, leading to reduced ore availability and higher production costs for manganese sulfate.

- Fluctuating Agricultural Demand: While the agriculture sector remained resilient during the pandemic, fluctuating demand due to changing planting cycles and shifts in global trade caused temporary price volatility for manganese sulfate used in fertilizers.

- Increased Demand from the Battery Sector: Despite overall economic slowdowns, the demand for manganese sulfate in the battery sector increased in 2020-2021, driven by the growing interest in electric vehicles and energy storage systems. This helped counterbalance some of the pandemic-related price declines.

By the end of 2020, the price of manganese sulfate had risen to between $600 and $900 per metric ton, reflecting both supply disruptions and increasing demand from the battery sector.

2021 Price Recovery and Surges

In 2021, the manganese sulfate market experienced significant recovery, with prices surging due to several key factors:

- Resumption of Mining and Production Activities: As global economies began to recover from the pandemic, mining activities in manganese-producing regions like China, South Africa, and Australia resumed, improving the availability of manganese ore and stabilizing supply chains. However, production costs remained elevated due to lingering supply chain challenges.

- Rising Demand from Electric Vehicles: One of the most significant drivers of manganese sulfate price increases in 2021 was the surging demand for lithium-ion batteries, particularly for electric vehicles. The push towards cleaner energy and government incentives for EV production in major markets like the U.S., Europe, and China led to a rapid increase in demand for battery-grade manganese sulfate.

- Agricultural Demand: Strong demand for agricultural products globally, fueled by rising food security concerns and higher crop prices, supported steady demand for manganese sulfate as a fertilizer additive. This helped maintain price stability throughout the year.

By the end of 2021, manganese sulfate prices had risen to between $850 and $1,200 per metric ton, driven by a combination of robust demand from both the agriculture and battery sectors.

2022 Fluctuations and Supply Constraints

In 2022, manganese sulfate prices fluctuated due to ongoing supply constraints and fluctuating demand across key industries:

- Supply Chain Recovery: While global supply chains improved somewhat in 2022, there were still occasional disruptions, particularly in shipping and transportation. Rising freight costs and logistical challenges contributed to price fluctuations in the manganese sulfate market.

- Increased Competition for Battery Materials: The continued growth of the electric vehicle market intensified competition for key battery materials, including manganese sulfate. This increased competition drove prices upward, particularly for battery-grade manganese sulfate.

- Fluctuating Agricultural Demand: The agricultural sector saw variable demand for fertilizers, depending on weather conditions and crop output. Periods of lower demand for agricultural manganese sulfate led to temporary price reductions in certain regions.

- Raw Material Price Volatility: Prices for manganese ore remained volatile in 2022, influenced by factors such as global mining output, geopolitical tensions, and energy prices. This volatility in ore prices had a direct impact on manganese sulfate pricing.

By the end of 2022, prices for manganese sulfate ranged between $900 and $1,300 per metric ton, with regional variations depending on supply constraints and market demand.

2023 Price Trends

As of 2023, the price trend for manganese sulfate continues to be shaped by several ongoing factors:

- Sustained Demand from the Battery Sector: The demand for manganese sulfate in lithium-ion batteries remains strong in 2023, particularly as the electric vehicle market continues to expand. With the growing adoption of renewable energy technologies, this trend is expected to support elevated prices for battery-grade manganese sulfate.

- Agricultural Market Recovery: The agricultural sector is seeing renewed growth in 2023, with strong demand for fertilizers driven by rising food prices and increasing awareness of the importance of soil micronutrients. This is likely to support stable demand for manganese sulfate in agriculture, contributing to price stability.

- Raw Material Costs: The prices of manganese ore have remained relatively stable in 2023, though they are still sensitive to changes in global mining output and energy costs. Stable ore prices are expected to help maintain relatively stable manganese sulfate prices in the short term.

By mid-2023, manganese sulfate prices are expected to range between $950 and $1,400 per metric ton, depending on market conditions and regional demand.

Key Factors Influencing Manganese Sulfate Price Trends

1. Demand from the Battery Industry

The battery industry is one of the largest and fastest-growing consumers of manganese sulfate. The push towards electric vehicles, renewable energy storage, and sustainable technologies is driving demand for lithium-ion batteries that use manganese in their cathode materials. As this trend continues, it is likely to have a profound impact on manganese sulfate pricing.

- Electric Vehicle (EV) Growth: The global EV market is expected to grow significantly in the coming years, particularly as governments implement stricter emissions regulations and offer incentives for EV adoption. This will increase the demand for battery-grade manganese sulfate, supporting higher prices.

2. Agricultural Demand

Manganese sulfate is a critical micronutrient used in fertilizers to correct manganese deficiencies in soils. As global demand for food increases and concerns over food security grow, the demand for agricultural manganese sulfate is expected to remain strong.

- Fertilizer Usage: Rising global food demand and the need for higher crop yields will continue to drive demand for fertilizers containing manganese sulfate. This will support stable demand from the agricultural sector, particularly in regions with poor soil conditions.

3. Raw Material Costs (Manganese Ore)

The price of manganese sulfate is closely tied to the cost of manganese ore, which is the primary raw material used in its production. Fluctuations in manganese ore prices, driven by factors such as mining output, energy prices, and geopolitical tensions, have a direct impact on the cost of producing manganese sulfate.

- Manganese Ore Mining: Any disruptions to mining operations in major manganese-producing countries, such as South Africa, Australia, or China, could lead to shortages of manganese ore and subsequent price increases for manganese sulfate.

4. Supply Chain and Logistics

Global supply chains play a crucial role in the availability and pricing of manganese sulfate. Disruptions in transportation, shipping delays, or increased freight costs can impact the delivery of both raw materials and finished products, leading to price volatility.

- Freight and Transportation Costs: Rising freight costs, particularly in the wake of the COVID-19 pandemic, have had a significant impact on the pricing of chemicals like manganese sulfate. Any further increases in transportation costs could lead to higher prices.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: [email protected]

Toll-Free Number: USA Canada — Phone no: +1 307 363 1045 | UK — Phone no: +44 7537 132103 | Asia-Pacific (APAC) — Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA